![]() If you’re a business owner, I have good news for you! Bank of America now has a rewards programs for their business customers which is similar to their normal consumer Preferred Rewards program. The Relationship Rewards Program has increased benefits for business checking customers to help grow your business! Basically, the higher your business deposit balances are with Bank of America and/or investment balances are with Merrill Lynch and Merrill Edge are, the better your benefits will be. For more, make sure to check out all of our Bank of America Promotions.

If you’re a business owner, I have good news for you! Bank of America now has a rewards programs for their business customers which is similar to their normal consumer Preferred Rewards program. The Relationship Rewards Program has increased benefits for business checking customers to help grow your business! Basically, the higher your business deposit balances are with Bank of America and/or investment balances are with Merrill Lynch and Merrill Edge are, the better your benefits will be. For more, make sure to check out all of our Bank of America Promotions.

| Chase Business Complete Checking®: Earn $300 or $500 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities. Chase offers financial products and services that let you bank when and how you want. Get Coupon---Chase Business Checking Review |

| Huntington Unlimited Business Checking: Earn $400 bonus when you open a Huntington Unlimited Business Checking account and make total deposits of at least $5,000 within 60 days of account opening. The $400 bonus will be deposited into your account after all requirements are met. This account is for businesses with higher checking activity and greater cash flow needs. Apply Now---Huntington Unlimited Business Checking Review |

| U.S. Bank Business Checking: Earn a $500 bonus when you open a Silver Business Checking Account or $900 when you open a Platinum Business Checking Account online with promo code Q1AFL25 and complete qualifying activities, subject to certain terms and limitations. Offer valid through March 31, 2025. Member FDIC. Apply Now---U.S. Bank Business Checking Review |

|

| Bank of America Business Advantage Checking Bonus Offer Open a new Bank of America Business Advantage checking account and complete the eligible requirements to earn a $200 cash bonus offer. See offer page for more details. Additional terms and conditions apply. See offer page for more details. Learn More---Bank of America Business Checking Review |

What To Know:

- Program Name: Business Advantage Relationship Rewards (BARR)

- Expected Launch Date: Early 2018

- Types of Rewards: Tiered business credit card bonuses, and more

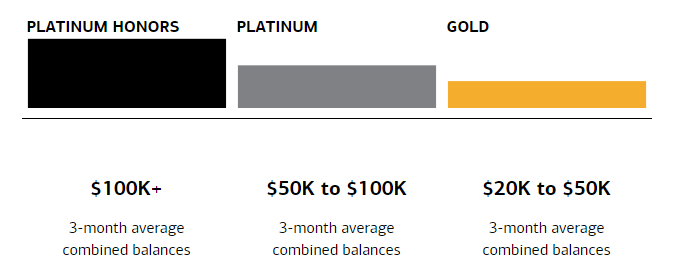

- Tier: Gold, Platinum, and Platinum Honors (same names as with the consumer program)

- Program Qualification: You must have an eligible Bank of America business checking account and 3-month average combined business balances of $20,000 or more in qualifying BOA business deposit account and Merrill Edge business investment accounts.

Three Relationship Tiers:

Similar to the personal Preferred Rewards program, the business rewards program also contains three tiers:

- Platinum Honors for those who have $100k+ with BofA

- Platinum for those who have $50k-$99k with BofA

- Gold for those who have $20k-$49k with BofA

Business checking and savings balances count towards your status, as well as investments held with Merrill Edge and/or Merrill Lynch. The terms however, indicate that only the business investments count toward the tier levels. Therefore, it would be difficult for the majority of us to qualify for a meaningful status unless you have a business with high cash reserves or if you shift your other investments over to business accounts.

Program Benefits:

- Rewards bonus on eligible credit cards: 75% for Platinum Honor, 50% for Platinum, and 25% for Gold

- No fees on select everyday banking services, such as inbound wires, stop payments and more

- Cash rewards on BofA Merchant Services processing (I don’t know what this means)

- Interest rate booster on your business savings account (this will probably be an opportunity to earn like .5% APY instead of .03% APY, nothing to get too excited about)

- Interest rate discount on certain business loans: .75%/.50%/.25% discount on credit line, term loan, and secured lending; .5%/.35%/.25% discount on auto and commercial real estate loans

- Monthly discount on full service payroll fee ($20/$15/$10)

- No fee on ATM transactions anywhere (Platinum Honors is unlimited, Platinum is limited to 12, Gold does not have this benefit)

- No fee trades (100 per month with Honors, 30 per month with Platinum, Gold does not have this benefit)

Bottom Line:

It’s safe to say that the majority of us aren’t running our own businesses which has an average of $100k+ in funds in their checking, savings, and investment accounts, thus it limits who will benefit from the program. However, if you are someone who does run a business with a large cash reserve may want to consider Bank of America to increase your benefits. Also, remember that it’s also possible that you can simply shift over your personal investments into a business investment account. If you don’t qualify, check out our full list of Business Bank Promotions for other deals!

| PROMOTIONAL LINK | OFFER | REVIEW |

| U.S. Bank Silver Business Checking Package | $900 Cash | Review |

| U.S. Bank Gold Business Checking Package | $900 Cash | Review |

| U.S. Bank Platinum Business Checking Package | $900 Cash | Review |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Huntington Bank Unlimited Plus Business Checking | $1,000 Cash | Review |

| Huntington Bank Unlimited Business Checking | $400 Cash | Review |

| Huntington Bank Business Checking 100 | $100 Cash | Review |

| Axos Bank Basic Business Checking | $400 Cash | Review |

| Axos Bank Business Interest Checking | $400 Cash | Review |

| Regions Bank Business Checking | $150 Cash | Review |

| NorthOne Business Checking | $20 Credit | Review |

| Novo Business Checking | $75 Cash | Review |

| BlueVine Business Checking | 2.00% APY | Review |

Leave a Reply