Many of us do not realize how often we are exposed to ACH payments or how much we depend on them to transfer money as a form of payment. One of the reasons why they are so popular is probably due to its convenience and low processing fee, which is a major benefit for consumers who work with them all of the time.

Since the majority of us are exposed to ACH payments, we should be able to recognize how those types of payments work and what goes on in the process of sending something as valuable as your hard earned money.

We have compiled some information regarding this particular type of money transfer, and hopefully after reading this post, all of our readers will understand how ACH payments work.

What is an ACH Payment?

ACH, or Automated Clearing House, is a network that connects financial institutions within the United States allowing the movement of money from one bank account to the next as a form of direct payment.

If you are familiar with Direct Deposits, which is a type of money transfer directly from the account of the payer to the recipients account, they are a common type of ACH payment. In addition to direct deposits, those recurring payments, one time payments, government payments, consumer and business transactions, and even international payments all run using the Automated Clearing House.

The ACH network can be easily deemed as one of the most secure forms of payment.It is considered to be the largest and most reliable forms of money transfers and because they are electronic, it is easier to keep track of your spending and finances. With ACH payments, you know exactly where your money goes and where it comes from.

How to Complete A Payment

In order to complete a payment, the organization who is requesting a payment – whether they want to sent funds or receive funds – needs to get bank account information from the other party involved.

Provide the following details:

- The name of the bank or credit union receiving funds

- The type of account at that bank (checking or savings)

- The bank’s ABA routing number

- The recipient’s account number

With information provided above, the payment can be created and routed to the correct account. Please note that the same details are required to make pre-authorized withdrawals from customer accounts.

Types of ACH transfers

ACH transfers are processed in two ways, which vary in delivery speed and cost:

| ACH debit transactions | Usually involves money getting ‘pulled’ from an account. So when you set up a recurring bill payment, the company you’re paying can pull what it’s owed from your account each month. |

| ACH credittransactions | This lets you ‘push’ money on line to account on different banks, either accounts you own or friends’ and family members’ accounts. |

Benefits of ACH Payments

There’s a reason why ACH payments are the most commonly used forms of payment. Not only do businesses benefit from them, but consumers do as well. ACH payments offers the convenience and flexibility of sending money without having to worry about lost payments or the time-consuming process of check payments.

Electronic payments are quicker and essentially more reliable since it doesn’t require you to forward the checks to a bank and waiting for it to bounce. However, they do not run in “real time” and it may take a couple of days for the payment to officially process.

How do they Work?

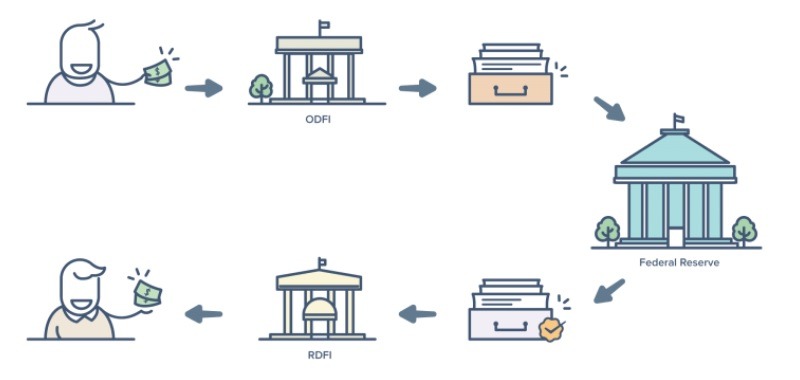

Some common banking terms regarding ACH payments are ODFI and RDFI. ODFI stands for Originating Depository Financial Institution and can be represented as the sender or where the payment is coming from. RDFI stands for Receiving depository financial institution which is the receiving end of the transaction or who you are sending the money to.

Whenever you make an ACH debit payment, the receiving end sends an ACH debit entry to their ODFI. The ODFI and RDFI basically exchange information to ensure that the funds are available in the account that is being debited. If there are sufficient funds, then the transaction is processed. If there are insufficient funds, than the OFDI will receive a return code.

A return code is essentially a receipt that gives you the reason of why a particular transaction failed to process. There are many different types of return codes and some common ones are:

- R01(Insufffient Funds)

- R02(Closed Account)

- R03(No Account/Unable to Locate Account)

- R04(Invalid Account Number)

- R10(Customer advises unauthorized, improper, ineligible, or part of an incomplete transaction)

- R20(Non-transaction Account)

|

|

Bottom Line

Hopefully after reading this post, you will understand how ACH payments work and the many benefits of using them to send money to other recipients. ACH payments are a common way to process and receive transfers as it is a safe and reliable method compared to traditional forms payment.

If you would like to know more about money transfers, check out our post ACH vs Wire transfer: What is the difference? to learn more about the different types of transfers. Or if you are looking for ways to save a few dollars on those hidden bank fees, there are many Ways to Avoid Excessive Bank Charges with many great tips to know when managing those banking fees.

If you are interested in bank promotions near you, check out our updated list of the Best Bank Bonuses for all of your banking needs!

Leave a Reply