Find the latest Fundrise promotions, offers, and promo codes here.

Find the latest Fundrise promotions, offers, and promo codes here.

Deciding on what tools to use to make your investments can be difficult. Even if you know what you want to invest in, the vehicle you use plays a big part. That is where Fundrise comes in.

Fundrise is an automated investing service created for the real estate industry. Other traditional automated invest services require diversified portfolios of stocks, bonds, index funds, etc. It can be compared to other real estate investment companies like Streitwise and Origin Investments.

(Learn more at Fundrise)

You can think Fundrise as an automated investing service for the real estate industry. Other automated investing services (e.g. Betterment and Wealthfront) work with diversified portfolios of stocks, bonds, index funds, etc.

Fundrise Features

| Minimum Investment | $500 |

| Fees | 0.85% per year |

| Year Founded | 2012 |

| REITs | Yes |

| Property Types | Commercial |

(Learn more at Fundrise)

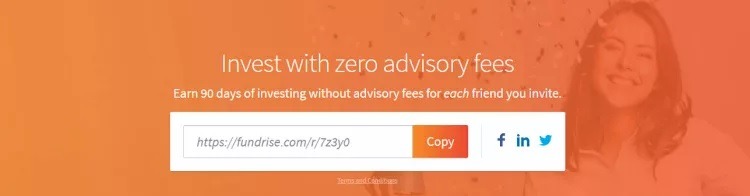

Current Fundrise Promotions

$0 Advisory Fees For 3 Months

Use our referral link below to get zero advisory fees!

Valid for a limited time, new customers can get $0 Advisory Fees For 3 Months per referral. Simply log into your account and you will be able to see this option on the sidebar or menus.

(Start Investing with $500!)

Featured Investing Promotions

|

You Invest by JPMorgan

|

TD Ameritrade

|

Ally Invest

|

| Trade Commission $0 |

Trade Commission $0 |

Trade Commission $0 |

| Account Minimum $0 |

Account Minimum $0 |

Account Minimum $0 |

| Read Our Review | Read Our Review | Read Our Review |

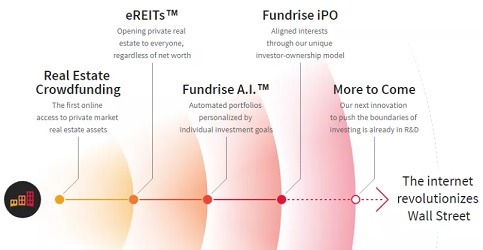

What Is Fundrise All About?

Starting in 2012, Fundrise has become an investment house backed by the community. If you’ve ever wanted to get into real estate or just property in general, this is a good place to start. With Fundrise, you benefit with much less risk than simply buying the property.

With Fundrise, the process in getting customers into the real estate industry is different because they invest your money in eREITs (Electronic Real Estate Investment Trust). Sometimes, they will also invest in eFunds or electronic funds.

If you are already know about investing in mutual funds or ETFs, then eREIT investing shouldn’t be to different for you. If you don’t know what those things are, simply put, mutual funds are programs managed by professionals and the funds come from share holders, like you if you decide to invest in them.

An ETF, or exchange-traded fund, allows funds to be invested and spread across different forms, like bonds, commodities, and other assets. You can find all of these things in an index fund. Keep in mind that the price changes on a daily basis as they are bought and sold.

What Are eREIT’s Exactly?

eREITs are slightly different from mutual funds and ETFs. For example, the fees are lower, and you don’t have to deal with a broker or intermediary. For eREITs, you deal directly with Fundrise.

Through the traditional method, a broker takes a portion of the fees, so this method helps reduce the fees significantly.

What Are eFunds?

Electronic Funds are one of the unique features of Fundrise and are one of the vehicles that count towards your investments in real estate. However, eFunds are not publicly traded like eREITs are. Also, they are taxed differently. You actually save some money here because they avoid double taxation. This happens because they are set up as partnerships, rather than as corporations.

