As great as it would be if loved ones had long, healthy lives there are circumstances that happen. Financial challenges can occur in a later age that leave a negative impact on family. AgeUp offers a solution by guaranteeing a steady income stream for those who live into their 90s. The deferred life annuity is issued by MassMutual and a part of Haven Life, both well-respected names in the life insurance industry. Keep reading to learn more about how AgeUp works.

| Annuity Type | Death benefit and lifetime income |

| Minimum Premium | $25 |

| Fees | Not published |

| Age Payouts Begin | 91-100 |

(Visit the link above to learn more about AgeUp)

AgeUp Features

The deferred life annuity provides a guaranteed steady income for loved ones as they live into their 90s. It should be noted that, AgeUp is meant to supplement retirement income, not replace it.

Monthly contributions start at $25 per month, which means that AgeUp is much more affordable than most other annuities that typically require an upfront payment of $10,000.

AgeUp provides two purchase options: death benefit or lifetime income.

- The death benefit option pays out a lower monthly amount, but paid-in contributions will be returned (less annuity fees) should your parent passes before the selected payout age.

- The lifetime income option pays out a higher monthly amount, but you’ll forfeit the refund should your parent passes before the selected payout age.

Upon selection between the two purchase option, you won’t be able to change it. However, you are able to increase, decrease or pause your monthly premiums.

AgeUp Requirements

There is only one requirement to purchase an AgeUp policy: your parent must currently be between 50 and 75 years of age. There are no medical exams required, nor credit checks.

AgeUp Pricing

Pricing varies and depends on the coverage chosen. The process begins by selecting a monthly payment you can afford, which ranges from $25 to $250.

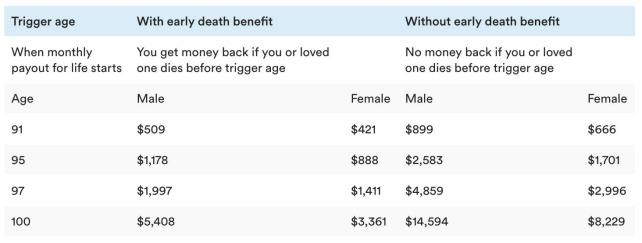

Pricing for an adult child purchasing an AgeUp policy at $50/month for their 65-year-old parent.

As shown in the example above, the longer your parent waits to receive payouts, the higher the monthly payout amount. Men also receive more than women of the same age. Additionally, your parent will receive a higher payout without the early death benefit.

AgeUp does not publish a fee schedule associated with its annuity. Be sure to bring this up with an AgeUp team member before signing any paperwork if you decide to move forward after receiving your online estimate.

AgeUp Limitations

Before signing up for an AgeUp policy, please be sure to keep in mind its limitations:

- It doesn’t start until 91, not when your parent hits 90.

- It reduces payouts with the early death benefit. If you want to recoup your premiums should your parent pass away before 91, you need to sacrifice some of the monthly payout.

- It is not a liquid product, which means you can’t withdraw money from your annuity, nor does it have any cash value.

- It’s not available in California, Florida and New York. But their website does state that policies will be available in California soon.

|

|

Bottom Line

AgeUp is a unique annuity process, you won’t be able to find another option in the market at this time. While AgeUp isn’t exactly a complete life insurance, term life insurance or traditional annuities, the annuity acts as a financial buffer intended for the best-case scenario that your parent lives well into their 90s. In these instances, AgeUp is the only easy and affordable option.

Alternatively, if you’re in need of a platform that gets you from company gossip to stop loss execution on a trade, you’ll want to consider taking a look at The Motley Fool instead. The Motley Fool offers relevant information for different stages of life, despite what its name implies, it is currently available for 50% off.

(Visit the link above to learn more about AgeUp)

Leave a Reply