With do it yourself prep software, it is always important to note the cost of you state return and e-Files as it may actually cost more than your federal return, especially if you wait until April to file. You may wish to do your state return separately. Based on their current, regular published prices at time of writings:

- TurboTax Online Deluxe and Premier $39.99

- Single state return with free state e-file. Simple tax returns are free.

- H&R Block Online Deluxe and Premium $36.99

- Single State return with free state eFile. Simple state tax returns are free.

- TaxACT Online Plus and Premium $39.95

- Single state return with free state e-File. Basic state tax returns are $19.95.

If you have only a simple return, TurboTax Free Edition and H&R Block Free Edition will let you file Fed + State + eFile for $0 if you only have the following situations:

- W-2 income

- Limited interest and dividend income reported on a 1099-INT or 1099-DIV

- Claim the standard deduction

- Earned Income Tax Credit (EIC)

- Child tax credits

You can’t itemize deductions, have stock sales, or have 1099-MISC income, for example.

E-File

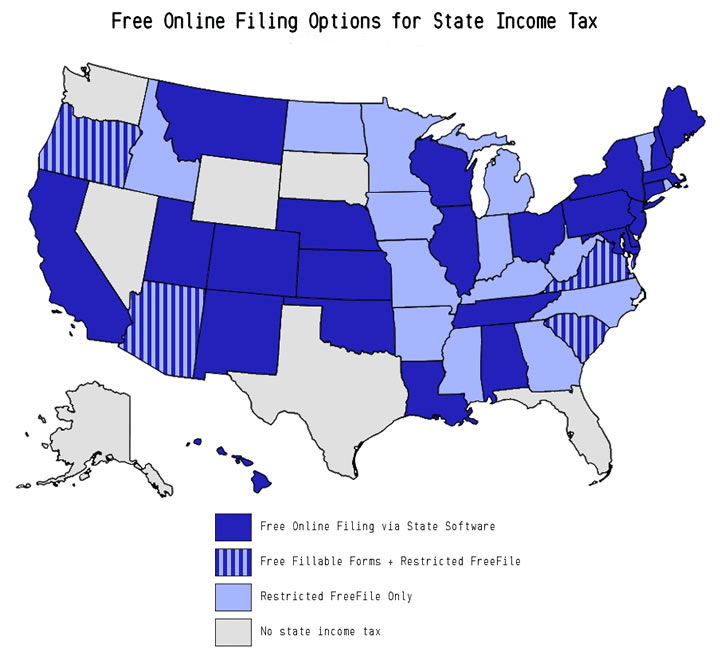

The extra money may be worth for the convenience that these softwares offer, but there are other options available! States that levy individual income taxes fall into three categories:

- They offer all taxpayers free electronic filing via official state-supported software.

- They offer all taxpayers access to free “fillable forms” which are basically electronic versions of the paper forms where you can type in numbers and any mathematical calculations are done for you. If your state tax returns are relatively simple, this may be all you really need.

- They allow commercial vendors via the “FreeFile Alliance” to offer free online filing for certain groups, usually through income limits, age restrictions, and/or active duty military personnel. The vendors in turn make money when some folks end up not qualifying and have to pay at the end.

Below, you’ll find free e-file information for all 50 states.

| State | Restrictions |

| Alabama | Free electronic filing using through My Alabama Taxes (MAT). No income restrictions. |

| Alaska | (No state income tax) |

| Arizona | File using AZ-specific fillable forms; No income restrictions. FreeFile options also available; income and/or other restrictions apply. |

| Arkansas | Various FreeFile options; Income and/or other restrictions apply. |

| California | Free electronic filing using through CalFile, UDS, and others. No income restrictions. |

| Colorado | Free electronic filing using through Revenue Online. No income restrictions. |

| Connecticut | Free electronic filing using through TaxPayer Service Center (TSC). No income restrictions. |

| Delaware | Free electronic filing through official state website. No income restrictions. |

| Florida | (No state income tax) |

| Georgia | FreeFile options available; income and/or other restrictions apply. |

