Investors who currently have a Capital One Brokerage Account will soon will their accounts transferred to E*TRADE®, a nationally recognized provider of retail brokerage services. The transfer is the latest deal in the discount brokerage industry as companies are pairing up in an effort to survive and thrive in the brokerage industry where commissions are quickly falling towards zero and free stock trading startups threaten paid-for stock trade businesses.

Investors who currently have a Capital One Brokerage Account will soon will their accounts transferred to E*TRADE®, a nationally recognized provider of retail brokerage services. The transfer is the latest deal in the discount brokerage industry as companies are pairing up in an effort to survive and thrive in the brokerage industry where commissions are quickly falling towards zero and free stock trading startups threaten paid-for stock trade businesses.

| PROMOTIONAL LINK | OFFER | REVIEW |

| J.P. Morgan Self-Directed Investing | Up to $700 Cash | Review |

| TradeStation | $3500 Cash | Review |

| WeBull | 12 Free Stocks & free trades | Review |

| SoFi Invest | $25 Bonus and free trades | Review |

The Switch to E*trade:

E*trade is buying over 1 million self-directed brokerage accounts, such as taxable accounts and IRAs that investors manage on their own, from Capital One. The deal, however, does not include small-business 401(k) plans administered by Capital One. The transfer over to E*trade means that one day you are a Capital One investing customer and wake up the next day as an E*trade customer. As per the notice issued by Capital One, your assets, account history, and other information will move automatically later in 2018 with no firm timeline in place as of now. Until the switch, Capital One investors may continue to use their account just as thy always have.

E*trade is buying over 1 million self-directed brokerage accounts, such as taxable accounts and IRAs that investors manage on their own, from Capital One. The deal, however, does not include small-business 401(k) plans administered by Capital One. The transfer over to E*trade means that one day you are a Capital One investing customer and wake up the next day as an E*trade customer. As per the notice issued by Capital One, your assets, account history, and other information will move automatically later in 2018 with no firm timeline in place as of now. Until the switch, Capital One investors may continue to use their account just as thy always have.

If you do plan to switch over to a different broker before the transfer to E*trade takes place, note that Capital One charges a fee up to $75 to transfer your account. Once your account is under E*trade, a full transfer out also carries a $75 ACAT fee so there’s no need to rush to find a new broker.

Why Are Customers Transferring?:

For Capital One, brokerage was never really a big business. Before it was Capital One Investing, the brokerage service operated under ShareBuilder, which came along when Capital One acquired online bank ING Direct in 2012. Although Capital One has a lot of accounts, their clients have a propensity to have less assets and trade less frequently than other brokerage competitors. On average, Capital One Investing Account makes 1 trade per year whereas E*Trade’s account makes about 4 trades per year. An E*trade brokerage account also has over 5 times more in assets, or about $93,600 at the end of the 4th quarter compared to Capital One’s measly $18,000.

The deal is a sound decision for both E*trade and Capital One. E*trade will gain over 1 million customers overnight that is less costly than what is typically costs to sign up new customers. Capital One won’t experience a great loss compared to its credit card and commercial banking units.

The Shrinking Brokerage Industry:

Seeing brokers and brokerage services pair up is no an uncommon event. As a matter of fact, in the past recent years, there have been a number of mergers and acquisitions among online discount brokers. Smaller brokers are quickly selling out as commissions decline and rivals generate better margins at lower price points. Some recent deals are listed on the table below:

