If you bank with Chase and are looking to save even more money, here you can find the latest promotions, statement credits, cashback offers from Chase Offers!

If you bank with Chase and are looking to save even more money, here you can find the latest promotions, statement credits, cashback offers from Chase Offers!

If you don’t know what Chase Offers is, it’s Chase’s program that lets you shop with your registered card at participating merchants and get a statement credit for that purchase. It is similar to American Express Amex Offers.

To get the offers, log in to your Chase bank account and check if your card is targeted! These are great options to save so much money on simple things! You can get access to these Chase Offers by downloading the Chase App via iOs or Android.

Note: Interested in banking with Chase? Check out our list of the latest checking bonus coupons from Chase Bank!

| PROMOTIONAL LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up to $700 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

Chase Offers Applicable Cards

Chase offers is available to both Chase debit cardholders and credit cardholders! You can click through the tabs and see which credit cards are valid, please note that if you have multiple Chase credit cards, you’ll likely see offers on more than one card.

So don’t forget to check if your card has the offer and don’t miss out on valuable points and perks!

The Chase Sapphire Preferred® Card offers 100,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. You'll earn: • 5x on travel purchased through Chase TravelSM • 3x on dining, select streaming services and online groceries • 2x on all other travel purchases • 1x on all other purchases • $50 Annual Chase Travel Hotel Credit • Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027. Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase TravelSM This card carries a $95 annual fee. |

The Chase Freedom Unlimited® Card offers a $250 bonus after spending $500 on purchases in your first 3 months from account opening. Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers. In addition, you can earn: • 6.5% cash back on travel purchased through Chase TravelSM, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase TravelSM, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases. There is no minimum to redeem for cash back & your cash back rewards do not expire as long as your account is open. This card comes with no annual fee and you'll get a free credit score that is updated weekly with Credit JourneySM. Member FDIC |

The Chase Freedom FlexSM offers a $200 bonus after spending $500 on purchases in your first 3 months from account opening. 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR. You'll earn: • Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter! • 5% cash back on travel purchased through Chase Travel?, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • Unlimited 1% cash back on all other purchases You cash back rewards do not expire as long as your account is open and there is no minimum to redeem for cash back. This card has no annual fee. |

The Chase Sapphire Reserve offers 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase TravelSM. You'll earn • 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel immediately after the first $300 is spent on travel purchases annually. • 3x points on other travel and dining • 1 point per $1 spent on all other purchases Get 50% more value when you redeem your points for travel through Chase Travel. This card does carry a $550 annual fee and there are no foreign transaction fees. However, you're able to earn a $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year & up to $120 application fee credit for Global Entry or TSA Pre?®. Member FDIC |

The Ink Business Preferred® Credit Card offers 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase TravelSM. You'll earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year; 1 point per $1 on all other purchases - with no limit to the amount you can earn. Furthermore, points are worth 25% more when you redeem for travel through Chase TravelSM. This card does come with a $95 annual fee but does not have any foreign transaction fees. |

The Ink Business Cash® Credit Card offers $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening. You'll earn: • 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year • 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year • 1% cash back on all other card purchases with no limit to the amount you can earn. This card comes with no annual fee. You'll be able to take advantage of employee cards at no additional cost. |

How To Get Chase Offer

- Sign in to the Chase Mobile app

- Explore offers selected just for you

- Activate deal at the brands you like and add offers to your cart

- Use your eligible card to redeem Chase Offer

- Enjoy!

|

|

Current Chase Offers Promotions

Take Advantage of Chase Offers

- Auntie Anne’s: Get 15% Back On Up To $20 Spend. Maximum $3 back. Expires 08/01/22.

- Bank Amerideals: Save 10% at Amazon 4-Star (Physical Store), Max $9 Cashback.

- BofA: 10% Back On Best Western ($29 Maximum)

- Burger King: Get 15% Back On Up To $20 Spend. Expires 6/26/22.

- Buffalo Wild Wing: Get 10% Back On Up To $50 Of Spend

- Circle K: Get 10% Back On Up To $60 Spend. Expires 07/01/22

- Cricket Wireless: Spend $30 & Get $25 Back.

- CVS: Save 10% at CVS, Max $4 Cashback.

- Giant Eagle: Save 10% At Giant Eagle, Up To $8 Max.

- Hannaford Supermarkets: Save 5%/10%, Up to $7 or $4 max.