Similar to eREIT’s, you do not generate any broker fees or commissions. The eFunds are used for Growth packages because they are built better for this goal.

What Are The Fees?

Fundrise charges an a fee called an annual asset management fee of 0.85% for the eDirect funds (eREITs and eFunds).

| PROS | CONS |

| Low minimum investment contribution ($500) | Lack of liquidity as they are not traded on the markets. However, they do offer quarterly distributions and redemptions (they are unfortunately not guaranteed) |

| Less risky than investing directly in real estate | Tax liability – distributions are taxed as regular income, as opposed to the 15% charged on qualified dividends |

| Low fees | In comparison to Index Funds, their fee structure is higher |

| Pre-funded with their own capital | The average investment is less than $10,000, in comparison to other crowdfunding sites like Realty Mogul, which edges on $60,000 |

| Big players in the industry back the Fundrise way of investing | Not open to non-U.S. citizens (at least not yet – although they suggest you can make a request if you’re an international client) |

| The deals are quality (and Fundrise only approves 2% of their deals) | |

| Their track record is one of the best in the investment industry | |

| There is no minimum criteria in terms of your own credentials (i.e. experience, gender, area code, income, etc.) | |

| 90-Day Guarantee is given to all new investors. What this means is that if you are not satisfied with the rewards gained in the first 3 months, you can close your account and Fundrise will buy your investment back at the original price you paid for it. Please note that there are certain limitations, terms and conditions. | |

| Diversity – their spread of real estate options allow you to ensure you smooth out any risk you are not happy with in the mix | |

| Accountability Policy – explained in detail below. In short, this is a guarantee that Fundrise offers each and every investor |

Fundrise Investment Options

The most important thing that comes with investing is your strategy. Lucky for you, Fundrise makes it easy by offering you a couple of strategies to choose from.

They do this because they know that most potential investors and newcomers don’t know how to start with real estate, so they provide their users with a calculator. To use the calculator, simply answer the questions provided to help them figure out what’s the best investment plan for you.

Additionally, Fundrise promotes Goal-Based Investing:

- Income Only

- Income and Growth

- Growth Only

The portfolio strategies on offer are three great choices, giving you diversity:

| Supplemental Income (Create an attractive, consistent passive income stream) |

| Objective: Income |

| Should you be looking to supplement your income, this is a great way to do it. Targeted at those getting near to retirement, or for those just wanting some additional income, the Supplemental Income package is actually what I chose for my initial investment with Fundrise (more on this below). This package won’t yield the highest returns over the long term. You’ll find low variability, a decent time horizon for growth, and a passive income offering in this package. |

| Balanced Investing (Build wealth confidently with the maximum level of diversification) |

| Objective: Income & Growth |

| If your aim is to build on what you already have, the Balanced Investing package is ideal.

Expect to leave your investment in for a moderate to long term period, and be open to many diverse avenues on the investment pickings. There are minimal risk factors with this investment package. |

| Long-Term Growth (Pursue maximum overall returns over the long term) |

| Objective: Growth |

| This is the package where you need to leave your money and not think about it. The Long-Term Growth package is built for the person that only wants to withdraw after a very long period of time. The results over this time will typically be better, but patience is the key here. Your investment is gauged into aggressive risk portfolios in the real estate market, and you will see many ups and downs as the years go by. |

|

|

Bottom Line

Overall, Fundrise offers a great way to invest in real estate, especially if you’re a beginner. All you have to have is $500 to invest, are a U.S. resident and are over the age of 18.

Keep this post saved if you decided to get this app. We’re always updating this post to make sure you know about all of the best promotions available. If you’re looking for more ways to save money when purchasing gift cards, check out our full list of Gift Card Promotions or ways to earn Credit Card Bonuses!

(Learn more at Fundrise)

Use link below for $100

https://fundrise.com/i/19yp3e?utm_source=fundrise&utm_campaign=ios_share

The return you get on Fundrise is around 2% per year. There are eReit sites that offer a much higher return.