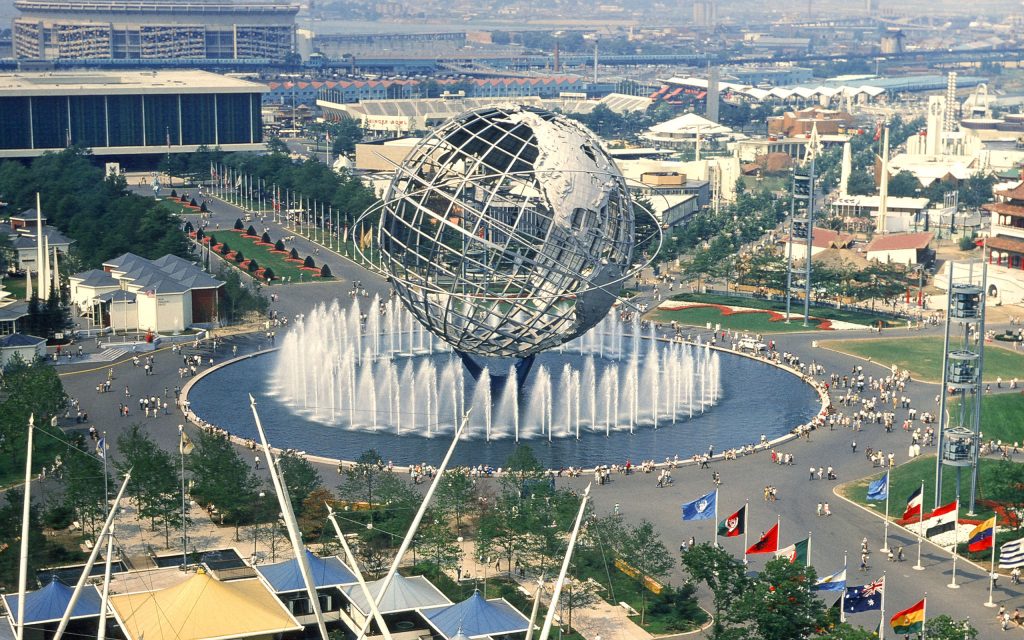

Queens is a New York City borough on Long Island across the East River from Manhattan. Flushing Meadows Corona Park, with the Unisphere, a 12-story 1964 World’s Fair globe sculpture, hosts the annual U.S. Open tennis tournament. The park’s Queens Museum is known for the “Panorama,” a building-for-building model of New York City. Nearby Citi Field is the stadium of pro baseball team, the Mets. There are so many wonderful sights to see in Queens! Fortunately, we have reviewed several checking promotions from banks and credit unions in Queens for you to browse. Here’s our list for the best checking promotions in Queens, New York!

Queens is a New York City borough on Long Island across the East River from Manhattan. Flushing Meadows Corona Park, with the Unisphere, a 12-story 1964 World’s Fair globe sculpture, hosts the annual U.S. Open tennis tournament. The park’s Queens Museum is known for the “Panorama,” a building-for-building model of New York City. Nearby Citi Field is the stadium of pro baseball team, the Mets. There are so many wonderful sights to see in Queens! Fortunately, we have reviewed several checking promotions from banks and credit unions in Queens for you to browse. Here’s our list for the best checking promotions in Queens, New York!

Best Checking Promotions Queens, New York

Chase Bank $300 Premier & $350 Checking/Savings Promotions

- Application Links:

- Availability: Bank Locator

- Credit Inquiry: Soft Pull

- Direct Deposit Requirement: Yes

- Bottom Line: These are some popular Checking account promotions with many features and easy to waive the Monthly Fee with just a $1,500 minimum daily balance. The Premier checking is also one of the highest checking promotion for residents of Staten Island, New York.

- Full Review: Chase Bank Promotions

TD Bank $300 & $150 Checking Promotions

- Application Links:

- Availability: CT, DC, DE, FL, MA, MD, ME, NC, NH, NJ, NY, PA, RI, SC, VA

- Credit Inquiry: Soft Pull

- Direct Deposit Requirement: None

- Bottom Line: TD Bank offers a variety of accounts to suit your financial needs and offers monthly fee waivers if you follow their simple requirements. A few features that all TD checking accounts include free mobile banking and bill pay, free access to thousands of TD ATMs, live customer service, and much more!

- Full Review: TD Bank Promotions

HSBC $750, $350, $200 Checking Promotion *The offer are currently unavailable*

- Availability: Nationwide (Online only)

- Credit Inquiry: Soft Pull

- Direct Deposit Requirement: No

Capital One $25 Checking/Savings & $100 Money Market Promotion

- Application Link:

- Availability: Nationwide

- Credit Inquiry: Soft Pull

- Direct Deposit Requirement: No

- Bottom Line: Capital One’s checking and savings promotion is quick and easy for those who have a little extra cash. With a capital one account, you’ll be able to refer your friends for a bonus as well! Be sure to check out our review below for more details!

- Full Review: Capital One Promotions

Apple Bank $100 Checking Promotion

- Application Links:

- Availability: NY

- Credit Inquiry: Unknown

- Direct Deposit Requirement: Yes

- Bottom Line: For residents of New York, Apple Bank would like to give you extra $100 bonus in your pocket! To score the $100 bonus, just sign up for the convenient and free Direct Deposit service with any new Apple Bank checking account. It’s as simple as that! With direct deposit, you can enjoy security and peace of mind, knowing your money is available immediately upon deposit. There are many checking accounts to choose from so you can find one that meets all your banking needs. Check out our review below to find out more details.

- Full Review: Apple Bank Promotion

Santander Bank $150 Checking Promotion

- Application Links:

- Availability: CT, DE, MA, NH, NJ, NY, PA, RI

- Credit Inquiry: Soft Pull

- Direct Deposit Requirement: Yes

- Bottom Line: Earn a $150 Bonus when you open a qualifying checking account by December 31, 2017. To earn the bonus all you have to do is open a new qualifying checking account in branch or online using the promotion code: DIG15010ND. Then you’ll need to have direct deposits totaling at least $1,000 post within the first 90 days, starting the first business day after account opening. This is a soft pull inquiry for opening with Santander Bank which does not affect your credit score plus you can fund your account up to $500 with a credit card!

- Full Review: Santander Bank Promotion

The Delta SkyMiles® Blue American Express Card offers 10,000 bonus miles after you spend $1,000 in purchases on your new Card in your first 6 months. You'll earn: • 2X miles per dollar at restaurants worldwide and purchases made directly with Delta • 1X mile on every eligible dollar spent on other purchases. In addition, you'll receive a 20% savings in the form of a statement credit after you use your Card on eligible Delta in-flight purchases of food, beverages, and audio headsets. This card comes with no annual fee or foreign transaction fees. (See Rates & Fees) Terms Apply. |

Leave a Reply