The ability to turn your paper check into a slip of paper that represents your banks account and the money you’re transferring is all thanks to the ability to write down all the important information that is required for the transaction.

Since the front of the check requires the most attention, payers tend to forget about the importance of the back of the check. Without properly endorsing your check, you may not be able to make important payments like a check for a house, car, or other major purchases.

In this post we’ll go over what you need to know about the back of a check and how to properly endorse it.

Note: Check out the following cards to earn one of the best flat cash back opportunities across all purchases: Wells Fargo Cash Wise card, the Chase Freedom Unlimited card, or the American Express Cash Magnet card! For a wider variety, see more credit card bonus offers here.

What You’ll See on The Back

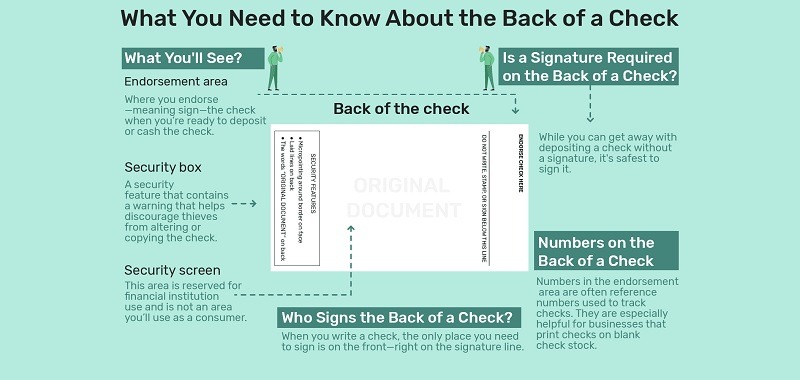

The back of the check may look nothing like the front, but the layout only composes of two parts:

Endorsement Area: Looking at the picture above, you’ll see a small rectangle labeled “Endorse Here.” This is the area where you’ll endorse, basically just signing, your check. This is always done before you deposit or cash in a check.

To prevent anyone from stealing and cashing in your check, what you can do is use an endorsement that restricts your check, such as writing down in the box, “for deposit only,” practically making your check impossible to steal since the thief doesn’t have access to your bank account.

Security Screen: This area is reserved for your financial institution to use for recording and documenting the processing of the check, not for the consumer. If you look closely, you can tell that it is colored with a very light ink and has the word(s) “Original Document” printed on it.

This pattern/ink makes the check hard to photocopy to prevent any fraudulent checks from being deposited.

Security Box: This is a security feature that contains a warning that helps discourage thieves from altering or copying the check. It also provides tips to help consumers determine if a check is actually legitimate.

For example, it might suggest that you look for microprint or watermarks on the check.

Who Signs the Back of the Check?

Knowing when and where to sign the check may be confusing since there is a place to sign it on the front (for those who are paying) and a place to sign on the back (for those who are depositing).

If you’re writing a check, you’ll sign along the signature line on the front of the check. You can also write down instructions such as “Hold for deposit until January 19, 2019.” that the bank has to honor. The problem is that it’s not always 100% that it is honored.

If you’re receiving a check, you’ll need to sign the back of the check, known as endorsing the check, when you deposit or cash in the check. Along with your signature, you can include directions such as, “For deposit in account 1234567.” This way if your check is ever stolen or lost in the mail, it cannot be used by anyone else.

Is Signing the Back Required?

There are many cases where a payee can get away without signing the back of a check. If you try to deposit your check without your signature, you’re risking the chance of the check being sent back to the issuer and making your payment(s) delayed.

Even if your deposited check is accepted and you get your available funds, it may be rejected a week or two later leaving you in a particular situation of possibly owing the bank money.

Your chances of depositing a personal check without a signature is far greater than your chance of depositing a business check without a signature. It’s usually not worth the risk and only takes a couple seconds to endorse/sign your check.

Don’t think you can always get away with it on mobile deposits either. Some banks may instruct you to write something regarding the mobile deposit in the endorsement area on the back of your check before your remotely deposit your check. It is possible to get away with it, but as previously stated, it should only take a couple seconds to sign the back of your check, it’s not worth the risk.

What are the Numbers on the Back of the Check?

If you’re not already familiar with the numbers on the front of the check, they refer to your account and routing number. What does it mean though if you have numbers printed on the back of the check?

Numbers printed in the endorsement area on the back of a check may be tracking numbers that the payer use to track where and when the check is deposited. They are especially helpful for businesses that print checks on blank check stock.

Numbers outside of the endorsement area are added by banks that handle the check when it is cashed or deposited. Those banks print their information on the check and then send it on to the bank that will ultimately release the funds.

|

|

Bottom Line

Getting the back of your check done properly is just as important as getting the front done. Without doing it properly it can result in the same results as messing up the front; the check being rejected or sent back to the issuer.

Despite the chances of getting away without signing the back, it’s always safe to endorse your check to ensure that everything is processed smoothly. If you enjoy and find posts like these interesting be sure to check out our other posts on Best Bank Bonuses, Best Bank Savings Rates, and Best Credit Card Bonuses.

Leave a Reply