Being in the workforce or by simply fiddling with banking, you may have heard of a Direct Deposit. In fact, having a direct deposit isn’t out of the ordinarily in this day and age.

A majority of US workers rely on direct deposit as their primarily form of getting paid and there’s a reason as to why the number to drastically skewed from those who still use traditional checks over direct deposit.

If you are a current Chase customer interested in setting up a direct deposit, then below is a detailed explanation on How To Set Up Chase Direct Deposit.

| PROMOTIONAL LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up to $700 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

What is a Direct Deposit?

A Direct Deposit is the electronic transfer of payment directly from the payer’s account to the recipient. Direct deposits eliminates the need for paper checks by conveniently depositing the check from one account to another.

The transaction is automatic and doesn’t require the use of a physical medium such as the paper check. Some forms of direct deposit payroll checks from your employer, social security, benefit payments, or investment income from certificates of deposit, mutual funds, or something of the like. It is simply the transfer of money from one account to another via electronically.

The following types of payments qualify for direct deposit:

- Payroll checks from your place of employment

- Payments for veterans benefits, Social Security, Supplemental Security Income, Railroad Retirement and other federal benefits

- Benefit payments issues by state governments for pensions, retirement, and unemployment

- Investment income from certificates of deposit, annuities and mutual funds

How to Apply for Direct Deposit with Chase

Setting up a Direct Deposit is simpler than you may think. Chase makes its easy, check out the instructions below!

- Download and fill out the direct deposit form. You’ll need your Chase Bank account number, the bank’s routing number and your current address.

- Bring the form and a voided check to your employer’s payroll department.

- Wait for your employer to deposit your paycheck into your bank account.

- Check your monthly paper statement or log in to your account online to verify that the deposit was made.

Alternatively, you can request a direct deposit form from your workplace and fill in your Chase Account information. Here is what you will need to fill out your form.

- Chase Routing Number: Find a full list of Chase Routing Numbers here.

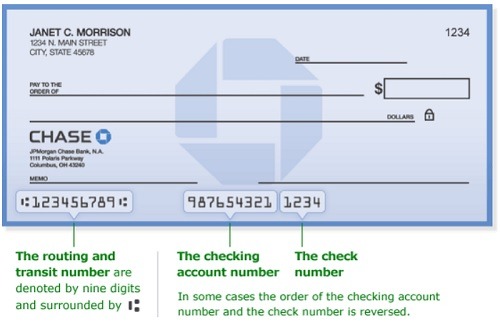

- Bank’s routing number: This is the nine-digit number, also known as the American Bankers Association — or ABA — number, printed on your bank statement or along the bottom left of your checks.

- Your account number: This comes after the routing number on the bottom of your check. You may also find it on your deposit slip or bank statement.

- Type of account: This typically will be your checking or savings account. It’s where your direct deposit will go.

What Are the Benefits of Direct Deposit?

You’ll enjoy several benefits when you take advantage of direct deposits with Chase.

- Convenience and Time: By setting up direct deposit it saves you time by having to manually deposit your check at a bank. This is especially convenient if your work hours clash with bank operating hours. It also removes the possibility of losing the check. However, if you use checks you can use mobile deposit using Chase QuickDepositSM.

- It Saves Money: Direct Deposit is in the best interest of you and the company. Direct deposits also cut down on expenses like purchasing checks, maintaining a printer, and buying ink and envelopes. Finally, direct deposits eliminate costs like reissuing checks that were lost or stolen and payment charges from banks.

- Employees are Paid on Time: The reduced effort required to process direct deposits, combined with new electronic payment technology, guarantees that you will get your money on time when you need it.

Chase Bank Direct Deposit FAQ

- How soon after applying does direct deposit start?

Chase lists two pay cycles as the average time before the direct deposit kicks in, but this might be different for each employer. - How long does it take for a Chase Bank direct deposit to clear?

Direct-deposit funds are available on payday. - Does Chase process direct deposits on weekends?

Chase must make your deposit available by the day after it receives the funds. So you can expect your direct deposits your employer initiates on Saturday and Sunday to post to your account on Monday.

Bottom Line

Being able to set up Direct Deposit with any employer allows you to receive your money faster without the hassle of visiting the bank. You can sit back and know that every one of your checks will go straight to your account.

Chase offers many beneficial features like direct deposit to further improve your experience such as Chase Pay Service and Chase Online Bill Pay. Utilizing these features may be to your advantage when banking with Chase. If you need a bank account and want to learn more about checking coupons, check out all of the bonuses available from Chase Promotions!

If you’re looking for credit cards with the best miles, cash, or points or for the latest credit card sign-up bonuses? You should check out our Best Credit Card Bonuses here on HMB.

I do the payroll for one of your business clients, and she would like to start paying her employees by Direct Deposit. What I need to know is, is there anything your client or I (her bookkeeper) need to do to start paying her employees via direct deposit. I have already collected the signed forms from the employees with their Bank Account number and Routing number. I’ve entered it in my system, now once I work up a payroll for direct deposit, and make an ACH file how do I submit it to Chase to process the deposits and make direct deposits into the employees bank accounts? Is there some kind of email address or web site I need to know?

Your help would be very appreciated!

Joan McArthy/Bookkeeper