Find the latest Emma App promotions, gift cards, and discount deals here.

Find the latest Emma App promotions, gift cards, and discount deals here.

Based in London, Emma is a money management app that has finally arrived in the United States. This great money management app allows you to connect to you bank account and credit cards, track your spending in real time, and set a budget to help you manage your finances.

Additionally, Emma will help you avoid overdraft fees, unsubscribe from subscriptions you don’t use anymore and learn more about your spending habits.

PROS

- Easy to use

- Budgeting tools

- Comprehensive analysis

- Financial insights

- Cryptocurrency integration

CONS

- No savings category

- Rewards paid by PayPal

- Not all banks are supported

Current Emma Promotions

$15 Per Referral

- Download the Emma app to gain access to their referral program.

- Start referring with your link and qualified referrals who start a subscription will earn you a $15 bonus.

- Keep in mind that only the referrer will receive the bonus.

- See the referral program terms here.

Emma Pro Free One Month Trial

If you’re the type of person who needs help managing your spending, Emma is the app for you. The regular version of Emma is completely free to use, but if you want more features then you can try Emma Pro out free for one month.

- What you get: One month of Emma pro for Free

- Offer expiration: Limited time offer

- How to get it:

- Visit the link below

- Set up your Emma account

(Click here to learn more at Emma)

How Does Emma Work?

Emma works by seamlessly integrating your budgets, salary, and payments throughout the month, while also reminding you of your future financial commitments. With the information Emma gets from your finances, it will be able to give you real-time evaluations from the data you input.

Emma is compatible with these banks:

Emma Features

Simply input how much you want to budget by category, such as eating out, groceries, etc., into the Emma app and it will notify you whenever you go over your budget for a certain category.

For additional information, Emma can calculate your average spending in each category, so that you can adjust your spending or budgeting if you deem in necessary.

Savings advice. The Emma App can use your financial information in conjunction with your spending habits to suggest ways for you to spend money without messing up your savings at the end of each month.

Bank fees. Occassionally, you’ll be hit with a bank charge that may seem uncalled for and you don’t know the reason behind the charge. The Emma App helps solve this problem by tracking when and why your bank charges these fees. This includes foreign transaction fees, overdraft fees, and fixed account charges.

If you are subscribed to multiple things, Emma makes it easy to view those repeating payments by separating them from your daily spending. This is a great tool in case you want to cancel any subscriptions you don’t use often.

Rewards. Use Emma to sign up for products and services to earn rewards for them. Although these are affiliate deals, Emma doesn’t keep the money, you do. Keep in mind that rewards earned from Emma can only be paid out via PayPal.

Quests. To make exploring the Emma app more interactive and fun, Emma awards badges and icons. However, if you want to earn all of the Quest badges, you will need to subscribe to Emma Pro.

Quizzes. While on the topic of fun and interactive, Emma hosts weekly trivia challenges. Answering five questions correctly will give you a chance to win $100.

Another aspect of your finances that Emma can track is your cryptocurrency balance. Here are the supported exchanges:

- Coinbase

- Bittrex

- Binance

- Bitstamp

- Kraken

- Bitfinex

Emma also supports individual Bitcoin and Ethereum addresses.

Long-term savings goals. Coming soon to the app, Emma will add a feature that will help their customers achieve their long-term savings goals. Currently, you can only track your finances on a monthly basis, but with this new addition, you will be able to track your finances over a longer period of time.

Total budgets. Soon, you will be able to add your total savings amount to your budgets. This will allow the Emma app to track more than just your salary.

Emma Fees

The base Emma app is completely free to use with no charges, but they do offer a Pro version that has a subscription fee.

Emma Pro

If you want a more customizable experience, upgrade to Emma Pro. With the premium version, you can:

- Make custom categories

- Rename your transactions

- Split transactions

- Export your data in a spreadsheet

- Add manual accounts (to track cash or overseas bank accounts).

Currently, you can get the pro version of the Emma app free for one week. After the trial period, you can either choose to pay for Emma Pro monthly, every six months or annually:

You can also access Emma Pro for free if you refer others to the app.

| # OF REFERRALS | EMMA PRO FOR FREE |

| 1 people | 1 month |

| 2 people | 2 month |

| 5 people | 6 month |

| 9 people | 12 month |

| 15 people | For Life |

Emma Security

If you’re worried about your information’s security, have no fear because Emma takes multiple steps to make sure your account is secure.

- Emma has read-only access. This makes it so the app can’t touch your money

- Emma does not store any banking credentials. If there’s a breach, your information won’t be compromised.

- Emma has bank-grade encryption. Be at ease knowing your information is secure.

- Emma is registered with the FCA (Financial Conduct Authority) and the ICO (Information Commisoner’s Office).

- Emma’s security team has worked for big companies like Google. With experience at large companies, their security is top of the line.

Emma’s Competition

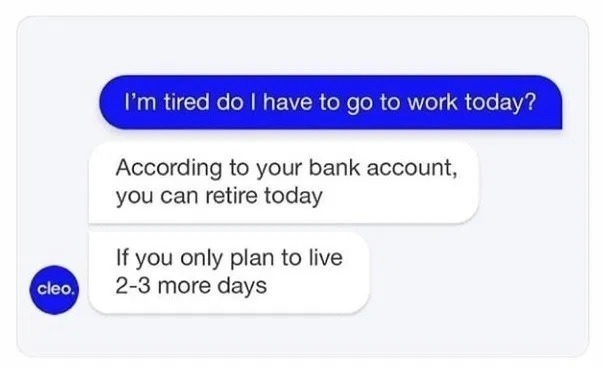

A new twist on finance management has come in the form of Cleo, an artificial-intelligence driven chatbot that analyzes your spending habits. Cleo will use data from your bank account to create a budget for you as well as offer a range of tools to help you save money.

Features include:

- Insight into your daily, weekly and monthly spending habits

- High-interest, automatic saving

- Cashback rewards

- Weekly money games and quizzes

- Interest-free salary advances

Similar to Emma, Cleo is free to use. One of the most entertaining features it has is the ability for Cleo to roast you in case you decide to do financially unwise things.

Cleo definitely offers a new and entertaining twist to budgeting.

Designed by the creators of TurboTax, you know you’re in good hands in terms of finances. Mint features:

- A complete picture of your financial life: bank accounts, credit cards, bills and investments.

- Bill tracking while keeping an eye on your account balances.

- Savings tips to help with budgeting and debt.

- Budgeting suggestions.

- Reminders to pay your bill.

- Unlimited credit scores for free.

- Multi-factor authentication and VeriSign to keep your account secure.

Similar to Emma and Cleo, Mint is a free service.

You Need A Budget (YNAB) is similar to the services mentioned because it’s also a financial tracking app designed to get you out of debt. YNAB features include:

- Bank syncing

- Transaction matching

- Real-time access to all your finance data

- Goal tracking

- Detailed, visual spending and trend reports

- A friendly support team available 24/7

According to YNAB’s database, new users tend to save an average of $600 in the first two months and more than $6,000 in the first year. If you’re not sure you want to commite the $84 a year, try it for free for 34 days.

|

|

Bottom Line

Emma is a great personal finance app, especially if it is hard for you to budget. The set up process is simple and quick. On top of their intuitive layout, the free version comes with a large variety of features including cryptocurrency management.

Keep in mind that Emma has its drawbacks:

- The app can only be used through a select number of banks in the United States

- Does not have a savings category

- Rewards are paid out via PayPal

If any of the cons above are an issue, you might want to consider other apps.

If you’re interested in more posts like this, check out list of bank promotions and credit cards, here on HMB!

Leave a Reply