- L.L. Bean: Get 10% Back On Up To $170 Spend. Expires 06/27/22

- Red Robin: Get 10% Back On Up To $70 Spend. Expires 07/02/22

- Starbucks: Get 5% back.

- Stop & Shop/Giant: Get 10% Back (Max $11 Cashback).

- The Children’s Place: Get 10% Back On Up To $85 Spend. Expires 06/27/22

- Verizon: Spend $40 on Verizon Prepaid service on an eligible Chase card and get a $30 statement credit. (Expiration Unknown)

- Walmart: Get $10 Back On Walmart+ Subscription. Stack with $80 Swagbucks. (Expiration Date Unknown)

Editor’s Note: Chase Offers are added often and each offer has an expiration date as well.

How to Get Chase Offers

Chase Offers are one of the best ways to easily earn cash back on your everyday purchases. The best part is that it is available to both credit and debit card users!

To access your Chase Offers, simply head to the Chase Mobile App or the Chase Pay App. You must have one of these apps downloaded to gain access to your offers.

Through the Chase Mobile App

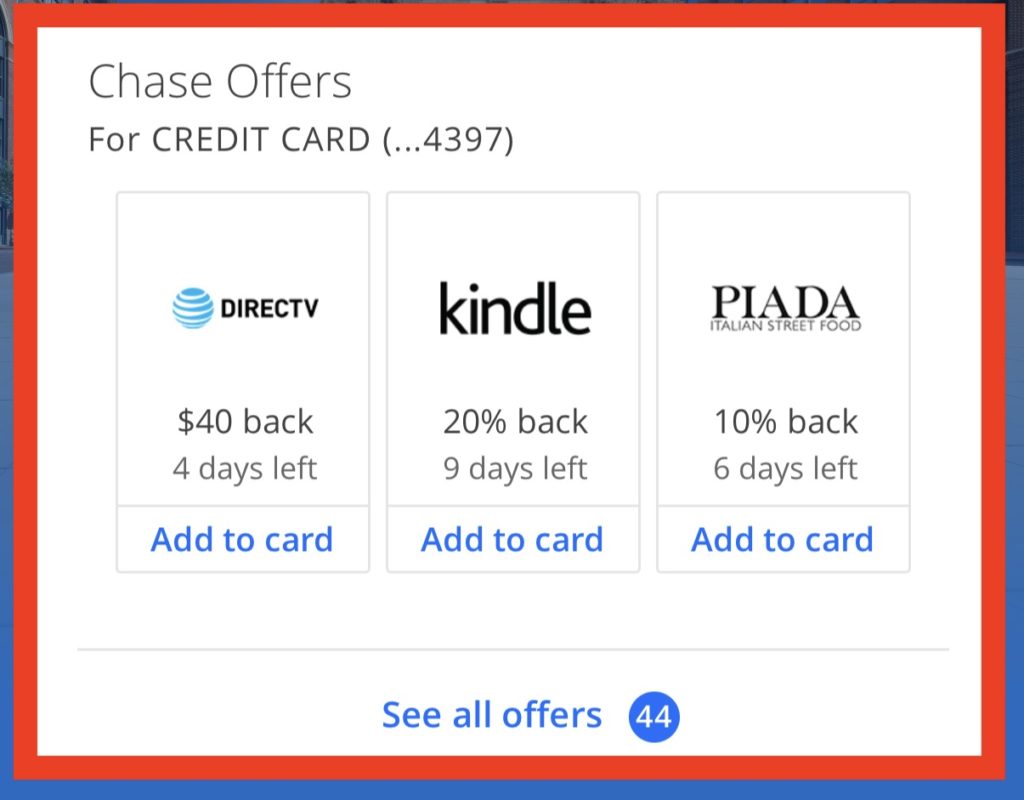

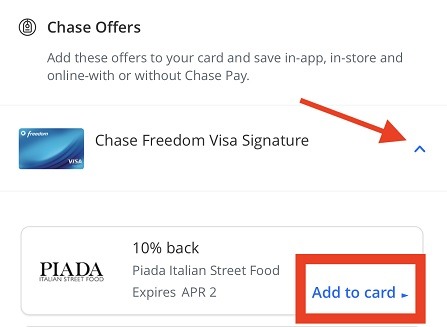

For the Chase Mobile App method, log in to your app to get started. Scroll down to the bottome of the page beneath the list of your cards and you will see “Chase Offers”. Click the “See All Offers” button to see all offers available to your cards.

