Are you tired of treating stocks like a gambling game? Then it’s essential that you understand a little something called Implied Volatility. It’s simply the markets opinion on how a stock will react within the next year.

Are you tired of treating stocks like a gambling game? Then it’s essential that you understand a little something called Implied Volatility. It’s simply the markets opinion on how a stock will react within the next year.

Although you shouldn’t always go with the majority, understanding what they are predicting can be a valuable tool when deciding to invest in a certain stock or not. Check out our Bank Bonuses, Saving Rates and Credit Card Bonuses!

| PROMOTIONAL LINK | OFFER | REVIEW |

| J.P. Morgan Self-Directed Investing | Up to $700 Cash | Review |

| TradeStation | $3500 Cash | Review |

| WeBull | 12 Free Stocks & free trades | Review |

| SoFi Invest | $25 Bonus and free trades | Review |

What is it?

Implied Volatility is a percentage of the stock price. If a stock has a 25% IV, that means the stock is expected to either go down or p by 25% within the next 12 months. In simpler terms, implied volatility is a boundary for the stocks price. Measuring the IV against your own predictions and thoughts can help lead you to a safer investment. Keep in mind there is a chance the IV doesn’t come true or go down instead of up, so be weary.

How Does it Affect Price?

Implied volatility and option prices have a direct relationship. If IV increases than the premium price will also increase, and vice versa. This means that a rising implied volatility is bad for buyers. Their break-even point increases, meaning they require a higher a mount of return on investment do earn profit.

For Sellers however, a rising IV is great. It means they get more from the inflated premium and have a lower break-even point. Depending on your situation, a higher IV can either be a curse or a blessing.

Standard Deviation

Standard deviation is the percentage chance of an IV coming true. The equation for this is

Stock price x Implied volatility x V(Days to expiration/365)

There are other ways to figure out the standard deviation, but this is a great way to double check so you don’t make an investment you’ll regret.

Which Options Does IV Affect the Most?

Implied volatility has the highest affect on an at-the-money option. Let’s look at an example.

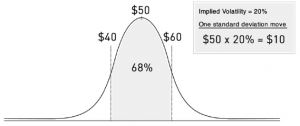

Amazon stock is currently trading for $50. You have a 3-month call for Amazon stock with a $50 strike price. You wouldn’t exercise the call right now. You could buy the stock from the open market at the same price. If the option has a 20% IV, it means the stock is predicted to increase or decrease 20% over the next year.

This means that the stock could change from $45 to $55. $50 x .20 x ?(90/365) = $5

If the call falls the $45, your call expires worthless. You wouldn’t a buy a stock at $50/share when it’s trading for $45. But, if the stock price rose to $55, you would exercise your call. You could then buy 100 shares at $50 and then sell them for $55/share. You’d realize capital gains of $500 minus the premium you paid for the option.

Using IV In Your Strategy

In simple terms, you should buy when IV is low and sell when it’s high. This way you buy at a lower premium and sell at a higher premium, which will net you more profit. The longer your expiration date the better, as it will give your stock more time to move in the direction you want it to.

Bottom Line

Investing can be a tricky thing, so it’s important that you understand and use all the tools at your disposal. Implied volatility is a critical factor and understanding will take your investing game up a level. Remember; Buy low and sell high.

The top investors in the world all use IV to their advantage, so make sure you follow in their footsteps! Check out our Bank Bonuses, Saving Rates and Credit Card Bonuses!

The United ClubSM Infinite Card offers 90,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening. You'll earn: • 4x miles on United® purchases • 2x miles on all other travel and dining • 1x mile on all other purchases. • Earn up to 10,000 Premier qualifying points per calendar year (25 PQP for every $500 you spend on purchases) This card does carry an annual fee of $525. However, you can get up to $120 Global Entry, TSA PreCheck or NEXUS fee credit. In addition, you'll get a savings of up to $360 per roundtrip (terms apply) by getting your first and second checked bags for free and Premier Access travel services! Member FDIC |

Leave a Reply