Seeing brokers and brokerage services pair up is no an uncommon event. As a matter of fact, in the past recent years, there have been a number of mergers and acquisitions among online discount brokers. Smaller brokers are quickly selling out as commissions decline and rivals generate better margins at lower price points. Some recent deals are listed on the table below:

| Acquiring Broker | What it Bought | Deal Closing Date |

|---|---|---|

| E*trade | Capital One Investing accounts | TBD |

| TD Ameritrade | Scottrade | Sept. 2017 |

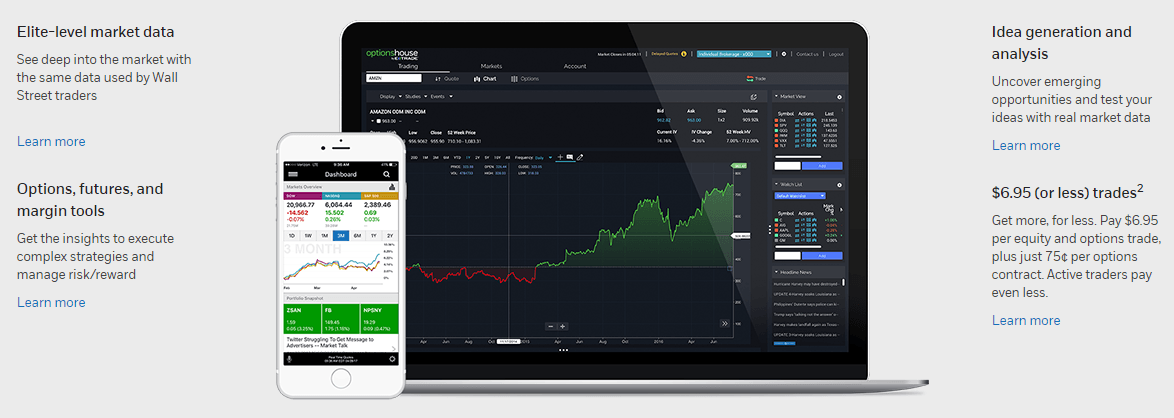

| E*trade | OptionsHouse | Sept. 2016 |

| Ally Financial | TradeKing | June 2016 |

| Charles Schwab | OptionsXpress | Aug. 2011 |

On a long enough timeline, commission prices will ultimately go to zero. Some brokers are able to compete on prices or shift towards products and services that generate recurring revenue to make up for the commission declines. It can be determine that this merger and acquisition spree is still in its early stages. In the prior year, E*trade was given and ultimatum to meet growth targets or the board will consider strategic alternatives, including selling the brokerage.

Bottom Line:

The merging of Capital One Investing Account and E*trade is something to take note of especially if you are an avid Capital One Investing customer. Since Capital One’s Investing Accounts on average has less assets and lower trading activity, it makes sense why they are merging with E*trade. Make sure if an E*trade account is the one for you! Or face a hefty $75 fee to transfer to a different broker. Interested in more brokerage accounts and reviews? Check out our list of Brokerage Account Bonuses!

Interested in more brokerage promotions? See more of the best options below!

- Ally Invest Brokerage Promotion

- E*Trade Brokerage Promotion

- TD Ameritrade Promotion

- Robinhood Review

- & More Brokerage Promotions

The American Express® Gold Card offers 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership. You'll earn: • 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. • 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. • 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. • 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. • 1X Membership Rewards® point per dollar spent on all other eligible purchases. Other benefits: • $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That's up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards points for Uber Eats purchases made at restaurants or U.S. supermarkets. Point caps and terms apply. • $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express(R) Gold Card at U.S. Dunkin' locations. • $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express(R) Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required. • $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express(R) Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required. • Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property. This card has an annual fee of $325 with no foreign transaction fees (See Rates & Fees). Terms Apply. |

I have pulled almost all of my portfolio out of Capital One in the past year, despite having service with them all the way back to Share Builder days.

No customer service and a back office who has a very myopic ignorant viewpoint. Trying to open an additional account and sent them passport copy to ‘prove who I am’ and then they want a SS copy? Who keeps their card anymore and why? They’ve been reporting 1099’s on me for decades! It’s their policy and NOT a federal requirement, the Patriot Act requires proof of who you are and an existing relationship is part of that chain.

Moved to Fidelity and transferred 4 accounts seamlessly. They even reinbursed all four $75 transfer fees! NEW accounts with SS number, not card.