Find the latest H&R Block promotions, discount deals, and coupons here!

Let H&R Block help you prepare your taxes for the tax season at an affordable price. Not only can you use the H&R Block software, but you can also walk into any of their physical locations to get face-to-face consultation. Check out our listings below to see if you can save money on your service!

Tips on How to Save Money at H&R Block

Before you start the filing process, you can get a free estimate of your refund using H&R’s Tax Calculator. You estimate your return based on answers to questions about your tax situation.

During tax season, many online tax prep services offer discounts on their filing packages to compete with other services. For 2020, H&R is offering 25% off its online Deluxe, Premium, and Self-Employed packages.

Book a free second look tax review with an H&R representative! During the session, the the representative will review your previous tax return to see if you have overlooked any credits or deductions. So if you catch previous mistakes, you might see that you’re entitled to a bigger refund.

If your tax situation is simple, you can file online for free. The Free version of H&R Block is made for those with W-2 incomes, retirement plan income, social security income and no mortgage. Support chat is also included.

If you need help on your taxes or have any questions, H&R shares expert tax tips and useful advices in their Tax information center! They also have a H&R Block Tax support page and you can fund support on their products and schedule an appointments at a local office.

Plus when you use H&R Block’s online tax filing service, you can talk with a tax pro for free to get advice and technical support!

With H&R Block’s online assist packages, you get on demand help while you prepare your taxes! You can also get help from a tax expert, enrolled agent, or CPA when you need it. Plus this add-on is less expensive than many assisted tax preparation services.

If you do decide to purchase the Deluxe or Premium filing package, you can opt to pay nothing out of pocket if you choose the Refund Transfer option. With Refund Transfer, you can set up a FDIC-Insured Refund Account to receive your refund and have your tax preparation and related fees subtracted from the total.

If you filed online or in-person with H&R Block, you can check your e-file status for free. Once your e-file is approved, you can look up your federal refund date by visiting Where’s My Refund.

If you file using a H&R Block Online product, in the unlikely event you are audited, H&R Block professionals can provide free audit support. This includes helping you understand and reply to an IRS or other tax notice regarding a return you filed with H&R Block Online.

If you filed with H&R Block Basic, Deluxe, Premium, or Premium & Business desktop software, you can get in-person audit representation for free.

Did you know that H&R Block has a referral program? You can earn $25 for every friend that you refer! They’ll earn a $25 discount on their tax prep fee. You can earn this bonus for up to eight referrals.

Continue reading this post below to see the latest H&R discounts and coupons!

Current H&R Block Promotions

20% Off Tax Season 2022

Currently, H&R Block is offering customers a 20% Off Tax Season 2022. All you have to do is head to their site and sign up with your ID to get these benefits and more! Keep in mind this is going throughout the end of May so sign up while you can.

- Promotions: 20% Off Tax Season 2022

- When it expires: Limited time offer

- Availability: H&R Block

- How to get it:

- Go to this H&R Block webpage.

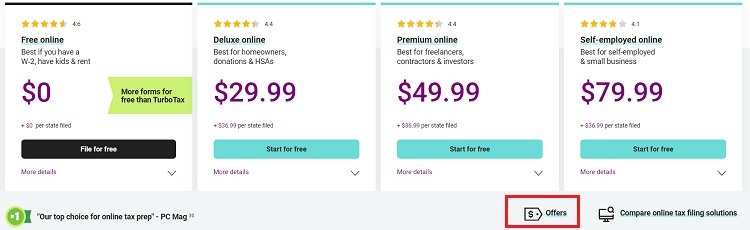

- Click on the “Offers” link as shown in the image above

- Scroll down to see the Amazon Refund Bonus offer.

(Visit the link above to start filing your taxes)

H&R Block 4% Refund Bonus

4% Refund bonus

H&R Block has an offer for you! When you put place some or all you refund on an Amazon gift card, you can get a 4% refund bonus! File online & select this H&R Block promotion when you’re finished filing.

How to get bonus:

- Visit the H&R Block webpage we’ve linked through the button below

- Then click on the “Offers” link, shown in the image above.

- Scroll down to see the Amazon Refund Bonus offer.

