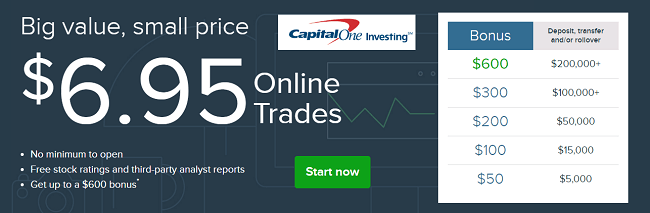

Capital One Investing is offering a $600 bonus for new and existing customers when you deposit $200K+ into your account good until January 31, 2018. Make sure to use Promo Code GET600M17 in order to qualify for this offer. The IRA account has a new $6.95 online trade price with no account maintenance fee for stocks, mutual funds, exchange-traded funds and more. The latest Capital One 360 bonuses are located on our Capital One 360 Promotions page!

Capital One Investing is offering a $600 bonus for new and existing customers when you deposit $200K+ into your account good until January 31, 2018. Make sure to use Promo Code GET600M17 in order to qualify for this offer. The IRA account has a new $6.95 online trade price with no account maintenance fee for stocks, mutual funds, exchange-traded funds and more. The latest Capital One 360 bonuses are located on our Capital One 360 Promotions page!

| PROMOTIONAL LINK | OFFER | REVIEW |

| J.P. Morgan Self-Directed Investing | Up to $700 Cash | Review |

| TradeStation | $3500 Cash | Review |

| WeBull | 12 Free Stocks & free trades | Review |

| SoFi Invest | $25 Bonus and free trades | Review |

Capital One Investing $600 IRA Bonus:

- Roll over, deposit, or transfer $200,000 or more and receive $600

- Roll over, deposit, or transfer $100,000 and receive $300

- Roll over, deposit, or transfer $50,000 and receive $200

- Roll over, deposit, or transfer $15,000 and get $100

- Roll over, deposit, or transfer $5,000 and get $50

Capital One Investing Bonus Information:

- Sign up Offer

- Account Type: Investing Individual Retirement Account (IRA), Individual, Joint or Custodial account

- Availability: Nationwide

- Expiration Date: 1/31/2018

- Online Trades: $6.95 per trade

- Hard Inquiry: No, Soft pull only. Hard pull if you apply for margin.

- Monthly Fee: $0.

- Additional Requirements: Must deposit $200K for the maximum bonus. Use promo code GET600M17. Read below for lesser amount.

- Closing Account Fee: Make sure to keep the deposit amount in your account for at least nine months or your award may be reclaimed by Capital One Investing.

How to Earn Your $600 Bonus:

- Open your new Capital One Investing account.

- Make sure to use Promo Code GET600M17

- Make a deposit within 90 days of account opening. The higher the deposit, the higher the bonus!

- Remember that the offer expires on January 31, 2018.

- Enjoy your new bonus!

Capital One Investing IRA Bonus Details:

There are two steps to getting your cash bonus. First, open a new Capital One Investing Individual Retirement Account (IRA), Individual, Joint or Custodial account using promotion code GET600M17 by 1/31/2018. You must have a U.S. Tax I.D. (Social Security number) to open a Capital One Investing account. Second, you must make a net deposit, transfer or roll over into your new account within 90 days of account open. Assets deposited must be valued at no less than $5,000 to be eligible for a $50 bonus, $10,000 for a $100 bonus, $25,000 for a $200 bonus, $50,000 for a $300 bonus, or $125,000 for a $600 bonus. Assets must be posted to your account within 90 days of account open. Subject to restrictions listed below, Capital One Investing will add the bonus to your account within 4-6 weeks following the 90 day qualification window.

Bottom Line:

Capital One Investing is a great investment tool for all your trading needs. It is less complicated, while giving you what you really need. You can build your portfolio steadily over time or invest in your way with intuitive and powerful tools. Versatile screeners, interactive charts, and customizable research to help you discover investments for your goals. Open the Capital One Investing today to receive up to $600 bonus in your new IRA account. If Capital One Investing is not for you, check out all of our brokerage promotions for your trading needs!

Interested in more brokerage promotions? See more of the best options below!

- Ally Invest Brokerage Promotion

- E*Trade Brokerage Promotion

- TD Ameritrade Promotion

- Robinhood Review

- & More Brokerage Promotions

If it is IRA, then u can’t close/get till 59.5, correct? (Re: acct closing fee in above post)

You are right Nell! The post has been updated. Thanks.

The link on your page shows higher levels of deposits are required for the bonus. For example, to get a $600 bonus, you must deposit $200K not $125

Bonus Deposit, Transfer

or Roll Over

$600 $200,000

$300 $100,000

$200 $50,000

$100 $15,000

$50 $5,000

There is a HUGE problem with this account – for regular brokerage accounts, they do NOT allow POD beneficiaries, unlike every other major brokerage or bank – so if you pass on, you can’t just have your heirs just take over your account – they’ll have to hire lawyers and go through probate to get it. HUGE FAIL. Avoid this brokerage until they fix that.

I received this

QUOTE

From Capital One ShareBuilder Customer Service

Hey XXXXXXX:

Thanks for hanging in there. Upon further review, it seems you’re not eligible for additional cash promotions, since you have previously received $275 from various promotions in your other Individual accounts.

ShareBuilder dos offers promotions as an incentive for trading and we do limit the number of promotions customers can take advantage of. In general we limit promotional awards to one per unique customer, which is defined as a different account type/registration (i.e. individual, Joint or Custodial). That means, since you already received several promotional offers, the Costco promotion is no longer valid.

QUOTE

I sent a reply to them and Costco stating that there was no such exception mentioned in the offer small print. I will keep you posted on what I hear from them.