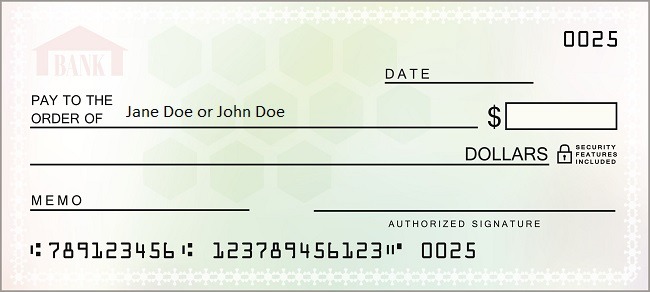

Planning on writing a check to a couple, several roommates or multiple people or have one to deposit? Then make sure to know the difference between “And” and “Or” when writing a check and endorsing ones.

Planning on writing a check to a couple, several roommates or multiple people or have one to deposit? Then make sure to know the difference between “And” and “Or” when writing a check and endorsing ones.

These simple words can offer security in who can deposit the check and what endorsements to shared accounts can be needed. If you’re not sure How to Endorse Checks Payable to Multiple People, then make sure to read on! Learn how to deposit or write a check to multiple people!

Using the Word “And”

If you’re planning on writing a check to several people at once, plan to use the word “And”.

“And” means everyone, which means if you’re making a check that is payable to two names, it can only be deposited into an account with both those names. Also, banks have have some specific rules for when the names on the checks don’t match.

This cuts down on the risk of one person running off with the check as both signature endorsements and a shared account will be needed when depositing the check.

To further reduce the risk of any fraud, some banks may require that all of the payees endorse the check together, in the presence of a bank employee. The people present would need to have valid identification to prove they’re allowed to endorse that check. The higher the amount of the check, the more careful the bank has to be.

The easiest route by far is depositing the check as opposed to cashing it. If the payees all own an account together (i.e. a joint account), then it is easier to deposit the check.

Using the Word “Or”

Planning on making a check out to two people but either parties are okay with each other depositing it? Then write the check out with the word “Or”. The word “Or” means anybody, which means either parties can deposit the check. With this it means only one signature and account with one name would be needed.

If The Check Isn’t Clear

For checks that aren’t clear and don’t specify “And” or “Or”, your check will be treated as if it would say “Or”. According to the Uniform Commercial Code (UCC), which generally serves as a template for how states handle these transactions, says that “ambiguous” checks can be negotiated by anybody named on the check. Which means anyone listed as the payee of the check can sign it and deposit it into their own account.

Although the UCC offers a guideline, banks don’t have to follow it. Banks tend to be extra careful around these checks to avoid taking losses themselves. Some banks may even require everyone to endorse the check if they suspect the check writer’s intentions.

|

|

Bottom Line

Writing a check to multiple people, it can get confusing, so make sure to learn How to Endorse Checks Payable to Multiple People. Words like “Or” and “And” can make an world of a difference. When writing the word “And” with multiple people, it must have endorsements of everyone and be deposited in an joint account or cashed will all the people present.

If you write or get a check with multiple people and it says “Or”, anyone on the check can deposit it and only a single endorsement will be needed. Check out our Bank Bonuses, Saving Rates and Credit Card Bonuses!

Leave a Reply