Money orders first came about in the 1863 by the U.S. postal system as a safe way of sending cash. A money order is basically a printed order for payment of a specified sum, typically issued by a bank, post office, convenience store, money transfer and check-cashing company or supermarket. Continue reading to learn more about money orders.

Best Places To Get Money Orders

When taking into consideration where you should get your money order, look for an issuer with convenient locations and low fees. Fees might depend on the amount of the money order. If you can’t find a money order provider near you, you may want to consider a cashier’s check.

Continue reading to learn more about the four best options that are available for those looking to get a money order.

Western Union

Through Western Union, each location is allowed to charge their own fees, so there are no set rates. If you don’t know how to order a money order from this location, you can simply call them and they will walk you through it.

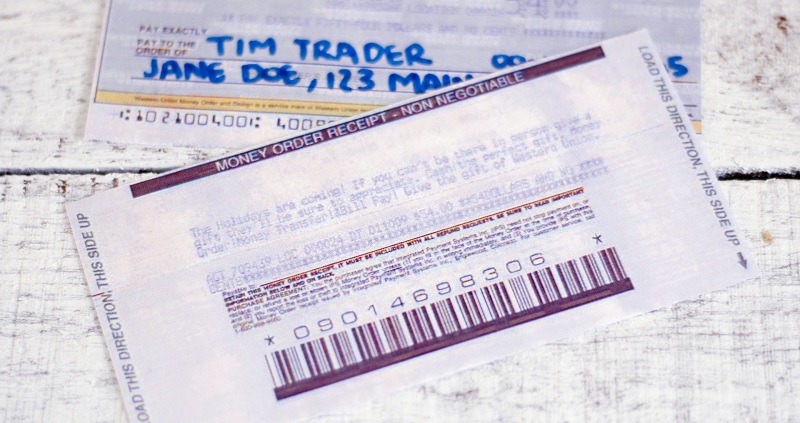

All you have to do to fill out a money order is write the person’s name along with your name and address under “purchaser,” and then sign it. Tear the receipt attached to the money order and store it in your records.

Limit: Up to $5,000 if sending in the U.S.

Fee: From 99 cents to well over $100, depending on the amount, whether you pay in person or online, and whether you pay through a bank account, credit card or debit card

Provider: Western Union

Pros:

- More than 500,000 agent locations available around the world

- No restrictions on sending internationally

- No bank account necessary

Cons:

- Potentially exorbitant fees

U.S. Postal Service

The post office money order is on the more affordable side of things. They are sold in amounts up to $1,000, and fees vary based on the amount of the money order.

U.S. Postal Service Money Order Fees

- Up to $500: $1.25

- $500.01 to $1,000: $1.75

- Postal military money orders: 45 cents

Limit: Up to $1,000 for domestic money orders

Fee: From 45 cents to $1.75 domestically; $10.25 plus country-based processing fee for international money orders

Provider: USPS

Pros:

- Easy to find a local post office

- Set rates

Cons:

- International money orders limited to $700 ($500 if sending to El Salvador or Guyana)

- Checks and credit cards not accepted as payments for money orders

Walmart

An authorized agent of MoneyGram, Walmart can get you a money order if you need one. You can buy a money order for a small of of no more than 88 cents. After filling out the form and obtaining your money order, you can choose between hand-delivering it to the recipient or mail it.

Limit: $1,000 without a government-issued ID

Fee: Up to 88 cents

Provider: MoneyGram

Pros:

- Available from the customer service desk or Money Services Center at any Walmart

- Supercenter or Neighborhood Market

- Stores located worldwide

- Less expensive than most banks

Cons:

- For recipients who cash money orders at Walmart, check-cashing fees might apply

Banks and Credit Unions

Nearly all banks and credit unions will sell and cash money orders. However, each has their own requirements when it comes to the fees associated with money orders and the required documents.

If you currently aren’t a member of a bank or credit union you plan to visit, bring forms of identification with you in case you need to sign up with the establishment. Additionally, bring a form of payment for your money order and any associated fees.

| Bank | Fees |

| Chase | $5; free for Chase Premier Plus, Chase Secure and Chase Sapphire checking accounts |

| Wells Fargo | Up to $5 |

| Citibank | $5 for Citi account holders |

| U.S. Bank | $5 |

| Fifth Third Bank | $1 with Fifth Third Free Checking in certain markets |

Pros:

- Might be free if you have the right account

Cons:

- Typically charge more than other providers

FAQ on Money Orders

What Is a Money Order?

A money order is simply a method of sending money to someone if you don’t have cash or a check on hand. It is a prepaid document, so you must pay the entire amount you want to send, including any fees when you purchase the money order.

The person who receives the money order can cash it at most financial institutions.

When Should You Use a Money Order?

A money order can be a good option for you if:

- You don’t have a bank account and can’t write a check.

- You don’t want the person receiving the money to see the banking information that’s printed on a personal check.

- You’re sending the money through the mail and want something more secure than cash.

Are Money Orders Safe?

Money orders are safer than sending physical cash because only the recipient can cash the money order because their name is on the document. Therefore, they must show their identification in order to cash it.

|

|

Bottom Line

If you’re looking for a way to securely and safely send money to someone, then consider a money order. Money orders are safe because they require the recipient to show a form of identification at the financial institution in order to cash it. For more posts like this, check out our list of bank guides!

Leave a Reply