Find the latest Amalgamated Bank Promotions, Bonuses, and Offers here.

Update 4/30/24: The $150 or $300 business checking bonus offers end today, 4/30/24!

About Amalgamated Bank Promotions

Established in 1923 in New York, Amalgamated Bank has a small footprint with just a little over 10 physical branches but they do offer nationwide availability with their online Checking and Savings accounts. Rates can often be much better than other traditional banks.

Some of the benefits you’ll enjoy while banking with Amalgamated Bank include 24/7 online and mobile banking, access to over 40,000 ATMs nationwide, and much more!

I’ll review the offers below.

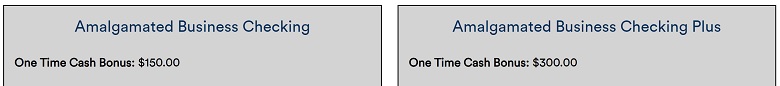

Amalgamated Bank $150 or $300 Business Checking Bonus

- What you’ll get: $150 or $300 bonus

- Account Type: Business Checking Account

- Availability: Nationwide

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Credit Card Funding: $500 Visa or Mastercard only. Open Savings account later for additional $500 credit card funding.

- Monthly Fees: $0

- Early Account Termination Fee: None

- Household Limit: None

(Expires 04/30/2024)

| Chase Business Checking ($300 or $500 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| Axos Business Premium Savings ($375 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Bluevine Business Checking ($300 Bonus) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

How To Earn Bonus

- Open your new checking account

- Fund your account and meet eligibility requirements

- $150 bonus: Amalgamated Business Checking: Minimum Average Monthly Balance: $2,500.00 every month for 3 consecutive months following one full calendar month after account opening.

- $300 bonus: Amalgamated Business Checking Plus: Minimum Average Monthly Balance: $15,000.00 every month for 3 consecutive months following one full calendar month after account opening.

- Receive one time cash bonus paid to your account

- Offer not available to existing or prior Business Checking or Commercial Checking customers of the Bank within the last 6 months.

- Qualifying transactions during the first 3 months starting the month after account opening include: ACH Credit, ACH Debit, Wire, Items Deposited, Checks Paid, Mobile Deposit, Bill Pay, Zelle®, and Point of Sale Purchases.

- Maintain an average daily balance and meet the qualifying transactions during the first three (3) consecutive months starting the month after account opening. For example, if you opened an account on February 26, 2024 and you do not fund the account by March 31, 2024 you will not qualify for the promotion. Upon the Bank’s determination of meeting the requirements, the one-time cash bonus will be credited to your checking account within 45 calendar days from the date you met the requirements.

- APY means Annual Percentage Yield. Rates effective as of November 13, 2023. APY is subject to change without notice.

- New money is defined as deposits not previously held by Amalgamated Bank.

Amalgamated Bank Up to $2,000 Checking Bonus (Expired)

- What you’ll get: Up to $2,000 bonus

- Account Type: Checking Account

- Availability: Nationwide

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Credit Card Funding: $500 Visa or Mastercard only. Open Savings account later for additional $500 credit card funding.

- Monthly Fees: $0

- Early Account Termination Fee: None

- Household Limit: None

(Expires 07/28/2023)

| BMO Smart Money Checking ($350 cash bonus) | BMO Smart Advantage Checking ($350 cash bonus) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

| First Tech Rewards Checking ($300 bonus) | |

How To Earn Bonus

- Open a new Online Checking or Affordable Checking account2 between May 30, 2023 and July 28, 2023 (11:59pm Eastern, Central, & Pacific time)

- Fund the new Online Checking or Affordable Checking account with new money4 only within 20 calendar days5 of account opening; and

- Deposit $30,000.00 – $74,999.00 and earn a $500 bonus

- Deposit $75,000.00 – $199,999.00 and earn a $1,000 bonus

- Deposit $200,000.00 – $299,999.00 and earn a $1,500 bonus

- Deposit $300,000 or greater and earn a $2,000 bonus

- Beginning on the 21st day maintain the qualifying balance for 90 consecutive calendar days in the respective bonus tiers to earn the one time cash bonus.

