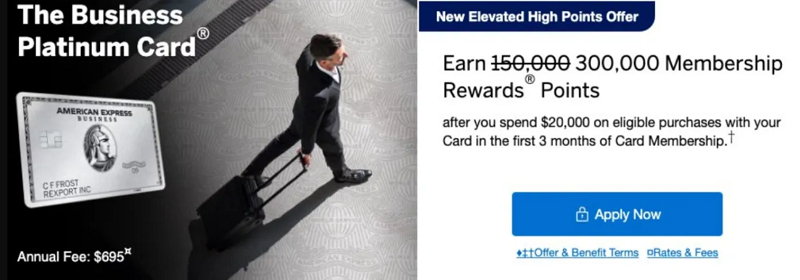

If you think Amex Business Platinum 250K offer is wild, then you won’t believe the new Business Platinum 300K offer with $20K spending within the first 3 months.

Update 4/25/24: The 300K is newly targeted for some markets.

Amex Business Platinum Referral

How to Find The Amex Business Platinum 300K Offer

Option 1)

Download Chrome, Opera, Firefox, Safari, Edge on computer and phone. The open this link in incognito mode from the many browsers. It should show the 190K offer. Let the offer expires in 30 minutes, then refresh the page and you may see 250K or 300K.

Option 2)

Google “amex platinum business” or “Amex biz platinum” from the many different browsers on phone and laptop. Click the first non-sponsored link in incognito mode. You may see 250K or 300K offer. If not, let the offer expires, then refresh the page to see 250K or 300K.

Option 3) Best Chance

Use a fresh browser and use a VPN in either Dallas or Denver.

- Google “Amex Business Platinum” using multiple browsers such as Chrome, Safari, Edge, Firefox.

- Then click on the first non-sponsored link using in incognito mode.

- Lets the 190K offer expired, then click refresh to see the 300K offer.

If these methods don’t work, you can keep trying different links, different browsers, locations, wifis – there has been reports that Opera browser being successful.

Keep in mind that this offer has lifetime language.

Card Benefits

- 5X Membership Rewards points for each dollar of eligible purchases made when you book on the American Express Travel website

- Earn 1.5X Points per dollar on eligible purchases of $5,000 of more, U.S. Electronics goods, retailers, software, and cloud service providers, U.S. Construction materials and hardware supplies, U.S. Shipping providers

- Use Membership Rewards Pay with Points for all or part of an eligible fare and get 35% of those points back, up to 1,000,000 bonus points per calendar year.

- Redeem points for 1 cent each if you also have an Amex Business Checking account.

- Get up to $400 in statement credits annually for U.S. purchases with Dell Technologies. Get up to $200 in statement credits between January and June, and up to $200 in statement credits between July and December. Enrollment required.

- Up to $120 annual statement credits for purchases made directly from any US wireless telephone provider, up to $10 per month. Enrollment required.

- Indeed – Get up to $360 credit ($90 per quarter). Enrollment required.

- Adobe – $150 annual statement credit. Enrollment required.

- Access to more than 1,400 airport lounges across 120 countries

- $200 in statement credits per calendar year for airline incidental fees. Enrollment required.

- Receive a statement credit every 4 years for Global Entry ($100) or every 4.5 years for TSA PreCheck (up to $85).

- Cover the cost of a CLEAR Plus membership with up to $189 in statement credits per year after you pay with your Business Platinum Card. Enrollment required.

- Complimentary membership in premium car rental programs, including Hertz President’s Circle status and other upgrades and discounts. Enrollment required.

- Marriott Bonvoy Gold Elite status

- Hilton Honors Gold status

- Platinum Card Concierge available 24/7 to help with anything from special dinner reservations to finding the perfect gift.

- Resy Dining Benefit

- No Foreign Transaction Fees

- Primary Cardholder Annual Fee: $695 (Rates & Fees)

- No Annual Fee for Employee Business Expense Card

This offer has the lifetime language:

“You may not be eligible to receive a welcome offer if you have or have had this Card or previous versions of this Card. You also may not be eligible to receive a welcome offer based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for a welcome offer, we will notify you prior to processing your application so you have the option to withdraw your application.”

You’re still able to apply if you can get the offer – even if you are not eligible. You’ll be able to withdraw from the offer prior to Amex processing your application. If you do not see a pop up then you’re good to go to receive the welcome offer.

| Ink Business Preferred® Card 90K Points after $8,000 spend within first 3 months | Ink Business Unlimited® Credit Card $750 Bonus after $6,000 spend within 3 months |

| Capital One Venture X Business 150K Miles after $30,000 spend within 3 months | Ink Business Cash® Credit Card Up to $750 Bonus: Earn $350 after $3,000 spend in the first 3 months and an additional $400 with $6,000 spend in the first 6 months. |

| Chase Sapphire Preferred® Card 100K Points after $5,000 spend within 3 months. | Chase Freedom FlexSM $200 Bonus after $500 spend within 3 months |

| The Platinum Card® from American Express 80K Points after $8,000 spend within 6 months. Terms Apply. | Capital One Venture X Credit Card 75K Points after $4,000 spend within 3 months. |

| American Express® Gold Card 60K Points after $6,000 spend within 6 months. | Chase Freedom Unlimited® Card $200 Bonus after $500 spend within 3 months |

| Chase Sapphire Reserve® Card 60K Points after $4,000 spend within 3 months. | Capital One Quicksilver Cash Rewards Card $200 Bonus after $500 spend within 3 months |

Bottom Line: To me, the 300,000 Membership Rewards points is worth $6,000 in value if you can get at least 2cpp through their transfer partners. You can easily recoup the $695 annual fee through the $400 Dell credit, then $200 airline credit, along with many benefits above. If you can find the offer, I highly recommended getting this hugh sign up bonus!

Leave a Reply