Read on to learn more about BayCoast Bank promotions, bonuses, and offers here.

Currently, they are offering a checking bonus of $222 for opening a qualifying account.

About BayCoast Bank Promotions

BayCoast Bank is a successful community bank serving the people and businesses of Massachusetts and Rhode Island. They support the established belief in community involvement and provides a wide range of financial services. BayCoast has 22 different locations with about 496 employees.

I’ll review the BayCoast Bank Promotions below.

BayCoast Bank $222 Checking Bonus

BayCoast Bank is offering a $222 bonus when opening a new qualifying checking account and meet account requirements.

- What you’ll get: $222 Bonus

- Account Type: Checking account

- Availability: MA, RI (Bank Locator)

- Direct Deposit Requirement: Yes, $250+ per month for 3 months

- Credit Inquiry: Unknown

- Chex Systems: Unknown

- Credit Card Funding: Up to $550

- Monthly Fees: $3, avoidable

- Early Account Termination Fee: $25, six months

- Household Limit: None

(Expires 01/31/2023)

| BMO Smart Money Checking ($350 cash bonus) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | |

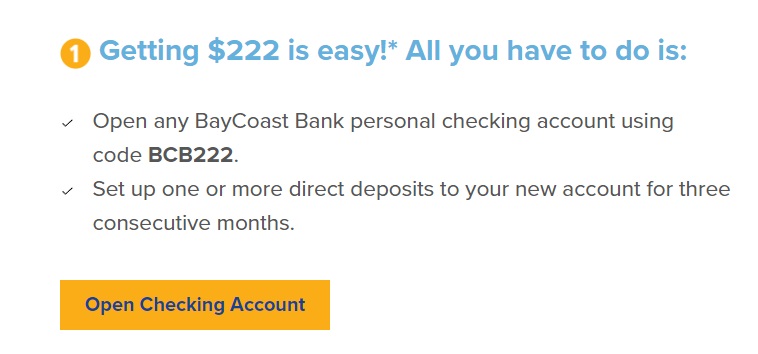

How To Earn $222 Checking Bonus

- To get this bonus, simply:

- Open any BayCoast Bank personal checking account using code BCB222.

- Set up one or more direct deposits to your new account for three consecutive months

- Use code BCB222.

- Receive $222.00 by opening any BayCoast Bank personal checking account and establishing direct deposit.

- To qualify for the $222.00 direct deposit incentive, customer must receive one or more direct deposits for 3 consecutive months that total $250.00 or more each month.

- Direct deposits are automatic electronic deposits made through the ACH network to your account by someone else, such as an employer issuing payroll or a government or retirement plan paying benefits.

- It may not include deposits to your account that are made by an individual using online banking, an Internet payment provider, or a merchant advancing payroll using a debit card.

- Offer valid for new accounts opened by 1/31/2023.

- Must be 18 years or older to open an account.

- Customer must not have had an open BayCoast Bank checking account within the last 6 months.

- Customer has up to 150 days after account opening to take the necessary action(s) to qualify for the incentive and account must be open and in good standing.

- A $222.00 credit will be applied within 30 days of completing these requirements.

- Starter checks will be provided at no cost following account opening upon request.

- Present this offer in person at account opening or enter the promotion code during the online account opening process to be eligible for this offer.

- Only one account is eligible for this offer.

- Offer is exclusive, nontransferable, cannot be combined with any other offer, and is subject to change at any time.

- Employees of BayCoast Bank and its subsidiaries are not eligible.

BayCoast Bank $250 Checking Bonus *Expired*

Earn a $250 bonus at BayCoast Bank!

BayCoast Bank is offering a $250 bonus when opening a new qualifying checking account and meet account requirements.

- Account Type: Checking account

- Availability: MA, RI (Bank Locator)

- Household Limit: Only one account is eligible for this offer.

