Have you receive a money order? This is basically a payment from another persons bank account. Now you can’t simply pay with that, you must cash or deposit it first because otherwise, it’ll just be a piece of paper.

Have you receive a money order? This is basically a payment from another persons bank account. Now you can’t simply pay with that, you must cash or deposit it first because otherwise, it’ll just be a piece of paper.

Money orders are comparable to checks in this manner. If you wish deposit it but don’t know what to do, continue reading on below because we’ve got your back! We have listed the ways on how and where to cash or deposit your money orders.

How to Cash / Deposit Money Order

- Firstly, you must bring the payment to a location that cashes money orders. Options include, but are not limited to, banks, credit unions, grocery stores, and check-cashing stores.

- Some banks require that you deliver the original money order to your bank for processing, and they don’t allow mobile money order deposits. Verify with your bank before you try to make a deposit.

- Endorse the money order by signing your name on the back.

- Show valid identification to verify that you are authorized to cash the money order.

- Pay any fees for the service. These costs will reduce the total amount of cash you receive.

- Finally, you will receive your cash payment! It’s as easy as that.

Where to Cash / Deposit Money Order

- Your bank: Your bank or credit union probably provides this service for free. However, you might not be able to get the full amount of the money order immediately. It depends on your bank on how much you can take immediately, and the rest of the funds should be available within a few business days. For USPS money orders, the first $5,000 may be available within one business day. For other money orders, the first $200 may be available immediately.

- Money order issuer: If you don’t have a bank account or you can’t get to a branch, try visiting a location of the money order issuer. The issuer is the organization that prints and backs the money order. Working directly with the issuer will help you minimize fees and increase your chances of getting 100% of the cash quickly. Be aware that some places won’t give you cash if you’re not a customer or if they didn’t issue that particular money order.

- Other options: You can also try to cash money orders at retail outlets like check cashing stores, convenience stores, and grocery stores. Some stores have Western Union or Moneygram services available at the customer service desk, so you might be able to get the entire amount of cash for free.

Depositing Money Orders

Let’s say you don’t need all of the money from the money order right away, the smart move is to deposit the money into your bank account. You can always get the cash later if you need it and your funds will be safe in your bank account. With the money in your bank account, you will be less likely tempted to spend it, and it won’t get lost, stolen, or damaged.

Where Should You Deposit a Money Order?

Utilize your current checking or savings account, and move the cash somewhere else on the off chance that you have different uses for it. In the event that you don’t have an account at a bank or credit union, you can utilize this money order for your initial opening deposit. Having a bank account can possibly save you money and time over the long haul.

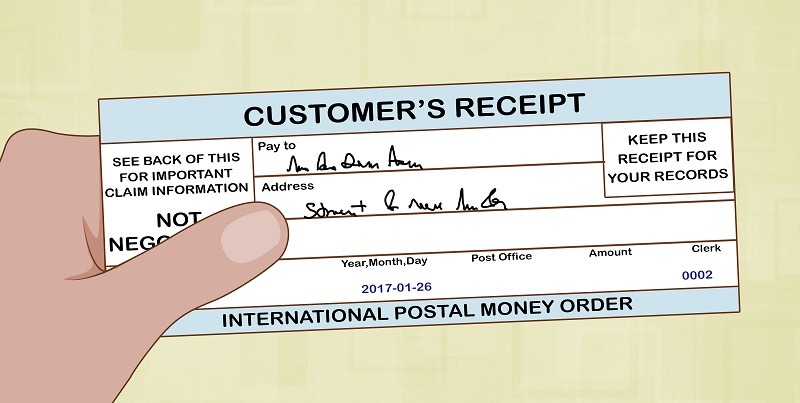

Technically speaking, depositing a money order is the same as depositing a check. You will have to endorse the back of the money order and list it separately (as a check) on your deposit slip.

The key difference in depositing a money order and a check is the authentication when it comes to mobile device deposits. Banks may require that you deliver the original money order to the bank for processing if they don’t allow mobile money order deposits. Check with your bank before trying to make these deposits.

Fees for Cashing Money Orders

If you’re wondering if there are any fees when you try to cash a money order anywhere besides your bank, the answer is yes. Normally, you will need to pay a couple of dollars in transaction fees or a percentage of the total you’re cashing. Be wary of check cashing stores and convenience stores because they tend to have higher charges.

If you’re receiving more than one or two money orders per month, then the smartest financial move is to open an accoutn at a credit union or a bank. Although they charge monthly maintenance fees, you will be able to cash your checks or money orders anytime you want without any fees.

Money Order Basics

Let’s say this is your first time ever receiving a money order. You might wander what it is. Well a money order is quite similar to a check, so you can treat money orders just like checks made out to you. In order to spend the money from the money orders made payable to you, you will need to cash the money order or deposit it into your bank account.

|

|

Bottom Line

If you got paid with a money order, be sure to deposit or cash that in as soon as possible. There is a chance of the payment being cancelled but if you cash the money order with the issuer, it can’t be cancelled.

Now if you received a money order, you can’t just go to a store and pay with that. You must cash it or deposit it at your local bank, credit union, grocery store, etc. Check out HMB’s in-depth list on Best Bank Account Bonuses, Credit Card Promotions, and Saving Rates.

Leave a Reply