Trim is offering new users a free, 14-day trial of a Premium service. Unwanted subscriptions can be cancelled with the help of Trim, along with the ability to lower your monthly bills by negotiating with your providers. Their Premium service offers greater features to explore, such as a high yields saving account and financial coaching. For more information about Trim, continue reading.

(Click here to learn more at Trim)

Trim 14-Day Free Trial

Trim is offering a free 14-day trail of their Premium service for new users only. Head to the Trim website using the link below and click on the “Start Free Trial” button.

(Click here to learn more at Trim)

Trim Features

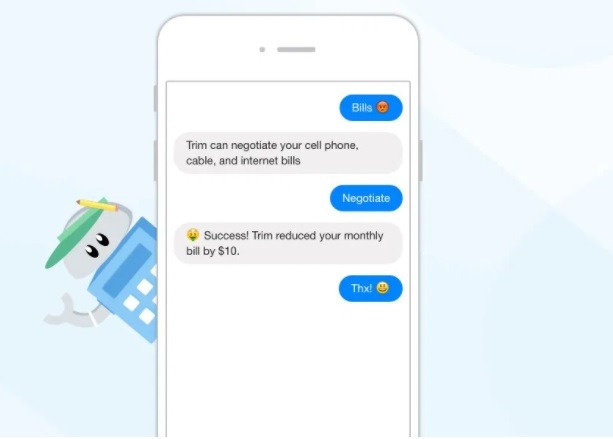

Trim helps their users save money by cancelling unwanted subscriptions and negotiating bills on behalf of their customers. Trim is different from other bill services because it is not done through an app. Instead, users will register for an account online on the Trim website and all interactions are completed via SMS text messages or Facebook Messenger. This process allows for a more real chatting experience with someone about your finances.

Cancelling Unwanted Subscriptions

Trim is almost like a personal finance bot that goes through your finances to find recurring subscriptions. They compile the services they found with how much you’re spending on them and send it to you. Out of that list, you select the services you don’t want and Trim will cancel them for you. Updates will be given throughout the process.

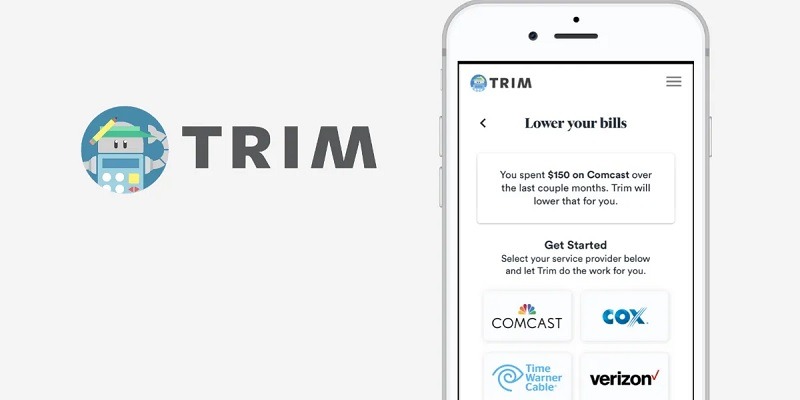

Lowering Your Bills

Trim is there to ensure their users get the best possible rates, so they negotiate your cable, internet, phone, and medical bills on your behalf. All you have to do is submit a bill for negotiation and provide a payment method, but they won’t charge your card unless Trim saves you money. They will contact the provider to negotiate, and you will be notified if Trim was able to save you money. Then, they will charge your card for the negotiation three days later if successful.

Other Features

There aren’t many budgeting tools, but Trim can help analyze your cash flow. You can also set alerts for upcoming bills, track your net worth, and receive text alerts on how much you’re spending at different merchants.

Furthermore, Trim works with sponsored personal finance products, like insurance companies, banks, and more, to help you find more ways to save.

Trim Premium

Trim Premium is a paid service with a savings account, automatic credit card payments, debt calculator, and financial coaching.

Trim Simple Savings

The Trim automated savings account comes with a 4% annualized bonus on your first $2,000. After that, the rate drops to 1.1%. All funds are FDIC-insured up to $250,000.

TrimPay

TrimPay helps you pay off credit card debt by setting up automated weekly bank transfers to your TrimPay savings account. You pick a credit card and select the day of the month you want to pay your credit card bill. You can also withdraw funds from your TrimPay account.

Debt Calculator

Once you link all your accounts, Trim can help build a payoff plan to minimize interest.

Financial Coaching

Premium members get unlimited email access to a team of financial planners that can answer personal finance questions, like creating an emergency fund, paying off debt, and saving for retirement.

Trim Fees

It is free to open a Trim account and use many of their services, such as finding subscriptions and cancelling them, setting up spending alerts and personalized reminders, detecting overdraft or late fees and finding them, and accessing your personal finance dashboard.

However, bill negotiation will cost 33% of your total annual savings. If Trim saved you $20 a month on your cell phone bill, or $240 for the year, you would pay $79.20 for the negotiation service. This fee is only applied after Trim has successfully negotiated down your bill.

The cost of Trim Premium would be $99 annually.

|

|

Bottom Line

Trim is a great option if you need help to cut back on your extra spending. This service will help you save money by cancelling unwanted subscriptions and lowering recurring bills, and more.

(Click here to learn more at Trim)

Other bill cancelling and negotiating services include Billshark and Truebill.

Leave a Reply