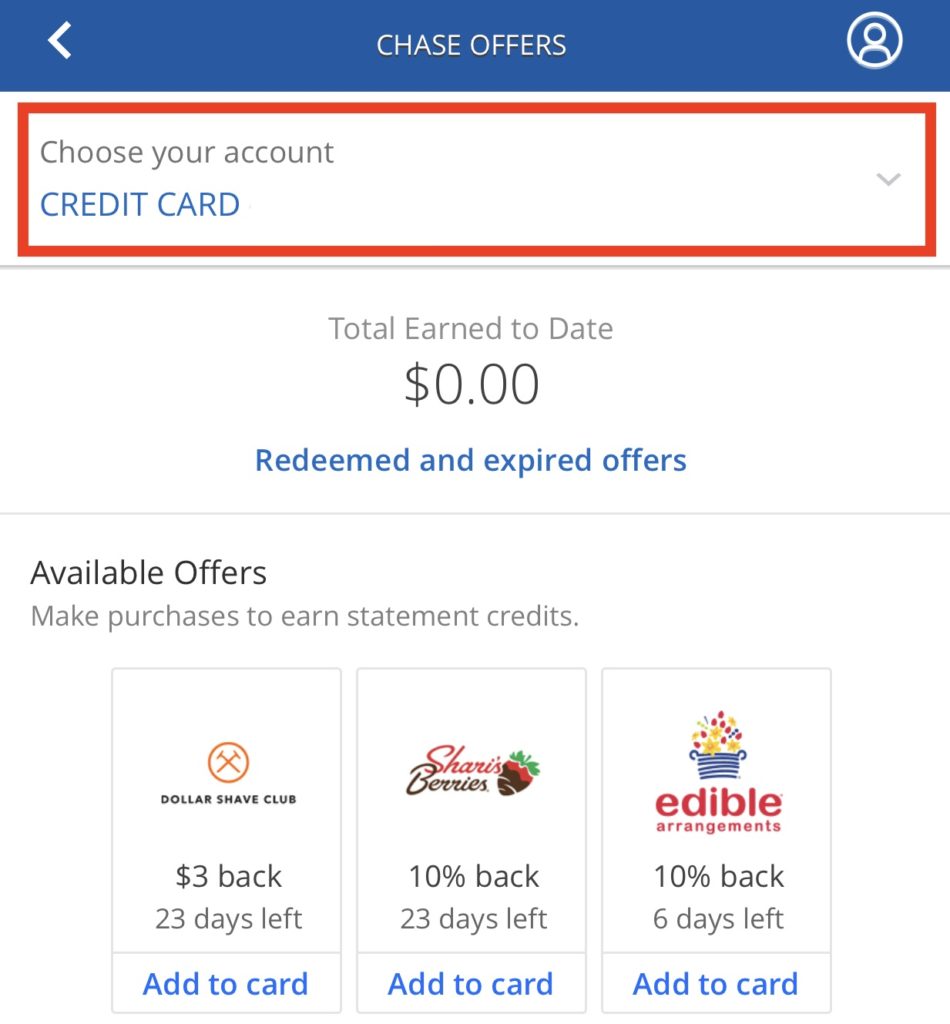

Within this menu, you will then be able to see which card has what offers available to it. Then, simply select the offers you want added to the Chase card of your choice.

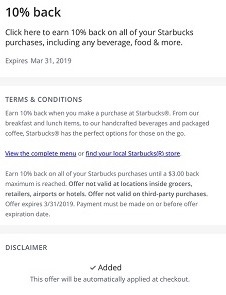

To activate your desired offer, just click “Add to card” under the offer you would like to use. This will prompt the app to bring up a screen with more details about the offer such as terms & conditions and the expiration details. Then, it will show a confirmation to let you know that your offer was added to your card.

The statement credit that comes with your Chase Offers will arrive within 7-14 business days. All you have to do is pay with your card that has the offer you want on it. There is a good chance you will see the same offer on multiple cards, so be sure to maximize your savings!

For example, if you have an offer available on your Chase Sapphire Preferred® and your Chase Freedom Unlimited®, you can activate it on both and take advantage of the offer on both.

