Here you will find all the latest Douugh Smart Bank Account Promotions, savings, deals, bonuses, codes and more to help you save money on this app.

Douugh is a personal finance app that is your one place to get budgeting, banking, saving, and investing all together. It has powerful automation capabilities that make managing and growing your money easily.

Compare Douugh to other bank promotions from institutions like Chase Bank, Huntington Bank, HSBC, Discover Bank, TD Bank, BBVA, CIT Bank, Bank of America, Wells Fargo, & more!

| Features | Banking, automated budgeting, saving, and investing |

| Minimum Balance | $0 |

| ATMs | 37,000+ in the MoneyPass network |

| Works With | Apple Wallet, Google Pay, Samsung Pay, PayPal, Venmo |

| FDIC Insured? | Up to $25,000 |

| Promotions | $20 welcome bonus, $20 referrals |

Douugh $20 Welcome Bonus

Valid for a limited time, Douugh is offering a $20 welcome bonus when you use a referral link to sign up for this personal finance app and make at least 5 debit card purchases within 30 days of account opening. Your bonuses will post to your Spending Jar.

Currently, we do not have a referral link, so our readers may feel free to post theirs in the comment section below.

(Click the link above to learn more about this app)

Douugh Give $20, Get $20 Referral Program

Refer a friend to Douugh and you’ll both get rewarded with a $20 cash bonus. To qualify, your friend must:

- Be new to Douugh.

- Use your unique referral link to sign up.

- Make at least 5 card purchases within 30 days of account opening.

Find your unique referral link by opening the Douugh app, going to your profile, and tapping on “Share the Douugh.” Your link can also be found in an email from Douugh. There is no limit to how many referral bonuses you can earn.

Currently, we do not have a referral link, so our readers may feel free to post theirs in the comment section below.

(Click the link above to learn more about this app)

How Douugh Works

As mentioned above, Douugh is a simple-to-use budgeting app that also provides banking, saving, and investing services. All you have to do is enter your bills and how much you want to save. Through automation, Douugh will handle the rest.

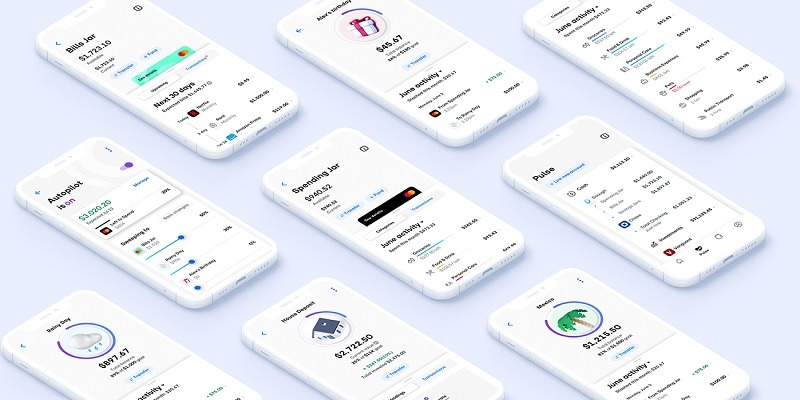

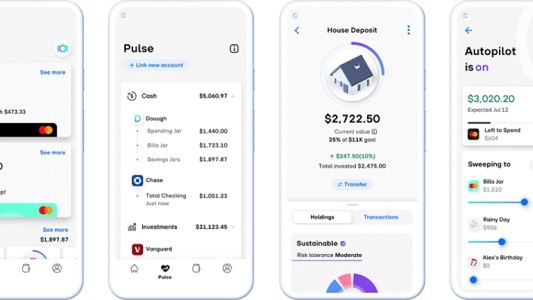

When a direct deposit is posted to your Douugh checking account, the app will automatically move money into your different “jars” for day-to-day spending, bills, savings, and investments, in accordance with your financial goals. You can think of these jars described as a sort of envelope system.

- The Bills Jar plans ahead for all your bills and subscriptions. It puts money aside for these expenses, so you don’t have to worry about coming up short that month. Douugh will even make your bill payments for you.

- Stash Jars are for your short-term savings goals. Open as many Stash Jars as you want and customize the goal amounts for each.

- Like Stash Jars, you can open unlimited jars for Grow Jars which have customizable balance goals. For example, you can have one jar for a general taxable investment account, another for your wedding, and another for buying a house. Grow Jars use low-cost ETFs to build diversified investment portfolios that automatically rebalance. There are three risk types to choose from: Conservative, Moderate, and Aggressive. Douugh offers traditional (core) options, as well as portfolios that focus on ethical and sustainable companies. Douugh does not charge trading commissions or management fees on balances held in Grow Jars.

- All Douugh checking account and debit card spending will come out of your Spending Jar. The amount of the Spending Jar is whatever is left after Douugh accounts for your upcoming bills, savings, and investments. You can safely spend the amount before your next payday, but ideally you’ll have money left over in the jar before your next paycheck comes in.

Douugh’s comprehensive account dashboard is called “Pulse.” It gives you a clear and concise snapshot of your finances across all Jars and any external accounts you linked to Douugh.

|

|

Bottom Line

Douugh is an all-in-one personal finance app that is stacked with automated and investment features that will help you manage yoru ifnances, create better spending habits, and grow your wealth. It is great to track both your day-to-day spending as well as your long-term financial health. For more posts like this, check out our list of the best personal finance apps.

Hey! I’m using Douugh to improve my financial fitness! Join with my code f039f888 and you get $20!

https://click.douugh.com/bS9S/5ce1a0e9

Terms apply, learn more at https://douugh.com/share-the-douugh

Here is $20! Join Douugh with my code a2cfc6d1 and you get $20!

https://click.douugh.com/bS9S/5ce1a0e9

Terms apply, learn more at https://douugh.com/share-the-douugh

Thank you!