- Joint and multi-party account ownership only qualify for payment of the one time cash bonus.

- A new Online Checking or Affordable Checking customer is defined as a customer with no prior checking relationship with Amalgamated Bank within the last 90 calendar days.

- Account must be opened during May 30, 2023 – July 28, 2023. Offer may be discontinued or changed at any time prior to the expiration date without notice. The Online Checking account or Affordable Checking account must remain open and in good standing at the time we attempt to deposit the bonus payment.

Please note that an account with a zero balance for more than 30 calendar days will result in your account being closed by us without prior notice, as further described in the Deposit Account Agreement. - New money is defined as deposits not previously held by Amalgamated Bank.

- If your 20th day falls on a Non-Business Day we will count the first Business Day after your 20th Day. Amalgamated Bank business days are Monday through Friday, excluding holidays.

- Your one time cash bonus is determined by the lowest account balance during the 90 calendar day period. Please understand if your Balance falls into a lower Balance Level for even one day during the 90 calendar days, your Bonus will change (see Promotional Rate Information section). For example, if your Balance on the 20th Day is $200,000, the maximum Bonus you could earn is $1,500, as long as the $200,000 balance was maintained for the 90 calendar days. If your starting balance was $200,000 on Day 21, and fell to $150,000 during the 90 calendar day period, then the Maximum Bonus you can earn changes to $1,000.

Amalgamated Bank $250 Money Market Bonus (Expired)

- What you’ll get: $250 bonus

- Account Type: Money Market Account

- Availability: Nationwide (Bank Locator)

- Direct Deposit Requirement: No, but $10K minimum deposit

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Credit Card Funding: $500 Visa or Mastercard only. Open Savings account later for additional $500 credit card funding.

- Monthly Fees: None

- Early Account Termination Fee: None

- Household Limit: None

(Expires 05/26/2023)

| BMO Smart Money Checking ($350 cash bonus) | BMO Smart Advantage Checking ($350 cash bonus) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

| First Tech Rewards Checking ($300 bonus) | |

How To Earn Bonus

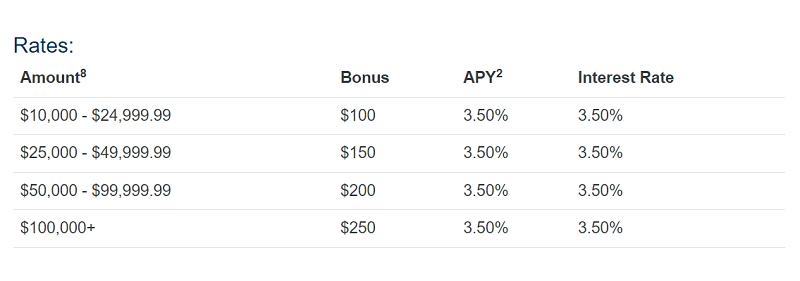

- Amalgamated Bank is offering a $250 money market bonus. The bonus you receive depends on the amount of funds you deposit and maintain for 90 days.

- Deposit $10,000 – $24,999.99 and earn a $100 bonus

- Deposit $25,000 – $49,999.99 and earn a $150 bonus

- Deposit $50,000 – $99,999.99 and earn a $200 bonus

- Deposit $100,000+ and earn a $250 bonus

- The value of the bonus may have to be reported to the IRS. Consult with your tax advisor for tax advice.

- APY means Annual Percentage Yield.

- Money market account is considered open and eligible for promotion upon bank approval and receipt of account funding by May 26, 2023.

- The Federal Deposit Insurance Corporation (FDIC) grants deposit insurance of $250,000 per account title. You may also qualify for more than $250,000 in FDIC coverage at Amalgamated Bank if you have single accounts, joint accounts, Individual Retirement Accounts and trust accounts.