(Visit the link above to start filing your taxes)

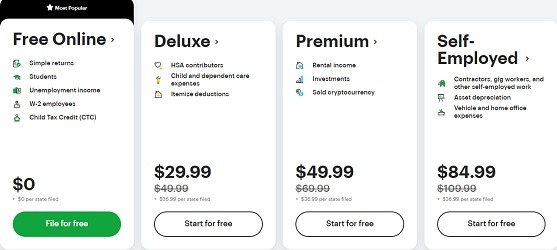

H&R Block Packages & Pricing

| PLAN | PRICING | DETAILS |

| Free | Federal: $0 State: $29.99 Tax Pro Review: $49.99 |

1040 plus Schedules 1-6 |

| Deluxe | Federal: $49.99 State: $39.99 Tax Pro Review: $79.99 |

Good for itemizers |

| Premium | Federal: $69.99 State: $39.99 Tax Pro Review: $89.99 |

Schedule D or Schedule E (investors & rental property owners) Schedule C-EZ (independent contractors) |

| Self-Employed | Federal: $104.99 State: $39.99 Tax Pro Review: $89.99 |

Small business owners Freelancers Independent contractors Imports Uber driver tax information Integrates with Stride Tax |

All packages include:

- Snap-a-pic W-2 capture

- Import from other tax preparers

- Refund results in real time

- Technical & tax help center

- Data security for online taxes

- Protection with Tax Identity Shield

H&R Block Tax Support

Regardless of the H&R Block package you decide to buy, you will have access the large number of human tax professionals across their 12,000 offices worldwide. Although this feature is not free, it is still nice to to know that you can get in-person help if you wanted it.

Ask a Tax Pro. With this add-on service, you will have the ability to chat with a tax expert on-demand and with unlimited access. Talk on the phone, or use a mobile phone or table to share your screen during your session.

Tax Pro Review. If you feel that you’ve made any issues regarding your taxes, you can have a one-on-one review by a tax professional to check for you. The review will be completed in three days, and the tax expert can sign and e-file the return it on your behalf.

Keep in mind that not all H&R Block tax experts are enrolled agents or CPAs, but they do go through 60+ hours of initial training, plus an additional 30+ hours of training every year to prepare for the tax season.

H&R Block Audit Support

H&R Block customers have the option of purchasing Worry-Free Audit Support which connects you with an Enrolled agent who will help you through an audit. It costs $19.99 and includes audit preparation, IRS correspondence management and in-person audit representation.

H&R Block Tax Refund Options

No matter how you file your taxes, you can choose to receive your refund via:

- A direct deposit to a bank account (fastest option)

- An H&R Block Emerald prepaid debit Mastercard

- A paper check

- Next year’s taxes

- U.S. Savings Bonds purchases

- Amazon gift card (5% bonus)

To get the most value out of your refund is to load the amount to an Amazon gift card. You can earn a 5% bonus your refund.

H&R Block vs. TurboTax

TurboTax is another tax prep option that offers a step-by-step guide while you navigate its user-friendly software. This is the biggest competitor to H&R Block. Below we will compare and contrast the two.

| FILING OPTION | H&R BLOCK | TURBOTAX |

| Free | Federal: $0 State: $29.99 |

Federal: Free State: Free |

| Deluxe | Federal: $49.99 State: $39.99 |

Federal: $39.99 State: $39.99 |

| Premium | Federal: $69.99 State: $39.99 |

Federal: $59.99 State: $39.99 |

| Self-Employed | Federal: $104.99 State: $39.99 |

Federal: $89.99 State: $39.99 |

Free Option. Both H&R Block and TurboTax offer a free option, but H&R Block covers more forms and schedules as well as allows the customers to file multiple state returns for free. TurboTax’s free option only includes one free state return.

Tax Experts. Although TurboTax doesn’t have physical locations like H&R Block, they do offer their customers access to tax experts – CPAs and EAs – for an additional fee. H&R Block still provides professional assistance online, through phone and in person.

Ease of Use. This is where the two services will differ because TurboTax is much easier to use through your desktop, tablet, or smartphone. It uses an interview style to navigate you through the filing process.

|

|

Bottom Line

Although H&R Block falls short in certain fields, it is still a fan favorite in terms of service. Due to their multiple locations and in person consultation, they can physically guide you through your taxes.

Be sure to take note of the exclusions. For additional savings like this check out our full Coupons list! While you’re here on HMB, learn other ways to maximize your savings with a rewards credit card!

Leave a Reply