Through the Chase Pay App

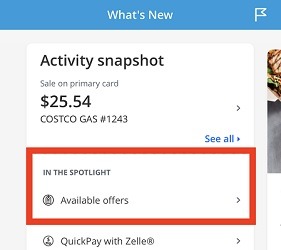

For the Chase Pay App method, start by logging into your app. There will be a couple places that you will be able to access your Chase Offers.

First, on your main page, you will see the “Available offers” button in the middle of your screen. Click on the arrow to see the list of available Chase Offers for you.

To add the offer onto your card of choice, click “Add to card” to the right of each offer. Similarly to the Chase Mobile App, you will be able to see the terms & conditions of the offer as well as the details.

An alternative way of finding specific Chase Offers is to click the “Find” button at the bottom left corner of the main screen. You will also be able to view all offers at the top right hand side of the screen.

Maximizing Chase Offers

The best part about Chase Offers is that it doesn’t hinder your ability to make use of discounts, savings, and other rewards. You will still be eligible to earn any credit card points you would usually earn when making any purchases even though Chase Offers.

Additionally, you will still earn cash back through shopping portals or even Ebates. If you have to physically go into a store to make your purchases or to participate in a sales event, you can stil reap the rewards of the discounts or coupons!

Chase Bank Promotions

• Enjoy $100 as a new Chase checking customer when you open a Chase College CheckingSM account and complete 10 qualifying transactions within 60 days of coupon enrollment. • $0 Monthly Service Fee while in school up to the graduation date provided at account opening (five years maximum) for students 17-24 years old. • Wire funds internationally using the Chase Mobile® app or chase.com. Send money to recipients around the world with multiple currency options. Fees apply. • Keep track of your money with confidence and control in the Chase Mobile® app. The Chase Mobile app helps you bank securely and conveniently from anywhere. • With Zelle®, you can send and receive money with people and businesses you know and trust who have an eligible account at a participating U.S. bank. • With Fraud Monitoring, Chase may notify you of unusual debit card purchases and with Zero Liability Protection you won't be held responsible for unauthorized debit card purchases when reported promptly. • JPMorgan Chase Bank, N.A. Member FDIC *With Chase Overdraft AssistSM, we won’t charge an Overdraft Fee if you’re overdrawn by $50 or less at the end of the business day OR if you’re overdrawn by more than $50 and you bring your account balance to overdrawn by $50 or less at the end of the next business day (you have until 11 PM ET (8 PM PT) to make a deposit or transfer). Chase Overdraft Assist does not require enrollment and comes with eligible Chase checking accounts. |

• You're eligible for up to a $3,000 bonus when you open a new Chase Private Client CheckingSM account with qualifying activities. • Speak with a Private Client Banker to open your Chase Private Client CheckingSM account today. Schedule your meeting at your nearest branch to get started. • Priority service for everyday banking. Receive personalized attention from a dedicated Chase Private Client Banker and 24/7 access to a U.S. based banking service line. • Earn $1,000 when you deposit $150,000 or earn $2,000 when you deposit $250,000 or earn $3,000 when you deposit $500,000. • No fees at Chase and non-Chase ATMs worldwide. • No Chase fee on incoming or outgoing wire transfers. • Enjoy higher limits on Chase Private Client debit card purchases and ATM withdrawals, as well as higher Zelle® and Chase QuickDepositSM limits. • Relationship rates which may make you eligible for a 0.25% auto loan rate discount, and invitation-only events. • Enhance your relationship with access to a J.P. Morgan Private Client Advisor who can help create a personalized investment strategy. • Deposit products provided by JPMorgan Chase Bank, N.A. Member FDIC. Deposit products are FDIC insured up to the maximum amount allowed by law. |

Chase Credit Cards

Personal Chase Credit Cards

The Chase Sapphire Preferred® Card offers 100,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. You'll earn: • 5x on travel purchased through Chase TravelSM • 3x on dining, select streaming services and online groceries • 2x on all other travel purchases • 1x on all other purchases • $50 Annual Chase Travel Hotel Credit • Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027. Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase TravelSM This card carries a $95 annual fee. |

The Chase Sapphire Reserve offers 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase TravelSM. You'll earn • 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel immediately after the first $300 is spent on travel purchases annually. • 3x points on other travel and dining • 1 point per $1 spent on all other purchases Get 50% more value when you redeem your points for travel through Chase Travel. This card does carry a $550 annual fee and there are no foreign transaction fees. However, you're able to earn a $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year & up to $120 application fee credit for Global Entry or TSA Pre?®. Member FDIC |

