We are in the modern digital age where most of us are using online payment methods like Venmo or Paypal or even a credit and debit cards to make our purchases. But there are certain situations where using a check may be your best payment option or even balancing out your checkbook.

A check is a written order to pay someone a specific amount of money on a certain date. Continue reading below to learn the basic steps to properly write out a personal check with dollars and cents for Huntington Bank.

| PROMOTIONAL LINK | OFFER | REVIEW |

| Huntington Bank Unlimited Plus Business Checking | $1,000 Cash | Review |

| Huntington Bank Unlimited Business Checking | $400 Cash | Review |

| Huntington Bank Business Checking 100 | $100 Cash | Review |

Step by Step on Writing a Check

If you’re filling out a check for the first time or if it has been a while for you, you might have questions about the process of writing one. While you might not write many checks, it’s still an important skill to have. Continue reading the tabs below for a quick step-by-step process.

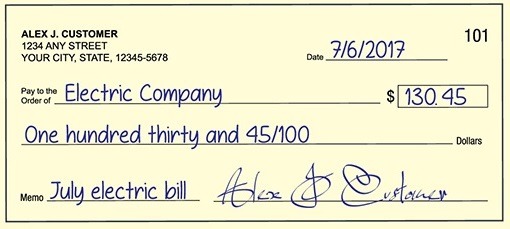

You’ll need to write the date on the line at the top right-hand corner. This step is important to start with, just in case you forget, since this will help the bank and/or the person you are giving the check to knows when you wrote it.

You’ll need to write the date on the line at the top right-hand corner. This step is important to start with, just in case you forget, since this will help the bank and/or the person you are giving the check to knows when you wrote it.

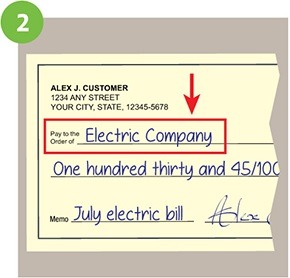

The next line on the check “Pay to the order of, is where you write the name of the person or company you want to pay. Plus you can also write the word “cash” if you don’t know that person or organization’s exact name.

The next line on the check “Pay to the order of, is where you write the name of the person or company you want to pay. Plus you can also write the word “cash” if you don’t know that person or organization’s exact name.

Please note that this can be risky if the check ever gets lost or stolen since anyone can cash or deposit a check made out to “cash.”

There are two spots where you need to write the amount you are paying. The first is the dollar amount numerically in the small box on the right. Make sure you write this clearly, so the ATM and/or bank can accurately subtract this amount from your account.

There are two spots where you need to write the amount you are paying. The first is the dollar amount numerically in the small box on the right. Make sure you write this clearly, so the ATM and/or bank can accurately subtract this amount from your account.

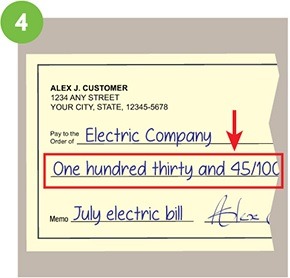

On the line where it says “Pay to the order of,” write out the dollar amount in words to match the numerical dollar amount you write in the box.

On the line where it says “Pay to the order of,” write out the dollar amount in words to match the numerical dollar amount you write in the box.

For example, if you are paying $130.45, you will need to write “one hundred thirty and 45/100.” To write a check with cents, be sure to put the cents amount over 100. If the dollar amount is a round number, still include”and 00/100″ for additional clarity.

Keep in mind, that writing the dollar amount in words is important for a bank to process a check as it confirms the correct payment total.

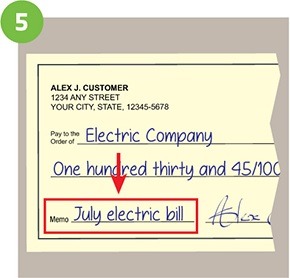

Filling out the line that says “Memo” is optional, but helpful for knowing why you write the check. So if you’re paying a check for a monthly electric bill or rent, you can write “Electric Bill” or “Monthly Rent” in the memo area. Often when you are paying the bill, the company will as you to write your account number on the check in the memo area.

Filling out the line that says “Memo” is optional, but helpful for knowing why you write the check. So if you’re paying a check for a monthly electric bill or rent, you can write “Electric Bill” or “Monthly Rent” in the memo area. Often when you are paying the bill, the company will as you to write your account number on the check in the memo area.

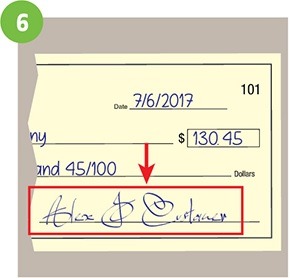

Just sign your name on the line at the bottom right-hand corner using the signature you used when you opened the checking account. This will show the bank that you agree that you are paying the stated amount and to the correct payee.

Just sign your name on the line at the bottom right-hand corner using the signature you used when you opened the checking account. This will show the bank that you agree that you are paying the stated amount and to the correct payee.

How to Balance a Checkbook

You should try to keep track each time you spend money or make a deposit on your checkbook’s check register. You can find this with the checks you receive from Huntington.

Your check register is meant to be used for keeping track of your deposits and expenses! All expenses should be recorded, including checks, ATM withdrawals, debit card payments, and deposits.

Record Your Transactions

- If you make a payment by check, start recording the check number, find this in the top right corner of the check. This also helps you keep track of your checks, helping you ensure non of your checks are missing, as well as reminding you when you need to reorder checks.

- Be sure to make note of the date for you records! Describe where the payment was made or for what in the “Transaction” or “Description” column. Then write down the exact amount spent in the withdrawal or deposit column depending on if you spent money or received it.

- Subtract the amount of any checks, withdrawals, payments and bank fees or add in deposits to the total amount in your account from the previous transaction

Reconcile Your Bank Statement Each Month

When you receive your monthly bank statement, whether it comes in the m ail or you view it online, take the time to balance your checking account. To get started, you can download Huntington’s Balancing Worksheet here. Then you can follow the directions to enter the information from your checkbook register and bank account statement as well as any unlisted deposits and outstanding checking/withdrawals. And once you’re finished with the worksheet, if your adjusted checkbook and account balance match, your checking account is balanced!

If you see any differences, take time to check your math to see if there are outstanding checks that might not show on your statement yet. So double-check to see you didn’t miss a fee or transaction. If you think there is an error on your bank statement, contact Huntington as soon as possible.

Although, balancing your checkbook may feel outdated compared to online banking, mobile banking, and budgeting technology, there are still benefits to balancing your checkbook each month, or even each week.

So for example, if you wrote someone a check and they haven’t had the time to cash it, that amount won’t be listed in your online history, but it will be in your check register. Keeping track of your transactions could help you avoid overdrafts or return fees, as well as help you spot potential instances of fraud.

|

|

Bottom Line

Now that you have familiarize yourself on writing a check, it’s hard to forget how to write a check! Hopefully these tips will help you properly write the checks you need as well as balancing your checkbooks!

Find yourself running out of checks or needing to start one, you can easily order checks online from Huntington. If you’re interested in what more Huntington has to offer, check out the latest Huntington Bank promotions here!

Leave a Reply