Checks has had a long longevity in financial institution, dating back as far as ancient Roman era. Checks are still widely used and accepted as a form of payment.

Modern day checks are a bit more complex but it still serve the same purpose. Most of the population will have to write a check sometime in their lives, whether it’s for business or personal.

Study claims about 28 million checks are written everyday so it is important to pick up some knowledge on how to read a checks. It will only take a few minutes to learn all the features on a check and it may help out big time in the future.

Reading A Check

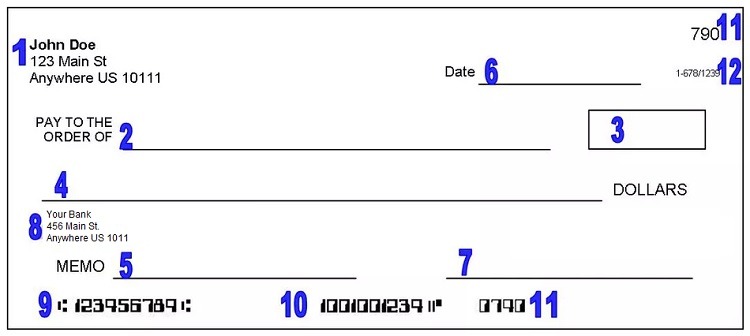

It’s not complicated, you can take a look at a sample check above:

This section of the check is all about the checking account owner. If you are on the receiving end of a check then you will know exact who is writing this check, their contact information and even their business/home address.

If you need to contact the check writer, you can find the contact information there, sometimes a phone number appears here, but not always. It’s also possible that you’ll find handwritten personal information in this area,(a cashier might require a phone number or driver’s license number in order to accept a check).

Hopefully your name is on the Payee line because this section of the check states who will be receiving the funds. You can make the check out for a person, a company, or even “Cash” so anybody can deposit or cash the check.

A check will provide a box for the dollar amount of a check which must be written in numeric value. However, if section #4 has a different number, the bank should use the amount that was written out in words.

The value of the check must also be written out in words. The value of the check in words should match the numeric value in section 3. However, if section 3 & 4 do not match then section 4 should take precedence since this is the official amount of the check.

If you wish to add any additional information onto the check then look to the Memo Line. This space allows the check writer to add in comments such as a bill reference number, rent information, reasons for the payment, purpose of check and more.

Write down the date which the check is written. The date should be formatted in month/day/year. You may choose to write it as 08/06/2018, Aug 06, 2018, or August 06, 2018.

The signature line marks the last parts of the check that needs to be filled in. Once you complete and review all other section, then register your signature to complete the check writing process.

This section identifies the financial institution responsible for issuing this check. Some checks hs detailed information on the financial institution while others simply use a bank logo.

Banks identify each other using a unique routing number that is typical found in the lower hand corner of the check. Banks use this number to find the check writer’s bank in order to transfer funds.

The second series of numbers at the bottom of the check is the check writer’s checking account number. This section of the bank identify the checking account which funds will be retrieved from.

An additional layer of verification rounds out the last series of numbers at the bottom of the check. This is representative of the check number which can also be found at the top right corner of the check. This number can help payer & payee keep track of multiple payments.

The Bank Fractional Number is another way for banks to identify each other.

Whoever deposits or cashes a check will generally endorse on the back of a check. This leaves a record of when and where the check was handled.

|

|

Bottom Line

Most people these days don’t even know how to write a check, let alone read one. If you are one of these people, hopefully you’ve learned something new!

There are quite a few things that come with a check but they aren’t hard to interpret.Checks are widely used around the world and it is definitely something worth learning about. Check out our Bank Bonuses, Saving Rates and Credit Card Bonuses!

Leave a Reply