DiversyFund is a real estate investment platform that gives regular investors access to multi-million dollar real estate assets starting at just $500. DiversyFund is a great option for those casual investors who are looking to diversify their funds past stocks and bonds.

(Visit DiversyFund for more details)

Other real estate investing options you make like:

Current DiversyFund Promotions

DiversyFund $50 Amazon Gift Card Offer

(Click the button above to sign up)

DiversyFund $100 Amazon Gift Card Referrals

Get a $100 Amazon gift card when you invest with DiversyFund and $100 for anyone you refer.

(Click the button above to sign up)

DiversyFund Quick Facts

| Investment Offerings | Growth REIT, IPO |

| Investment Accounts | Individual & joint, trusts, retirement (self-directed IRA), certain entity accounts |

| Investment Amounts | $500 – $1,000,000 |

| Accredited Investor Status | Not required |

| Availability | All 50 states |

PROS

- Invest with just $500

- Higher historical returns than stocks

- No accredited investor requirement

- Available for self-directed IRA accounts

- Available in all 50 states

- No expensive broker fees

CONS

- Private REIT (not tradeable)

- “Blind pool” investments

- Long-term investment (5 years)

(Visit DiversyFund for more details)

DiversyFund Investment Offerings

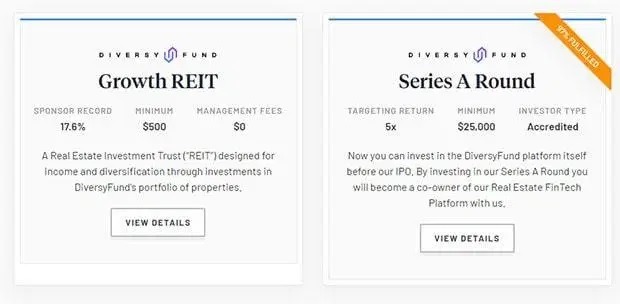

DiversyFund offers two investment opportunities: DiversyFund Growth REIT and Diversyfund Series A Round. For reasons that will become clear below, the bulk of this article will focus on the DiversfyFund Growth REIT.

The DiversyFund Growth REIT gives you an opportunity to invest in a portfolio of properties, without having to get involved with managing them. It’s as simple and easy as typical paper investments.

The DiversyFund Growth REIT:

- Focuses on apartment buildings

- Requires zero management fees

- Is SEC-qualified

- Is a private REIT

Shares are $10 each. So with a $500 minimum investment, you’ll be able to purchase 50 shares. A $500 minimum investment is relatively low, making it a viable option for most people.

Your investment is considered preferred equity. This mean you’ll get both dividend distributions as well as capital appreciation on the sale of the properties in the fund.

The DiversyFund Series A Round is a direct investment in the company itself. It’s an initial public offering (IPO) with the opportunity to become co-owner of the DiversyFund Real Estate FinTech Platform. The company’s mission is to become the go-to alternative-investment platform for everyday investors.

However, the Series A Round investment is not for the everyday investor. It requires accredited investor status and a minimum investment of $25,000. The IPO timeline is two to four years, seeking a 10x return on a minimum two-year investment. Of course, these numbers are highly speculative which is why it warrants accredited investor status.

How DiversyFund Works

Simply, DiversyFund invests in apartment buildings which in turn act as investment partners. This results in no investment fees, and the fund doesn’t make any money unless you do.

Here’s how it works:

- Acquisition. The fund buys multi-family apartment buildings with rented units, so it’s already generating revenue. However, these properties are purchased at a low cost because they are in need of improvements.

- Renovations. To increase cash flow, each building will complete renovations within one year of purchase. These renovations allow the fund to increase rent and raise the value of the property.

- Holding period. Each investment is held for five years, allowing it to appreciate in value.

- Distributions. Cash flow distributions (rent income, etc.) are reinvested monthly for investors until the property is sold and the final return is distributed.

Here’s how DiversyFund returns work:

- Investors are protected by a 7% preferred return before DiversyFund receives any profit split.

- After the preferred return, there’s a 35/65 profit share between DiversyFund and the investors.

- Once the investors have made 12% per year, the profit split changes to 50/50.

- After five years, the property will be sold and the profits split.

Why DiversyFund?

First of all, you don’t have to be an accredited investor to start investing with this platform, so you can start with as little as $500. That makes the DiversyFund Growth REIT open to all investors.

Another great reason is the average annual return is over 17%. That’s way higher than you can get normally with stocks and just about any other traditional form of investment.

DiversyFund cleverly plans their investing around multi-family apartment buildings. This is important to keep in mind because apartment complexes are one of the best-performing as well as highly reliable sectors of the real estate market. Even if the economy goes down, the apartment market tends to stay strong. This is because most people during this time cannot afford home ownership, so they turn to renting.

DiversyFund owns and manages all of its assets. This removes the need for third-party involvement along with their fees. Therefore, you won’t have to pay any management or platform fees.

As with any other investments, with DiversyFund, you will spread your risk across several properties and investments, limiting loss from one property.

DiversyFund Fees

For investors, there are no fees. In addition, DiversyFund does not charge a sales commission.

|

|

Bottom Line

Even if you’re looking to simply invest in traditional stocks and bonds, you can still do it with DiversyFund with just $500. The Growth REIT is an excellent way to diversify in one of the most stable and lucrative sectors of the real estate market.

For more ways to earn more through referrals check out our Best Bank Referrals!

(Visit DiversyFund for more details)

Leave a Reply