| Hawaii | File for free at Hawaii Tax Online. |

| Idaho | FreeFile options available; income and/or other restrictions apply. |

| Illinois | Free electronic filing through MyTax Illinois. No income restrictions. |

| Indiana | FreeFile options available through INfreefile; income and/or other restrictions apply. |

| Iowa | FreeFile options available; income and/or other restrictions apply. |

| Kansas | Free electronic filing through KS WebFile. No income restrictions. |

| Kentucky | FreeFile options available; income and/or other restrictions apply. |

| Louisiana | Free electronic filing through Louisiana File Online. No income restrictions. |

| Maine | Free electronic filing through Maine FastFile. No income restrictions. |

| Maryland | Free electronic filing through Maryland iFile. No income restrictions. |

| Massachusetts | FreeFile options available; income and/or other restrictions apply. WebFile for Income was shut down in 2017. |

| Michigan | FreeFile options available; income and/or other restrictions apply. |

| Minnesota | FreeFile options available; income and/or other restrictions apply. |

| Mississippi | FreeFile options available; income and/or other restrictions apply. |

| Missouri | FreeFile options available; income and/or other restrictions apply. |

| Montana | FreeFile options available; income and/or other restrictions apply. Looks like they recently get rid of free electronic filing through Taxpayer Access Point (TAP). |

| Nebraska | Free electronic filing through NebFile. No income restrictions. |

| Nevada | (No state income tax) |

| New Hampshire | Free electronic filing through e-File New Hampshire. No income restrictions. (No state personal income tax, but there is tax on investment income.) |

| New Jersey | Free electronic filing through NJ WebFile. No income restrictions. |

| New Mexico | Free electronic filing through New Mexico Taxpayer Access Point. No income restrictions. |

| New York | Free electronic filing of select forms online with New York State Income Tax Web File, but note that New York law prohibits commercial software from charging an additional charge for e-filing. |

| North Carolina | FreeFile options available; income and/or other restrictions apply. |

| North Dakota | FreeFile options available; income and/or other restrictions apply. |

| Ohio | Free electronic filing through I-File from Ohio Online Services. No income restrictions. |

| Oklahoma | Free electronic filing through Oklahoma Taxpayer Access Points (OkTAP). No income restrictions. |

| Oregon | File using OR-specific fillable forms; No income restrictions. FreeFile options also available; income and/or other restrictions apply. |

| Pennsylvania | Free electronic filing through PA DirectFile. No income restrictions. Free Fillable PDF Forms also available. |

| Rhode Island | FreeFile options available; income and/or other restrictions apply. |

| South Carolina | File using SC-specific free fillable forms; No income restrictions. FreeFile options also available; income and/or other restrictions apply. |

| South Dakota | (No state income tax) |

| Tennesse | Free electronic filing through state website of Hall Income Tax. No income restrictions. (No state personal income tax, but there is tax on investment income.) |

| Texas | (No state income tax) |

| Utah | Free electronic filing through Taxpayer Access Point (TAP). No income restrictions. |

| Vermont | FreeFile options available; income and/or other restrictions apply. |

| Virginia | File using VA-specific free fillable forms; No income restrictions. FreeFile options also available; income and/or other restrictions apply. |

| Washington | (No state income tax) |

| Washington D.C. | File using DC-specific free fillable forms; No income restrictions. FreeFile options also available; income and/or other restrictions apply |

| West Virginia | FreeFile options available; income and/or other restrictions apply. |

| Wisconsin | Free electronic filing through Wisconsin efile. No income restrictions. |

| Wyoming | (No state income tax) |

Bottom Line

Hopefully this list helps you prepare and file your federal individual income tax return for free using tax preparation and filing software! See which tax software works for you or check out the Free E-file Fillable Forms from your state! And while you’re here on HMB, check out more ways to Save Money!

| BMO: Open a new BMO Smart Advantage Checking Account and get a $400 cash bonus* when you have a total of at least $4,000 in qualifying direct deposits within the first 90 days. Learn More---BMO Checking Review *Conditions Apply. Accounts are subject to approval and available in the U.S. by BMO Bank N.A. Member FDIC. $4,000 in qualifying direct deposits within 90 days of account opening. |

Leave a Reply