For those that are carrying a balance on a high interest card, you’re more susceptible to more charges that will cost more out of your wallet. This can potentially destroy your credit history, which affect most things that you need in life. You can always opt for balance transfers on credit cards. It’s very simple, simply apply for a new card with a lower interest rate, move your debt balance onto the new card and save money! So you’re pretty much utilizing another card to help pay off your debt. Interests rate can increase, racking up a mere $80 or more. If you have a huge amount of loans, a balance transfer is one of the best options to do! A balance transfer credit card can be a good way to keep track of your balance and payments with everything in one place. It’ll help reduce interest payments or help consolidate multiple debts into one manageable monthly sum. But before you do, learn more information on how a bank transfer works before you manage your debt!

For those that are carrying a balance on a high interest card, you’re more susceptible to more charges that will cost more out of your wallet. This can potentially destroy your credit history, which affect most things that you need in life. You can always opt for balance transfers on credit cards. It’s very simple, simply apply for a new card with a lower interest rate, move your debt balance onto the new card and save money! So you’re pretty much utilizing another card to help pay off your debt. Interests rate can increase, racking up a mere $80 or more. If you have a huge amount of loans, a balance transfer is one of the best options to do! A balance transfer credit card can be a good way to keep track of your balance and payments with everything in one place. It’ll help reduce interest payments or help consolidate multiple debts into one manageable monthly sum. But before you do, learn more information on how a bank transfer works before you manage your debt!

How It Works

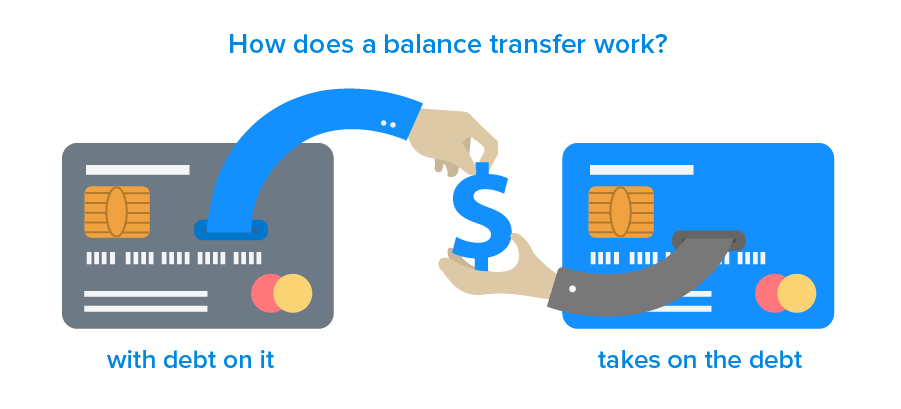

Balance transfers on credit cards work by literally shifting your debt from one credit card to another. A balance transfer credit card is the tool that you use to do this; the balance of your old card is paid off by your new card, effectively swapping who you have to repay. So it’s pretty self explanatory. You’ll be signing up for a brand new credit card that has 0% interest rate, move your debt onto the new card and you’ll avoid the interest rate! A balance transfer will give you a temporary breather on your debt if you’re furiously suffering.

Balance transfers on credit cards work by literally shifting your debt from one credit card to another. A balance transfer credit card is the tool that you use to do this; the balance of your old card is paid off by your new card, effectively swapping who you have to repay. So it’s pretty self explanatory. You’ll be signing up for a brand new credit card that has 0% interest rate, move your debt onto the new card and you’ll avoid the interest rate! A balance transfer will give you a temporary breather on your debt if you’re furiously suffering.

You usually can set up a balance transfer by signing in to your online account for the new card or calling the number on the back of that card. You’ll have to provide the account number that you want to transfer the balance from and the amount you want to transfer. When applying for credit cards, most providers will ask if you would like to make a balance transfer as part of your application. If you already have a credit card, your provider might allow you to transfer a balance to your card, subject to acceptance and your credit limit.

Is This The Best Option?

So far you’re probably wondering why do people do this? How is this the best option for me? Besides the fact that bank transfers on credit cards can reduce interests fee, you need to learn about the mathematical side of it. Balance transfer fees usually are 3%-5%, or can be 0% if you can find one that’s available. Let’s start with an example:

- Let’s say you want to transfer $3,500 with a current APR of 16.15%.

