Here you will find all the latest Bill.com promotions, bonuses, deals, savings, codes and more to help you save some money on paying or sending money to international and domestic vendors.

Bill.com is a cloud-based payment software that is efficient and helps digitize and automate accounts payable and accounts receivable for a simplified, clutter-free experience that frees up your time for other important business matters. Continue reading to learn more about this platform and what it has to offer.

(Learn more at Bill.com)

Bill.com $100 Referral Bonuses

Enjoy a $100 Visa gift card when you share Bill.com to your colleagues and family members, and they use your referral link to subscribe to a plan. All you have to do to get started is head to the Bill.com referral page, enter the email address you use with Bill.com, and click on the “Start Referring” button. Doesn’t appear to be any incentive for those using your referral link.

Note: Through January 31, 2022, you’ll earn a $50 gift card for sending 5 referrals, regardless if they subscribe.

Currently, we do not have a referral link, so our readers may feel free to post theirs in the comment section below.

Bill.com Features

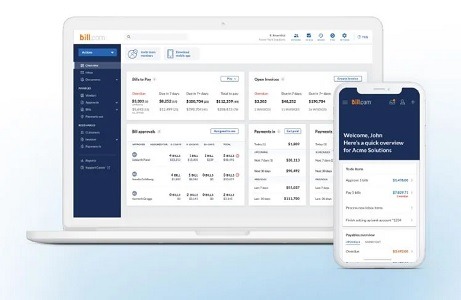

Bill.com is an innovative accounting solution that uses automation and cloud storage to make your back office financial operations much less time-consuming and much more painless. The software lets you create and pay bills, send invoices, and even get paid.

Members have access to ACH payments, international payments, and software integration. You can set up approval workflows and custom roles, and you can easily sync transactions with compatible accounting software and other payment tools. Plus, all your documents – business invoices, contracts, spreadsheets and more, are stored in the cloud for easy access during audits and tax season.

Accounts Payable

Bill.com’s accounts payable offers many functions, such as receiving supplier invoices, managing cash flow, creating approval workflow, submitting payments, monitoring cancelled checks, and preparing for audits. Here’s how it works:

- Vendors send their invoices to your digital inbox, or you can upload photos of invoices.

- The invoices are automatically processed and scheduled to pay now or pay later.

- The invoices go through your approval steps before they’re processed. Approvers can easily accept or reject invoices via the app.

- Payments (manual and automatic) are made by ACH, check, virtual card or international wire transfer, then recorded.

- Vendors and invoices sync with your accounting software.

Features include:

- Vendor dashboard, with outstanding bills, recent payment history, vendor credits, and documents.

- Store and manage vendor information, like billing address, shipping address, payment terms, and more.

- Easily search for vendors via the Business Payments Network.

- Customizable chart of accounts, so transactions are categorized similarly to your accounting software.

- Automatic sync every 24 hours. An instant sync option also available.

Accounts Receivable

Bill.com’s account receivable service lets you send automated electronic invoices to your customers, and payments can be made via ACH, check, virtual card or international wire transfer. It works much like their accounts payable service:

- Invoices are submitted to your customers via email.

- Automatic reminders are sent out for past-due invoices.

- Bill.com notifies you when a payment is made.

- Everything syncs with your accounting software.

Features include:

- Invoice dashboard that shows a quick overview of your accounts receivable.

- Customizable invoice templates, with optional printing and mailing service.

- Client portal, where customers can view and pay their invoices directly.

- Contact information storage, such as billing address, shipping address, account number, default payment terms and notes.

- Integration with compatible accounting software.

Bill.com Plans & Pricing

Bill.com offers four plans for businesses and one plan for accountants. All include a free trial, no credit card information required and cancel at any time.

Business Essentials ($39/User/Month)

With the Essentials Plan, you can manage either payables or receivables (not both), and:

- Accept payments online

- Connect to the Business Payments Network

- Enable approval workflows

- Have strong user permissions

- Use unlimited document storage

Business Team ($49/User/Month)

The Team Plan lets you manage either payables or receivables, and includes everything in the Essentials Plan, plus:

- Sync with QuickBooks Online, QuickBooks Pro/Premier, and Xero

- Custom user permissions

Business Corporate ($69/User/Month)

With the Corporate Plan, you can manage both payables and receivables, and includes everything in the Team Plan, plus:

- Invoice & payment automations

- Discounted approval-only users

- Custom approval limits

Business Enterprise (Custom Pricing)

The Enterprise Plan includes everything in the Corporate Plan, plus:

- Sync with QuickBooks Enterprise, Oracle NetSuite, and Sage Intacct

- Importing and exporting with Microsoft Dynamics

- Multi-entity and multi-location accounting files

- API access for custom integrations

- Premium phone support

Accountants ($49/Month)

Bill.com provides a plan for accounting firms. Members enjoy:

- Automated bookkeeping tasks

- Secure payment portal for clients

- Accountant Console, where you can manage your practice and access all your clients.

- Accountant Resource Center with tools to help you grow your practice, including templates and best practices.

|

|

Bottom Line

Bill.com is a great platform to choose if you’re looking for an easy-to-use, automated, cloud-based accounts payable and accounts receivable solution that integrates with your accounting software. Additionally, they tend to offer some great bonuses when you sign up for an account.

(Learn more at Bill.com)

Melio is a similar platform that allows you to make credit card payments, even if the vendor doesn’t accept cards. This allows you to earn credit card rewards on your payments and to access additional cash flow when needed.