Available nationwide except for the states of AR, GA, NV, and OK, Brightpeak Financial is saying hello to savings and goodbye to freak-outs. Be prepared for whatever life throws at you with an emergency savings account, plus, you can earn up to a $100 bonus! To earn this bonus all you have to do is deposit at least $50 per month. Then you’ll need to maintain a specific balance amount for a period of time in order to earn your bonus. Also, not only will you qualify, but you’ll have access to great features such as online banking, bill pay, and much more. So if you are interested and qualify, make sure to take advantage of this offer and sign up today!

Available nationwide except for the states of AR, GA, NV, and OK, Brightpeak Financial is saying hello to savings and goodbye to freak-outs. Be prepared for whatever life throws at you with an emergency savings account, plus, you can earn up to a $100 bonus! To earn this bonus all you have to do is deposit at least $50 per month. Then you’ll need to maintain a specific balance amount for a period of time in order to earn your bonus. Also, not only will you qualify, but you’ll have access to great features such as online banking, bill pay, and much more. So if you are interested and qualify, make sure to take advantage of this offer and sign up today!

Editor’s Note: You must be Christian in order to qualify for this promotion. If you are ineligible, check out our complete listing of Best Savings Promotions here on HMB.

If you’d like to participate in our Rewards Program, simply contact us when you find a new bank promotion and get paid up to $15!

| BMO Bank Checking: Open a new BMO Smart Money Checking Account and get a $350 cash bonus* when you have a total of at least $4,000 in qualifying direct deposits within the first 90 days. Learn More---BMO Checking Review *Conditions Apply. Accounts are subject to approval and available in the U.S. by BMO Bank N.A. Member FDIC. $4,000 in qualifying direct deposits within 90 days of account opening. |

| Chase Ink Business Unlimited® Credit Card: New cardholders can enjoy a welcome offer of $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. Click here to learn how to apply--- Review |

Brightpeak Financial $100 Bonus Info:

- Sign up Offer

- Brightpeak Financial Promotion PDF Printout

- Account Type: Emergency Savings

- Availability: Nationwide except AR, GA, NV, and OK (Bank Locator)

- Expiration Date: None

- Credit Inquiry: Unknown. Let us know.

- ChexSystems: Unknown

- Opening Deposit: $1

- Credit Card Funding: No

- Direct Deposit Requirement: None.

- Monthly Fee: None.

- Additional Requirements: You must keep the account in good standing.

- Household Limit: 1

- Closing Account Fee: $20 closing fee

Earn Brightpeak Financial $100 Bonus:

- Open an Emergency Savings Share Account with a $1 minimum opening deposit from Brightpeak Financial.

- To receive bonuses you’re required to deposit at least $50 per month.

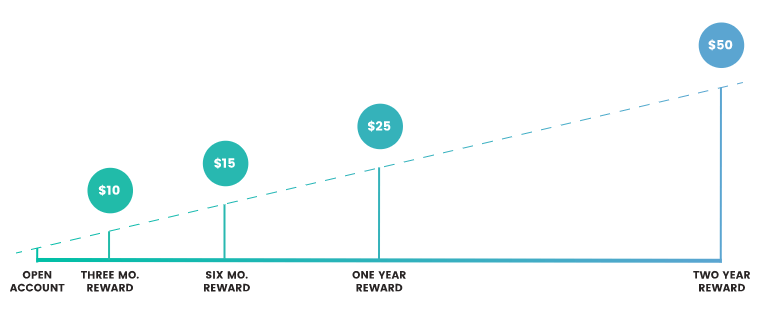

- Have a balance of at least $150 in the savings account when it has been opened for three months to receive $10.

- Have a balance of at least $300 in the savings account when it has been opened for six months, to receive $15.

- Have a balance of at least $600 in the savings account when it has been opened for twelve months, to receive $25.

- Have a balance of at least $1,200 in the savings account when it has been opened for twenty four months, to receive $50.

If a participant fails to meet any of the requirements at any time that Brightpeak may be calculating reward eligibility, the participant won’t be eligible to receive the reward payment at that time. However, they will remain enrolled in the program and will have the opportunity to receive future rewards if all of the requirements are met for the each of the subsequent rewards.

How to Avoid Monthly Fees:

- Emergency Savings: There are no monthly fees.

Bottom Line:

If you are looking for a great savings account, check out this offer from Brightpeak Financial. The purpose of this program is to help Brightpeak members meet their savings goals and build financial strength. Plus there are no monthly fees for you to worry about which is always great. Also, if you have any previous experiences with this bank then go ahead and leave us a comment. We would love to hear back from you. If you would like to see more, check out our full list of Bank Bonuses for all your banking needs.

The Chase Sapphire Preferred® Card offers 100,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. You'll earn: • 5x on travel purchased through Chase TravelSM • 3x on dining, select streaming services and online groceries • 2x on all other travel purchases • 1x on all other purchases • $50 Annual Chase Travel Hotel Credit • Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027. Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase TravelSM This card carries a $95 annual fee. |

After 3 months from opening, I noticed I did not receive my 3 month payment. I contacted them today and received this message in response:

Thank you for contacting us.

This email is in reference to your Thrivent Federal Credit Union inquiry [REDACTED].

I apologize for any inconvenience. Brightpeak discontinued the rewards incentive for these accounts at the end of September. Any rewards that were owed to members were deposited around September 27th. For more information, you will want to contact brightpeak at 855-348-3001, option 1.

If you would like further assistance, simply reply to this email. We can also be reached by telephone at 866-226-5225.

Thank you

Julie Besaw, Lead Customer Care Professional

So they hung onto my money for the last few months for nothing.

They claim it takes less than 5 minutes to set it up, but in reality, it will likely take MUCH longer. I don’t trust people that give time estimates that are WAY off. It takes way more than 5 minutes to read thru all of the requirements and understand them. I really don’t trust these people and back in 2017, they had a $200 identical 24 month offer so now it is only half of that. It is not worth the hassle and risk for only $100. Other banks give bonuses MUCH quicker than 2 years and much more than $100. The only way I would do this offer is if I lived close to where their office is so I could monitor what they are doing. Too many comments with people that had issues. I’ll pass.

This can basically be viewed as a high % interest bearing account. Using “rough” numbers, you will have about $500 tied up (on average) for 2 years and get $100 bonus total so that is about 10% interest a year. So for $1000 “invested”, if all goes well, you should have $1100 at the end of 2 years. Not a great way to make money but still $100 for free. I asked them on the phone what happens if the account is closed “midway” and they told me any partial incentives earned up to that point can be kept by the account holder, with the exception being if you close the account before 3 months of it being open, there is a $20 close fee which will effectively negate any partial incentive earned up to that point. If I apply for this offer, I will watch if they post the partial incentives promptly to determine if I will keep the account open or not. Note that in one place they say $50 per month (or equivalent) but elsewhere (in the FAQ section) they say something else. It is not totally clear to me what the requirements are.

You won’t be able to go anywhere with all the accounts you’ve opened. Most banks use Chex systems

How do they know if you are a Christian?

Hi Ally,

Thanks for the info. May I ask how many accounts you had in the past 12 months?

it was chexsystems.

Denied for excessive inquiries. Not sure if they ran chexsystems or credit report – waiting on a letter. Taking my business elsewhere! Unjustified.

2 years. Wow.

…you also have to be a Christian. That should be listed under requirements.