- Fees may apply for non-Amalgamated, non-Allpoint® and international ATM transactions.

- Allpoint+® ATMs may not be available in all states.

- Your mobile carrier’s message and data rates may apply.

- To qualify for the Money Market promotion, you must meet the minimum balance requirements to obtain the APY and cash bonus illustrated in the table above. To open a non-promotional Money Market account online, $100 minimum deposit is required. No minimum deposit is required to open a Money Market Account in branch. There is a maximum account opening funding capability of $100,000 if opened online, if opened in branch there are no deposit funding restrictions. Additional deposit may be made by visiting an Amalgamated Bank branch or by making an Electronic Funds Transfer (“EFT”). An EFT includes, ACH, Wire, External Transfers, and Internal Transfer

How To Waive Monthly Fees

- Online Checking: no monthly maintenance fee

- Affordable Checking: $0 monthly maintenance fee

- Convenience+ Checking: $0 monthly maintenance fee with a qualified direct deposit or $10 if no direct deposit

- Give-Back Checking: None listed

- Money Market Account: None

- Amalgamated Business Checking: No monthly maintenance fee

- Amalgamated Business Checking Plus: No monthly maintenance fee

|

|

Bottom Line

Amalgamated Bank offers great promotions for you to earn money over time. This is a nice bonus and should be very popular. There hasn’t been a bonus offer from Amalgamated since 2016.

While they have a generous bonus, Amalgamated Bank doesn’t have great rates for CDs and Savings. You may want to check out our full list of Bank Rates and CD Rates.

Compare Amalgamated Bank with other bank bonuses from banks like Citi, Huntington, HSBC, Chase, TD, Discover Bank, Axos Bank, BMO Harris, SoFi, US Bank, and more!

*Check back at this page for updated Amalgamated Bank promotions, bonuses and offers.

I was denied.

The $500 “recurring direct deposit” is required to get the $500 bonus, whereas any DD amount will waive the monthly fee.

I had planned to DD $500 each month until I got the bonus and then change my deposit to a lower amount (I figured that once I got the bonus, I no longer needed to keep the monthly deposit at $500). I ended up getting the bonus promptly: about a month after my first direct deposit.

Serve worked for me for meeting the $500 direct deposit requirement for the bonus. After that, I have avoided monthly fees by transferring a smaller amount each month from Santander (and not continuing transfers from Serve).

With other banks, I have heard of people successfully using one DD method to waive the monthly fees that didn’t necessarily work for meeting the bonus requirement. That’s why I mention my two different approaches separately.

In most cases, DD is ACH from your pay check. And I believe you have to maintain the recurring monthly $500 DD to avoid ATM charges, but sometimes you can avoid the fees with a minimum balance like $1000. Anyway, I talked them and they are really nice and helpful, in case you want some answers.

EDIT: Ok, so the terms are confusing. First it says you need to have a $500 deposit within 60 days to receive the bonus, but it also says you need a recurring $500 DD, though a DD of any amount will waive the monthly fee. So I don’t know which is actually true.

The $500 DD requirement is only to receive the bonus. A monthly DD of any amount will waive the monthly fee according to the article. As far as I know nobody knows what actually counts as a DD right now.

$500 per month.

Can someone confirm if that’s $500 a month or $500 a paycheck? I need to know because I make $300 a week and only get paid weekly.

I live in nj and was able to apply for the bonus. bank called to confirm that I will get the bonus if I meet the bonus requirements

I believe they do soft pull.

According to item #3 on the first page of the application process, you can provide initial funding via a credit card:

What you will need

Applying is fast and easy. Here’s what you’ll need to have handy:

1. Your Social Security number or Individual Tax Identification Number (ITIN)

2. A federal or state US government-issued photo ID (driver’s license, passport, state or military ID)

3. A credit/debit card or US checking or savings account to fund your new account if you choose to fund your account at account opening