With the evolution of technology comes modern day banking. Nowadays, people can do all of their banking completely online. Banks have even started releasing their own banking apps that makes accessing your financial activity easy.

Contrary to popular belief, you should still keep a record outside of the online register to achieve true financial responsibility. By simply following the steps below, you will be well on your way to achieving those once hard-to-reach financial goals.

What Is a Checkbook Register?

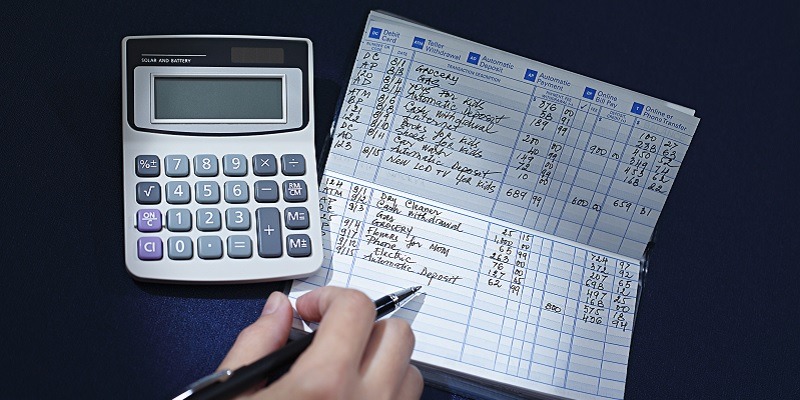

Before you could access your transaction history through your mobile device, or pay bills online, the checkbook register was an easy way to check your transactions and remaining balance.

The register is located in the back of the checkbook, and in a time where people were used to writing checks, it was easy to just write the total down and add it up later. Basically, all your transactions were written down in real time and would be deducted or added later.

Why the Checkbook Has Staying Power

Although not many people know how to balance a checkbook now because the practice has become automated, it is still an essential money management tool. Actively tracking what is spent versus what is earned can do wonders for staying on a budget and managing money efficiently.

Why You Should Balance Your Checkbook

Balancing a checkbook can actually make you feel at ease with your transactions. It is complicated and the rewards of taking the time to do it can be reaped quickly. By simply following these steps below, tackling your checkbook register will come easy.

How To Balance Your Checkbook

- Write down your transactions. This the simplest and first key to success when balancing your checkbook. Whether you’re buying groceries, or depositing your check to your account, deduct and add the amounts accordingly.

- Check the bank’s work. Before online banking became a thing, customers had to wait for a banking statement at the end of each month to compare with their check register. With online bank, you no longer have to wait. So check your register with what the app is reporting.

- Understanding the outstanding. Understand that although online banking is giving you all your transactions to you, there is still a delay on when it reports them. For example, depositing a check may take a couple of days to actually hit your account.

- Check your balance. Once you’ve completed all the necessary steps to balancing your checkbook on your side, it’s time to check what your app reports. The balances may not match, so double check with your bank to make sure the right amount is there.

- Write the wrong and reconcile. Most financial institutions have a window for when discrepancies can be brought to their attention. Mistakes are costly — and without a watchful eye, bank fees can creep in without warning. Keeping a running log is not to make anyone’s life harder, but rather to ensure the money earned is going to its rightful owner. In the digital age, fraud is prevalent. Balancing your checkbook, and having an easily accessible list of charges you’ve made, can aid in finding fraud charges before they do any damage.

- Note the last time you balanced your checkbook. It is recommended to draw double lines underneath the balanced amount in the checkbook. This will act as a reminder for the last known correct amount in the register — staying on track until the next transaction is made.

Common Mistakes and Tips for Balancing a Checkbook

Mistakes can happen, we’re all human, but they don’t have to cost you. Banking is a people business after all. Although the amount lost per month may not be much, over time it can add up to be a considerable amount.

Not only can fees be incurred by the account holder, but merchants can create them, too. Human error and processing fees can occur, which can be charged to the purchaser’s account. One slight surprise in bookkeeping could cause a ripple effect if sufficient funds are not available beyond the price of the original transaction.

Using Technology for Better Budgeting

Even though it seems that balancing a checkbook is an out-of-date practice, the reality is technology makes the practice more modern. There are even many smartphone apps on the market that can be utilized to keep checking account balances in check.

|

|

Bottom Line

Balancing your checkbook can be one of the most vital tools in budgeting responsibly. You can go as far as going old school and using a checkbook register to actively track every transaction, and then balancing it at the end of each month. This will help you double check your balance with what your financial institution is reporting. For more posts like this, check our list of bank guides!

Leave a Reply