The Chase Freedom FlexSM offers a $200 bonus after spending $500 on purchases in your first 3 months from account opening. 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR. You'll earn: • Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter! • 5% cash back on travel purchased through Chase Travel?, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • Unlimited 1% cash back on all other purchases You cash back rewards do not expire as long as your account is open and there is no minimum to redeem for cash back. This card has no annual fee. |

The Chase Freedom Unlimited® Card offers a $250 bonus after spending $500 on purchases in your first 3 months from account opening. Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers. In addition, you can earn: • 6.5% cash back on travel purchased through Chase TravelSM, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase TravelSM, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases. There is no minimum to redeem for cash back & your cash back rewards do not expire as long as your account is open. This card comes with no annual fee and you'll get a free credit score that is updated weekly with Credit JourneySM. Member FDIC |

The Chase Slate Edge Card offers 0% Intro APR for 18 months from account opening on purchases and balance transfers. You'll be able to lower your interest rate by 2% each year and automatically be considered for an APR reduction when you pay on time, and spend at least $1000 on your card by your next account anniversary. On top of that, you can raise your credit limit. Get an automatic, one-time review for a higher credit limit when you pay on time, and spend $500 in your first six months. Keep tabs on your credit health - Chase Credit Journey helps you monitor your credit with free access to your latest score, real-time alerts, and more. This card comes with no annual fee. Member FDIC |

The Southwest Rapid Rewards® Plus Credit Card offers a Companion Pass through 2/28/26 and 30,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. You'll also earn 3,000 bonus points after your Cardmember anniversary each year. You'll earn: • Earn 2X points on Southwest® purchases. • Earn 2X points on local transit and commuting, including rideshare. • Earn 2X points on internet, cable, phone services, and select streaming. You're able to redeem your your points for flights, hotel stays, gift cards, access to events & more! This card does carry a $69 annual fee. |

The Southwest Rapid Rewards® Premier Credit Card offers Companion Pass through 2/28/26 and 30,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. In addition, you'll earn 6,000 bonus points after your Cardmember anniversary each year. You'll earn: • Earn 3X points on Southwest purchases. • Earn 2X points on local transit and commuting, including rideshare. • Earn 2X points on internet, cable, phone services, and select streaming. You're able to redeem your points for flights, hotel stays, gift cards, access to events and more. This card does carry a $99 annual fee, but there are no foreign transaction fee. |

The United Explorer Card offers 60,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open. You'll earn: • 2x miles on United® purchases, dining, and hotel stays. • 1x mile on all other purchases Perks of this card include: • Enjoy priority boarding privileges and visit the United Club with 2 one-time passes each year for your anniversary • Free first checked bag - a savings of up to $160 per roundtrip. Terms Apply. • Up to $120 Global Entry, TSA PreCheck or NEXUS fee credit • 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Explorer Card There is a $0 introductory annual fee for the first year, then $95. Member FDIC |

The United GatewaySM Card offers 30,000 bonus miles after you spend $1,000 on purchases in the first 3 months your account is open. With this card, you'll earn: • 2x miles on United® purchases, at gas stations, and on local transit and commuting. • 1x mile on all other purchases. This card comes with no annual fee. |

The IHG One Rewards Traveler Credit Card offers 80,000 Bonus Points after spending $2,000 on purchases within the first 3 months of account opening. You'll earn: • Up to 17 total points per $1 spent when you stay at IHG Hotels & Resorts • 3 points per $1 spent on purchases on monthly bills, at gas stations, and restaurants. • 2 points per $1 spent on all other purchases This card has no annual fee or foreign transaction fees. Member FDIC |

The Southwest Rapid Rewards® Priority Credit Card offers 30K bonus points + Companion Pass through 2/28/26 after spending $4,000 on purchases in the first 3 months from account opening. In addition, you'll earn 7,500 bonus points after your Cardmember anniversary each year. You'll earn: • Earn 3X points on Southwest® purchases. • Earn 2X points on local transit and commuting, including rideshare. • Earn 2X points on internet, cable, phone services, and select streaming. Some perks include $75 Southwest travel credit each year., receiving 4 Upgraded Boardings per year when available, savings of 25% back on in-flight drinks and WiFi, and more! This card carries a $149 annual fee and no foreign transaction fees. |

