There’s much for to buying and selling stocks than what may meet the eye. When you consider Call Options you have a chance to really increase your profits. At the very least, they will help you minimize risk.

There’s much for to buying and selling stocks than what may meet the eye. When you consider Call Options you have a chance to really increase your profits. At the very least, they will help you minimize risk.

Buying call options can be a great strategy for new investors. Experienced investors often take it a step further and also sell (or “write”) options.

Continue reading below to learn more!

| PROMOTIONAL LINK | OFFER | REVIEW |

| J.P. Morgan Self-Directed Investing | Up to $700 Cash | Review |

| TradeStation | $3500 Cash | Review |

| WeBull | 12 Free Stocks & free trades | Review |

| SoFi Invest | $25 Bonus and free trades | Review |

What Is A Call Option?

When you decide to purchase a call option, you are paying for the choice to purchase a stock at a certain price by a certain date. It’s a contract that you’re signing – you’re agreeing to purchase the stock, and if enough time elapses, you can walk away without having to pay for your agreement. Additionally, you can sell a call option. You’ll sell a stock at a certain price within a time frame. The specific price is the strike price.

Difference Between Buying and Selling Calls

The main difference between the two is obligation to take action upon the contract.

- When you buy a call, you do not have the obligation to follow through with the contract. You can wait for the contract to expire and pay for the premium fee and not purchase the stocks that was agreed upon.

- When you sell a call, you are obligated to follow through with the contract. If the buyer executes the call or option, you must comply with it. Selling calls is a riskier situation because you do stand to lose money if the price of the underlying stock’s shares increases.

Who Is Involved When Buying and Selling Options

Let it be known that the companies of the securities for each options contract are not involved in any transaction. The buyers and sellers of options are individual investors or third parties acting for the investor.

The companies behind the underlying securities do not provide any of the cash flow for the options contracts on either of the sides. Both parties are involved in the contract are hoping to profit by either buying or selling their call options.

Index and ETF Options

You can purchase options of an underlying individual stock. But, you can also purchase options as a financial derivative of an index, such as the S&P 500 or a specific ETF. ETF options are not as heavily traded as those on individual securities or major indexes, though. ETFs focus on a specific market segment, which may or may not bring many investors.

Before you begin trading options, look at the volume of options trading going on at that time. Trading options without high volume have a lower likelihood of creating a profit. If you make traded volume a part of your factors, in addition to the bid/ask prices and option liquidity, you may have a better chance at creating a profit.

How Do You Buy a Call Option

Remember when we said you have a choice to buy an option? You are never obligated to follow through with the contract. You only want to follow through when you are “in the money.”

In other words, it’s only a smart thing to do if you’re getting a better deal on the underlying stock than someone who would buy shares outright on that day. In order for this to happen, the strike price must be less than the market price.

For example – ABC stock has a current market price of $35. You can buy a call option contract with a strike price of $45. The premium on the contract is $3. It expires in 6 months. This means that within the next 6 months, if the stock price rises above $45, you’ll be in the money. Because each contract equals 100 shares, you’d pay a $300 premium for this right as a call buyer.

Let’s say in 5 months the stock price is $55.

You could exercise your right to buy the stock for $45. It would cost you $4,500. You would make $5,500 in the current market, selling it right away. It looks like you’d make $1,000 in profit, but remember, you paid the premium for the right to buy the underlying shares. In reality, you’d make $700 as a call buyer, which is the $1,000 profit minus the $300 premium.

Now let’s pretend the stock didn’t rise. Instead, it fell to $30. You still hold the option to buy the stock at $45. But why would you? Instead, you’d let the contract expire worthless. You’d be out $300 as a call buyer. But if you had bought the stock outright, you’d lose more.

It would have cost you $3,500 for the initial stock. If the current price is $30, your shares would be worth $3,000. You’d be out $500.

What Are The Benefits?

Over time, you’ll come to realize the benefits of being a call buyer: unlimited profits and minimal risks. Given the risks of investing, these are great beneficiaries.

When you set up a buy call, you’re agreeing to purchase a stock when it reaches a certain price. It doesn’t limit how high the stock can go, meaning that the profit can just keep increasing more and more.

The risks you incur are known from the start. It simply equals the amount of the premium you paid for the right to buy the underlying shares. Remember, you multiply the cost of the contract by 100. This gives you the total premium for the 100 shares. You only risk a loss when the market price doesn’t increase as you thought it would before expiration.

How Can You Sell Options?

An investor selling a call option is known as the writer. The writer is the person on the other end of the equation. This person wants the stock price to fall. This way, the contract expires “out of the money.” The seller walks away with the premium in his pocket.

