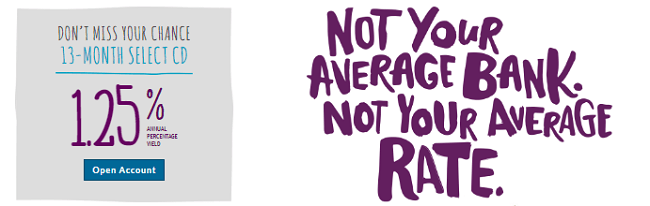

Ally Bank is an online bank that focuses on offering consumer savings products and is popular for their strong rates, innovative tools and great customer service. They are currently offering a 13-Month Select CD with a 1.25% APY and no minimum deposit for a limited amount of time which is an improvement of their last select CD which offered the same APY rate but instead for 15 months.

Ally Bank is an online bank that focuses on offering consumer savings products and is popular for their strong rates, innovative tools and great customer service. They are currently offering a 13-Month Select CD with a 1.25% APY and no minimum deposit for a limited amount of time which is an improvement of their last select CD which offered the same APY rate but instead for 15 months.

Why Ally Bank:

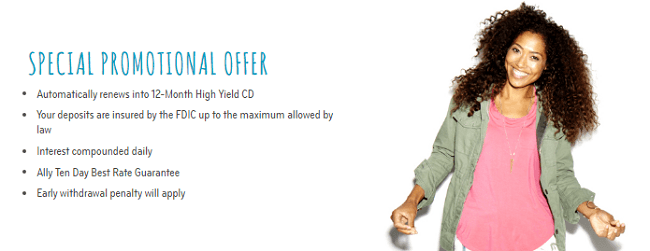

With Ally Bank’s 13 Month Select CD your interest will be compounded daily and your deposits will be insured by the FCIC, so know your money is tucked away safely. For those who don’t know what a CD is, a CD or Certificate of Deposit is a certificate issued by the bank to a person depositing money for a specific amount of time or in this case, 13 months. During the 13 months your money is deposited, you will earn 1.25% APY for Ally Bank 13-Month Select CD. The only catch is that you’re not allowed to withdraw it without a penalty. Ally Bank also does not charge maintenance fees for any Ally Bank CDs and offer their 10 day best rate guarantee. Accessibility is also no issue as you can keep track of your account online or on your mobile. A Certificate of Deposit is a surefire way to invest and all you have to do is deposit your money and keep it there for a specific amount of time.

Ally Bank 13 Month Select CD:

Ally Bank’s 13 Month Select CD is only available for a limited amount of time and if you’re interested, this is Ally’s best deal for a term of around one year. Their Select CD offers a 1.25% APY and no minimum opening deposit or maximum balance cap. So any amount you deposit makes a 1.25% APY rate. The only thing you have to worry about is an early withdrawal penalty which is 60 days of interest but to avoid any penalties, simply don’t withdraw any amount of money.

Compared with Ally Bank CDs:

Comparing Ally Banks 18-Month High Yield CDs in comparison to Ally Bank’s 13-Month Select CD, their Select CD still offers a better deal. Ally Banks 18-Month High Yield CD only offers a 1.25% APY rate when you deposit at least $5,000 minimum while their 13-Month Select CD offers the same APY rate with no minimum and offers a shorter amount of time. If you’re interested in earning a higher APY rate in a shorter amount of time then make sure to take advantage of the Ally Bank 13-Month Select CD that is only available for a limited amount of time to earn the best rate for any amount of money.

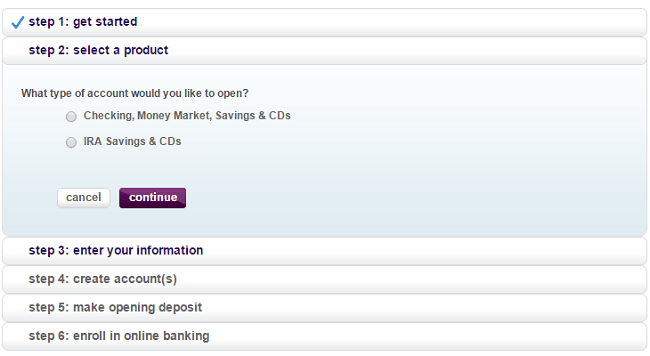

How to Open Your Ally Bank CD:

If you’ve never opened an account with Ally Bank, rest easy as they make it very simple. Simply choose your account type, enter your personal information and the information of any joint account holders. The entire process shouldn’t take more then 5 minutes. Ally Bank even makes funding your Ally Bank 13-Month Select CD easy as well as they let you link your checking accounts to fund it. Usually for online banks they make you complete two small transactions with your bank to verify that you’ve linked the correct account but with Ally Bank you can verify instantly.

Bottom Line:

Ally Bank offers some of the best interest rates anywhere and with their Ally Bank 13-Month Select CD, be sure to take advantage of this great CD and sign up today as this select CD is only available for a limited amount of time. This 13-Month Select CD offers 1.25% APY with no minimum deposit and no maximum cap. Ally Bank is one of the largest and trusted online banks that attracts customers by offering simple, transparent products with competitive rates. Visit our table for the best CD rates now!

The Ink Business Preferred® Credit Card offers 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase TravelSM. You'll earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year; 1 point per $1 on all other purchases - with no limit to the amount you can earn. Furthermore, points are worth 25% more when you redeem for travel through Chase TravelSM. This card does come with a $95 annual fee but does not have any foreign transaction fees. |

Leave a Reply