The British Airways Visa Signature® Card offers 75,000 Avios after you spend $5,000 on purchases within the first three months of account opening. You'll earn: • 3 Avios per $1 spent on purchases with British Airways, Aer Lingus, Iberia, and LEVEL. • 2 Avios per $1 spent on hotel accommodations when purchased directly with the hotel. • 1 Avios per $1 spent on all other purchases. This card comes with a $95 annual fee and no foreign transaction fees. You'll be able to get 10% off British Airways flights starting in the US when you book through the website provided in your welcome materials. In addition, every calendar year you make $30,000 in purchases on your British Airways Visa card, you'll earn a Travel Together Ticket good for two years. |

The Marriott Bonvoy Boundless® Credit Card offers 100,000 bonus points plus $150 Statement Credit after you spend $3,000 on purchases in the first 3 months from account opening. You'll earn: • Up to 17X total points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy • 3X points per $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. • 2X points for every $1 spent on all other purchase • 1 Elite Night Credit towards Elite Status for every $5,000 you spend. You gain an automatic Silver Elite Status each account anniversary year. Path to Gold Status when you spend $35,000 on purchases each account year. You'll receive 15 Elite Night Credits each calendar year & an additional Free Night Award (valued up to 35,000 points) every year after account anniversary. This card does carry a $95 fee; there are no foreign transaction fees. |

Business Credit Cards

The Ink Business Unlimited® Credit Card offers $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. You'll earn an unlimited 1.5% cash back on every purchase made for your business and you'll receive employee cards at no additional cost. This card carries no annual fee. |

The Ink Business Cash® Credit Card offers $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening. You'll earn: • 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year • 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year • 1% cash back on all other card purchases with no limit to the amount you can earn. This card comes with no annual fee. You'll be able to take advantage of employee cards at no additional cost. |

The Ink Business Preferred® Credit Card offers 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase TravelSM. You'll earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year; 1 point per $1 on all other purchases - with no limit to the amount you can earn. Furthermore, points are worth 25% more when you redeem for travel through Chase TravelSM. This card does come with a $95 annual fee but does not have any foreign transaction fees. |

The Southwest® Rapid Rewards® Premier Business Credit Card offers 60,000 points after you spend $3,000 on purchases in the first 3 months from account opening. You'll earn • Earn 3X points on Southwest Airlines purchases. • Earn 2X points on Rapid Rewards hotel and car partners. • Earn 2X points on rideshare. • 1 point per $1 spent on all other purchases. This card does carry a $99 annual fee and there are no foreign transaction fees. Member FDIC |

The Southwest® Rapid Rewards® Performance Business Credit Card offers 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening. This card earns • Earn 4X points on Southwest purchases. • Earn 3X points on Rapid Rewards hotel and car partners. • Earn 2X points on rideshare. • Earn 2X points on social media and search engine advertising, internet, cable, and phone services and 1X points on all other purchases. In addition, you can score 9,000 bonus points after your Cardmember anniversary, get 4 upgraded boarding passes per year, and more! Member FDIC |

The United? Business Card offers 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open. You can also receive 5,000-mile better-together anniversary bonus when you have the United Business Card and a personal United credit card. You'll earn: • 2x miles on United® purchases, dining including eligible delivery services, at gas stations, office supply stores, and on local transit and commuting. • 1x mile on all other purchases. The card does carry a $99 annual fee ($0 intro annual fee for the first year, then $99). You're able to save up to $160 per round-trip with a free checked bag (terms apply). In addition, you can enjoy priority boarding privileges and have the opportunity for two one-time United ClubSM passes each year — Over $100 in value per year. Also, enjoy $100 annual United travel credit after 7 United flight purchases of $100 or more. Member FDIC |

|

|

Bottom Line

If you’re a Chase Cardholder, don’t miss out on this promotion and start earning statement credit with Chase Offers. Simply register one of your cards in the links above and start earning for your purchases. These are some of the current Chase Offers that you can use for your purchases. They will be ending, but regardless, you still have plenty of time to participate.

If you’re interested in what more Chase has to offer, see our list of the bank promotions from Chase Bank and see which credit card from Chase to use! For more credit cards, see our latest list of card deals!

Same with Chipotle

Is “lowe’s” in the title outdated? I can’t find any current offers (~ April 13, 2021) from Lowe’s in your blog or in my account. Thanks.

So you have to pay through Chase Pay app when you check out? Can you just use the Chase card alone also?