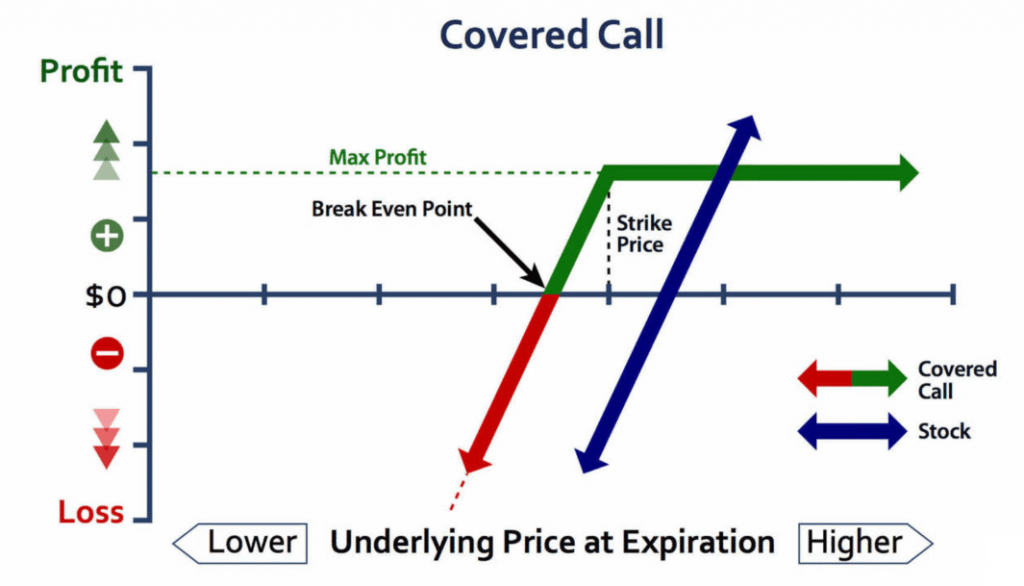

Sellers can sell calls two ways: covered or uncovered (also known as “naked”).

When an investor writes a covered call, it means he owns at least 100 shares of the underlying stock. When the buyer exercises his right to buy the stock, the seller has possession of it.

An uncovered, or naked, call means that the seller/writer does not have 100 shares in his possession. If the buyer exercises his right to buy the stocks, the writer must also buy the stocks which can incur in an even greater loss. He buys the stock at market price and sells them to the buyer at the strike price.

What are the Benefits of Selling Calls?

It may be hard to see why people would choose to sell instead of buy. Note that selling calls is not for novices, but for experienced individuals. If you’re a good predictor of the market, then you could make a good profit from selling.

Right away, you decrease the amount paid for the stock ownership as you collect the premium for the contract. The rest depends on how the market reacts:

- If the underlying stock never rises above the strike price, the seller gets to walk away with the premium that the buyer had to pay for.

- If the underlying stock rises above the strike price, you’ll sell the stock and and make the difference between what you sold and the premium paid for.

- Selling options either covered or uncovered can be a way to generate a steady stream of income. You hedge your losses by creating a steady stream of income with the premiums collected. It’s not a ‘get rich quick’ scheme, but done right, it may help you increase your profits.

If you decide that you don’t want to risk it, you have the option of buying the stocks back and walking away without any profit.

What are the risks though?

Just like everything involved in the stock market, there’s a risk to it. However, just like outright buying a stock, the risks are the same – if the market tanks, you lose your money. You can also decide to ride it out and wait to see if you still come out ahead.

You aren’t risking a greater loss writing a call. As a matter of fact, the amount you lose if offset by the premium paid for by the buyer.

Don’t Forget Commissions!

Just like outright buying a stock, the process must be done through a brokerage which can include rates and fees. You have to pay the brokerage to help you execute a call.

If you are a very active trader, be sure to choose a low-commission broker. If you are a new trader, focus on a broker that will provide you with the most support.

|

|

Bottom Line

Buying and selling calls is another way to take advantage of the stock market and make a profit. With experience selling may become your best friend and profits can become instant with premiums.

Many investors write calls to minimize their losses. It helps force them to sell when the underlying stock hits their targeted price. Either way, you can make decent profits.

Never forget that creating a diverse portfolio is the best way to minimize losses. Mixing in different industries and companies to your portfolio really helps minimize loss when one of those industries has a downturn.

If you enjoyed this post, be sure to check out more on HMB! You can find more of the latest brokerage promotions here!

For money making opportunities, see our list of the latest bank bonuses and credit card promotions.

You can find plenty of guides that can help you through the stock market or with banks!

| BMO Bank Checking: Open a new BMO Smart Money Checking Account and get a $350 cash bonus* when you have a total of at least $4,000 in qualifying direct deposits within the first 90 days. Learn More---BMO Checking Review *Conditions Apply. Accounts are subject to approval and available in the U.S. by BMO Bank N.A. Member FDIC. $4,000 in qualifying direct deposits within 90 days of account opening. |

| Chase Ink Business Unlimited® Credit Card: New cardholders can enjoy a welcome offer of $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. Click here to learn how to apply--- Review |

Leave a Reply