- Closing Account Fee: Unknown

(Offer expires December 31, 2021)

| BMO Smart Money Checking ($350 cash bonus) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | |

How To Earn $250 Checking Bonus

- Open a Direct Checking with 3 consecutive qualifying monthly direct deposits

- Make 12 qualifying debit card purchases within 90 days and get a $50 incentive

- Sign up for eStatements and get a $25 incentive

- Make a bill payment and (or) mobile deposit and get $25

- Open a safe deposit box and receive a $40 credit toward your annual fee

- Receive your first order of starter checks with a $10 first order credit

Use promotion code BC250

- Receive up to $250 with Direct Checking.

- Minimum opening deposit is $10.00.

- Average daily balance of $1,500.00 or one direct deposit per statement cycle waives the $3.00 monthly maintenance service charge.

- Offer valid for new accounts opened by 12/31/2021.

- Must be 18 years or older to open an account.

- Customer must not have had an open BayCoast Bank Checking account within the last 6 months.

- Customer has 90 days after account opening to take the necessary action(s) to qualify for the incentive(s).

- Starter checks will be provided at no cost following account opening upon request and the safe deposit box credit will be applied directly toward annual rent at the time of box rental.

- Other incentive(s) will be credited to the account within 90 days of qualification and account must be open and in good standing.

- Present this offer in person at account opening or enter the promotion code during the online account opening process to be eligible for this offer.

- Only one account is eligible for this offer.

- Offer is exclusive, nontransferable, cannot be combined with any other offer, and is subject to change at any time.

- Employees of BayCoast Bank and its subsidiaries are not eligible.

- To qualify for the $100.00 direct deposit incentive, customer must receive one or more direct deposits for 3 consecutive months that total $250.00 or more each month.

- Direct deposits are automatic electronic deposits made through the ACH network to your account by someone else, such as an employer issuing payroll or a government or retirement plan paying benefits.

- It may not include deposits to your account that are made by an individual using online banking, an Internet payment provider, or a merchant advancing payroll using a debit card. To qualify for the $50.00 debit card incentive, customer must make 12 point of sale debit card purchases each of $5.00 or more within 90 days.

- ATM transactions do not qualify as debit card purchases.

- Enrollment in online banking is required to sign-up for eStatements make bill payments and perform mobile deposits.

- Safe deposit boxes are not available at all branch locations and availability varies by branch.

How To Waive Monthly Fees

- Direct Checking: $3 monthly fee, waived if maintained average daily balance of $1,500.00 or one direct deposit per statement cycle

- Preferred Checking: $15 monthly fee, waived if maintained average daily balance of $5,000 in combined deposit balances & mortgage loan balances (including HELOC & home equity loans)

- Active Checking: $10 monthly fee, waived if average daily balance of $1,500.00 for the statement cycle or satisfaction of all quali?cation requirements during a quali?cation period

- Student Checking: $6 monthly fee, waived if you are 23 years or younger

- Senior Checking: $6 monthly fee, waived if you are 65 years or older

- Honor Checking: $5 monthly fee, waived if you are active and retired armed services personnel and veterans. One direct deposit per statement cycle

- Small Business Checking: None

- Business Analysis Checking: Competitive earnings credit to offset monthly activity charges with a minimum daily balance of $500.00

- Right Fit Checking: Interest compounded and paid monthly. Minimum balance to obtain interest: $10.00.

- Municipal/Non-Profit Checking: Interest compounded and paid monthly. Minimum balance to obtain interest: $500.00.

|

|

Bottom Line

BayCoast Bank is currently having a promotion where you can earn a $250 bonus simply by opening a new checking account. Be sure to take advantage of this if you reside near a BayCoast Bank.

Furthermore, feel free to leave your comments about BayCoast Bank. Your feedback is highly appreciated and helps us improve our site.

However, BayCoast Bank offers pretty standard rates when it comes to CDs and Savings Accounts. Therefore, check out our full list of Bank Rates and CD Rates for the best rates nationwide.

*Compare BayCoast Bank Promotions with other bank bonuses from banks like Huntington, HSBC, Chase, TD, Bank of America, Citi, and more!*

*Check back for updated BayCoast Bank promotions, bonuses, and offers.

Leave a Reply