- Your interest that you would pay is $565.

- We’ll calculate savings based on a 0% Intro APR for 12 months and a 3% transfer fee.

- You would take your current amount and multiply that by 0.03 which will give you $105 of transfer fee.

- If you compare savings, $565 – $105 = $460 in savings.

To figure out how much it would take you to pay, add the transfer fee of $105 to your total amount: $3,500 + $105 = $3,605. So if you wanted to pay off your debt within 12 months (which is the period where you will receive 0% intro APR), it would take you approximately $300 monthly payments. To compare, you’re saving hundreds in interests rate that will go a long way. This is why people resort to bank transfers on credit cards because it gives you the ability to increase savings, reduce fees, and leisure time to pay off your debt.

What to Avoid

When considering if bank transfers on credit cards is a good option, try to avoid credit cards that have a high transfer fee. It’s best to aim for credit cards that have a no balance transfer fees. Other than that, it’s okay to use one, as long as the fee is between 3%-5%. But also be mindful of how much savings you’ll actually receive when you calculate how much interest fees you may be paying and the transfer fee you have to make. Credit cards that are specifically designed for balance transfers have a lower introductory rate for transfers, and 0% intro periods are common. Remember that you must stay within your limit and to make your monthly payments on time, otherwise you will lose the promotional offers on your account and pay the standard interest rate instead.

You must also avoid any troubles with the grace period. The grace period is the time between when your credit card billing cycle ends and when your credit card bill is due, during which you don’t have to pay interest on your purchases. By law, it must be at least 21 days. You only get the grace period if you aren’t carrying a balance on your credit card. What many consumers don’t realize is that carrying a balance from doing a promotional balance transfer affects the grace period.

The Chase Freedom Unlimited® Card offers a $250 bonus after spending $500 on purchases in your first 3 months from account opening. Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers. In addition, you can earn: • 6.5% cash back on travel purchased through Chase TravelSM, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase TravelSM, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases. There is no minimum to redeem for cash back & your cash back rewards do not expire as long as your account is open. This card comes with no annual fee and you'll get a free credit score that is updated weekly with Credit JourneySM. Member FDIC |

Important To Remember

Before you do balance transfer with a credit card, you need to take into account of some things. But most importantly, pay attention to your interest rate and check the credit limit as well. If you do go over the limit, you will have to pay extra fees and nobody wants that. Once you’ve been accepted and you’ve received your card, you will usually have to switch any debts within 60 days. Check the terms and conditions as failure to play by the rules can create more fees and problems, and possibly ruin your credit history. When you make a purchase or other transaction that is more than the amount in your checking or savings account, and you haven’t opted into an overdraft program, the bank may decline the charge or return it unpaid. Here are some tips and tricks to remember:

Before you do balance transfer with a credit card, you need to take into account of some things. But most importantly, pay attention to your interest rate and check the credit limit as well. If you do go over the limit, you will have to pay extra fees and nobody wants that. Once you’ve been accepted and you’ve received your card, you will usually have to switch any debts within 60 days. Check the terms and conditions as failure to play by the rules can create more fees and problems, and possibly ruin your credit history. When you make a purchase or other transaction that is more than the amount in your checking or savings account, and you haven’t opted into an overdraft program, the bank may decline the charge or return it unpaid. Here are some tips and tricks to remember:

- Using ATMs that aren’t affiliated with your bank can lead to charges from the ATM provider and your bank.

- Don’t apply for multiple credit cards in a short space of time

- Don’t miss or make late payments

- Register on the electoral roll and install a landline (if you haven’t already)

- Pay attention to the interest fee (if any) that you’re paying for

- Decide how long you need to pay off your credit card.

- You’ll need a clean credit history

- You may transfer other debts, not just credit cards

- Transfer rates expire

Bottom Line

Now that you’ve been educated on bank transfers on credit cards, you have a better judgement whether this is the best option for you. It’s very simple but can bite you back if you don’t cooperate with guidelines. Bank transfers are good to keep track of your balance and payments with everything in one place. You can transfer your current debt onto a new card with a lower interest rate, to save money on extra fees. It can help reduce interest payments or help multiple debts to de-stress your worries. If you’re interested in learning more, you can check out our list of 0% APR Balance Transfer Credit Cards that you can utilize here on HMB!

Leave a Reply