If you’re planning on making a payment and don’t have a checking account or plan to send money overseas and more, Money Orders are the way to go! Money Orders are a printed order for payment of a specified sum.

If you’re planning on making a payment and don’t have a checking account or plan to send money overseas and more, Money Orders are the way to go! Money Orders are a printed order for payment of a specified sum.

These printed documents are similar to checks but their information is pre-printed on the face, all you need to do is sign the document. Additionally, you can track or cancel Money Orders, and they’re always “made out” to a particular recipient.

A lost or stolen money order is less problematic than losing cash. Money Orders are one of the safest and easiest ways to make payments, so make sure you learn how to make and accept them! Check out our Bank Bonuses, Saving Rates and Credit Card Bonuses!

How to Use a Money Order

If you’re familiar with writing a check, filling out a money order is similar. You just need to purchase the money order first. If this is all new to you, we’ll break it down step by step. Finally, we’ll cover how to deposit or cash a money order you receive.

Buy the Money Order

The first step to getting a money order is buying it. Simply get a money order for the amount you need. If you need to pay someone $100, you will need to buy a money order for $100. You can either pay for it with cash, a debit card, or a credit card cash advance.

You can purchase it at several locations. Ease and cost is determined by where you buy it at. Banks and credit unions tend to charge $5 or more per money order, but other vendors usually charge around $1. The United States Postal Service charges up to $1.70. Here’s a list of places to buy a money order:

- Convenience stores

- Grocery stores (the Customer Service desk)

- US Post Offices

- Pharmacies

- Check cashing and money transfer stores

- Banks and credit unions

Fill it Out

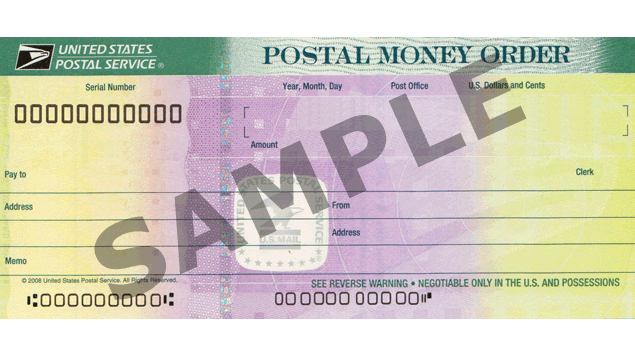

You will need to fill out some information when you receive your money order. The amount of your money order will already be on the document when you purchase it. You will need to know the following when filling out your money order:

- Payee information. When you’re writing the name of the person or business down, you must write it in the section titled “Pay to the order of”. Ask the recipient to confirm what name to put in this section.

- Addresses. Not all, but some money orders will require you put an address for the recipient. This will help with tracking and ensuring that the money order gets to the intended person.

- Memo. Money orders may provide an area labeled “Memo” or “Re:” for additional details about your payment (your account number or order confirmation, for example). If you can’t find that area, you can write anything needed in any blank section on the front of the money order. A sticky note on the money order might also do the trick.

- Signature. Your signature is required at the bottom of the money order. Simply sign your name on the front (not the back) of the document. This area might be labeled “Signature,” “Purchaser,” or “Drawer.”

Make your Payment

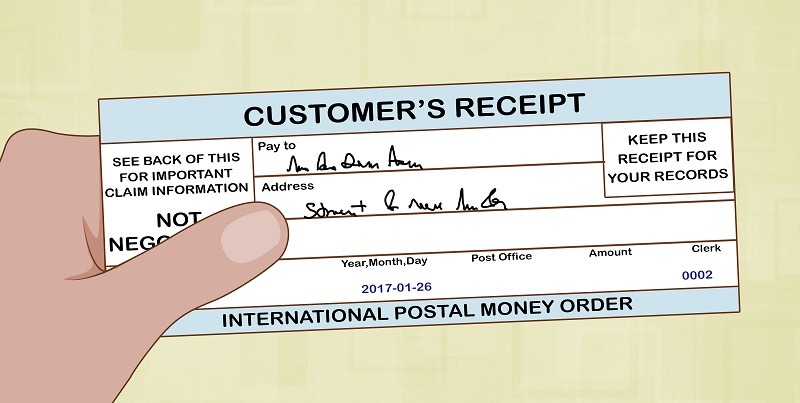

After filling out all of the information on your money order, all you have to do is make the payment. Unlike cash, it is safe to mail a money order as long as you keep a copy of the receipt.

Making a deposit at a bank branch or ATM is the simplest way to deposit your money order. Some banks may allow mobile deposits on money orders but most banks don’t allow it. Once you successfully make the deposit, the funds should be available within a few days.

Keep in mind that you might get scammed when accepting money orders because they can be fake. If someone wants to pay you with a money order, do not send any money or provide payments until you know the payment is legitimate.

How to Make Money Orders

- Head to a place that makes Money Orders, such as check-cashing locations, convenience stores and more.

- Pay for money orders with cash, a debit card, or a credit card cash advance.

- Select the information to be pre-printed on the face and get your money order.

- Make sure to keep the receipt to track it!

How to Accept Money Orders

- Once you’ve receive your Money Order you must endorse it on the back.

- You can deposit into your account by heading to a branch or using an ATM.

- OR, to get cash you must head to the money order issuer and get cash through them.

Money Orders Features

- Can track or cancel Money Orders, and they’re always “made out” to a particular recipient.

- All information will be pre-printed on the face.

- Are a form of “guaranteed” payment.

- Less expensive for recipient than credit cards.

- Cost up to $5.

- You can get them at check-cashing locations, convenience stores, gas stations, drugstores, post offices, & retailers.

- Used if you don’t have a checking account, mailed payments, to prevent bounced checks, to avoid using personal checks, to send money overseas.

- Accepted at banks, businesses, & individuals.

|

|

Bottom Line

For an safe and easy way to make any kinds of payments, check out Money Orders! Simply head to a convenience store or any places that make money orders, select the recipient and other information, and pay with a card or cash to get your money order.

Please note that depending on where you get your Money Order from there may be a fee of up to $5. Make sure to keep your receipt to keep track of your Money Order or cancel it if needed. Check out our Bank Bonuses, Saving Rates and Credit Card Bonuses!

Leave a Reply