For one of the safest and easiest ways to purchase or sell something, Money Orders are your best bet. These printed orders for payment of a specified sum, issued by a bank or post office are similar to checks but can be easily tracked and cancelled. In addition you will not have to use your credit card, a credit card, or pay in cash.

For one of the safest and easiest ways to purchase or sell something, Money Orders are your best bet. These printed orders for payment of a specified sum, issued by a bank or post office are similar to checks but can be easily tracked and cancelled. In addition you will not have to use your credit card, a credit card, or pay in cash.

Moreover, you can list the recipient’s name so they can be the only person or company authorized to deposit or cash the money order. If you’re interested about learning more about money orders, be sure to checkout below as we will provide a step by step guide on how to fill one out and more!

Above all, if you’re planning on using an money order to make a payment, check out how to fill one out below! Check out our Bank Bonuses, Saving Rates and Credit Card Bonuses!

What is a Money Order?

A money order is a printed document payment that the payer can use to guarantee a payment they intend on issuing. Consequently, since the payer has already paid the lender of the money order to obtain it, the beneficiary will only receive a document that is already prepaid.

Typically, money orders only allow for payments to reach a limit of $1,000. In other words, if you need to make a payment of more than $1,000, you will need to fill out more than one form, or you will need to use another form of payment, such as writing a check or a bank transfer.

How To Fill Out A Money Order

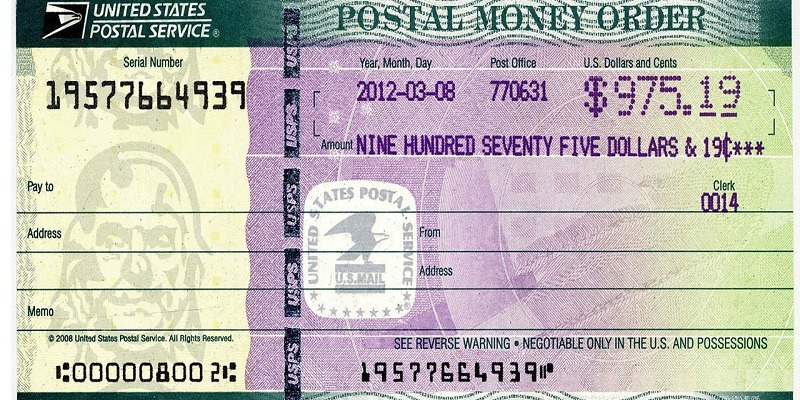

- Fill in the recipient’s name – The recipient will be the only person or company authorized to deposit or cash the money order. On the form, you will be required to fill out the recipient’s details under the section named either “Pay to the order of”, “Payee”, or “Pay to”. Additionally, to avoid losing your money in case the the form is lost or stolen, avoid making your money order payable to cash.

- Write your address in the purchaser section – List your address so your recipient to know how to contact you if there are questions or issues with the payment.

- Include your account number if you’re paying a bill – Filling it out helps make sure your account is credited for the payment, not all Money Orders have this. Some will have a section named “Re” or “Memo” for you to provide additional order details. Order details can include information such as order details, transaction details, your name, or your account number especially if you are paying a bill.

- Sign the bottom where it says ‘purchaser’s signature’ – Your signature makes this Money Order official. Be sure to sign where it says “Purchase’s signature” and not the back side, as that is where the beneficiary of the funds will sign once they have received them.

- Keep your receipt – Use this to track and cancel your money order if needed. This will also be a form of proof of your payment. You can also use it to verify whether the beneficiary received it and has cashed or deposited the money.

What To Do If You Make a Mistake on a Money Order

When filling out your money order, be careful because you won’t be able to make changes to it. If you do make a mistake, you will need to get a refund or replacement, depending on where you bought it.

If you need any extra help filling out the money order, ask the issuer for an example of how to do so. Don’t send the money order if you’re unsure about any mistakes that may have been made. Instead, keep the money order and receipt, then contact the issuer and explain the problem. That way you might be able to get a refund or replacement.

The Different Types of Money Orders

Below is a list of ways on how to fill out a money order from Western Union, a Post Office, and Moneygram.

