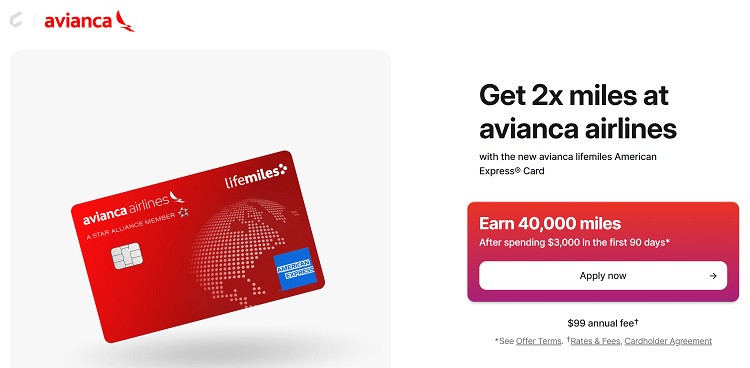

The Cardless Avianca Lifemiles American Express Card currently offers 40,000 miles after spending $3,000 in the first 90 days.

Cardless Avianca Lifemiles American Express Card Summary

Cardless Avianca Lifemiles American Express Card Highlights

- Earn 40,000 miles after spending $3,000 in the first 90 days

- 2x on all avianca airlines and lifemiles purchases

- 2x on groceries and restaurants

- 1x on everything else

- Get silver status with access to travel benefits like lounge access, priority boarding, and more.

- Each year your status will automatically renew if you maintain an active avianca lifemiles card.

- Lounge access

- Premium seat selection

- Additional checked bags

- Priority boarding

- Get a 5% redemption discount on avianca airlines flights booked through lifemiles.com

- No foreign transaction fee

- Miles do not expire for as long as you use your card

- $0 foreign transaction fee

- $99 annual fee

(at Cardless)

| Ink Business Preferred® Card 90K Points after $8,000 spend within first 3 months | Ink Business Unlimited® Credit Card $750 Bonus after $6,000 spend within 3 months |

| Capital One Venture X Business 150K Miles after $30,000 spend within 3 months | Ink Business Cash® Credit Card Up to $750 Bonus: Earn $350 after $3,000 spend in the first 3 months and an additional $400 with $6,000 spend in the first 6 months. |

| Chase Sapphire Preferred® Card 100K Points after $5,000 spend within 3 months. | Chase Freedom FlexSM $200 Bonus after $500 spend within 3 months |

| The Platinum Card® from American Express 80K Points after $8,000 spend within 6 months. Terms Apply. | Capital One Venture X Credit Card 75K Points after $4,000 spend within 3 months. |

| American Express® Gold Card 60K Points after $6,000 spend within 6 months. | Chase Freedom Unlimited® Card $200 Bonus after $500 spend within 3 months |

| Chase Sapphire Reserve® Card 60K Points after $4,000 spend within 3 months. | Capital One Quicksilver Cash Rewards Card $200 Bonus after $500 spend within 3 months |

|

|

Bottom Line

If you fly Avianca frequently, this card is a great way to help maximize your travel.

Make sure to also visit HMB to explore more credit card bonuses.

The editorial content on this page is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are author’s alone.

Leave a Reply