How to fill out a Money Order from Western Union

The Western Union is well known for providing money orders. Their website provides a filter where you get to choose the location. This filter will make it easier to find the locations you can buy a form near you.

Firstly, all you will need to fill out here is the name of the beneficiary, your full name and contact details, and your signature. Then, you will take your receipt and you should be good to go. Additionally, you will need to fill out your bank account details if required.

Above all, the money order fees vary from one Western Union location from the other. In other words, be sure to confirm the charges first before purchasing them.

How to fill out a money order from a Post Office

Most, if not all, Post Offices provide more than just a service of sending and receiving mail, but also sell Money Form orders. Additionally, they also allow one to sell them internationally. If there is a post office location closer to you than the Western Union or your bank’s branch, then you can also check to see if they sell them.

When filling out a post office money order, you will be required to fill out the beneficiary’s address and additional details on what the payment is for. You can will this out at the bottom where it says “Memo”

How to fill out a money order from Moneygram

Firstly, use the Moneygram (locator) to find the nearest locations to you. Additionally, you can also check your local Walmart or CVS to see if there is a Moneygram in the premises. If there is, you can purchase a money order form from them.

A money order form from Moneygram may be the simplest one to fill. The only requirement is to fill out the recipient’s name, your address, and append your signature. Then, you will tear off the form and keep the receipt.

The Pros and Cons

Pros

- If you don’t want to involve your bank in the payment process or do not have a bank account, then a this would be an ideal form of payment. You can use your credit card, cash, or even your debit card to purchase one.

- They are useful when you need to make a payment to a vendor who doesn’t accept checks. In these cases, you can keep your bank account information disclosed as it will not be required.

Cons

- Money orders can be prone to scams or fraud. In the case that you do receive one, be sure to check if it is a real one or a fraudulent one. You can verify this by double checking the amount on the money order. In addition, be sure to confirm if the details provided appears to have been written over previously written details.

- In addition, you can also call the U.S. Postal Offices using 1-866-459-7822 to verify any of their money orders. For Moneygram, you can call 1-800-Moneygram.

- Unfortunately, they do have a limit of $1,000.

- Lost Money orders are much harder to track than bank transfers.

Difference Between a Money Order and Check

Although both a check and a money order cost a fee and can be deposited into the accounts of the recipient, they do hold key differences. Firstly, a money order doesn’t require you to have a bank account. Additionally, it doesn’t require you to buy one or write one especially when purchased with cash. With a personal check or cashier’s check, you will need a bank account.

Secondly, they have a limit of $1,000 that can be transferred at a time. Consequently, a check allows you to exceed that $1,000 limit. In addition, it is also easier to track a cashier’s check than it is to track a money order.

For payments that you want to make without going through your bank, a money order is the way to go. This is especially useful if you don’t have a bank account because a money order will allow you to make payments anyways. Regardless of the type of money order you are using, you must know how to fill it out.

The most important things to keep in mind when filling it out are the recipient’s details such as the address and the name. Additionally, you will need to fill out your own name and address, and in some occasions, your own bank account number. After signing off on the document, you are good to go.

Money Order Features

- Can track or cancel them, and they’re always “made out” to a particular recipient.

- Used if you don’t have a checking account, mailed payments, to prevent bounced checks. This is to avoid using personal checks to send money overseas.

- Cost up to $5.

- Accepted at banks, businesses, & individuals.

- Are a form of “guaranteed” payment.

- Less expensive for recipient than credit cards.

- You can get them at check-cashing locations, convenience stores, gas stations, drugstores, post offices, & retailers.

|

|

Bottom Line

To make an safe and easy payment on anything, check out Money Orders! If you’re planning on making a payment on your bills or making a purchase, make a Money Order today. This is a great way to use your cash and make sure that it is safe until delivered.

Please note that there is a fee using this form of payment. Their fees are usually more expensive at banks or credit unions compare to convenience stores and more. Don’t forget to keep your receipt to keep track of your form or cancel it if needed. Check out our Bank Bonuses, Saving Rates and Credit Card Bonuses!

Leave a Reply