(Click the button above to learn more about Joy)

The Thinking Behind Joy

Authors Elizabeth Dunn, Ph.D., and Michael Norton are able to outline five research-based principles to finding financial happiness in their book Happy Money: The Science of Smarter Spending.

- More happiness is gained from buying experiences than material things.

- People find more happiness, on average, when they use their money to benefit others, rather than themselves.

- People feel more happy when they pay in advance for something they will consume later.

- More happiness is gained when they spend money to treat themselves.

- People find more happiness when they buy time, like buying their way out of cleaning the bathroom

Joy Features

Happy Money’s team of psychologists, neuroscientists, data scientists, financial professionals and tech experts worked together to create the Joy app using the Science of Smarter Spending framework. The free personal finance tool is designed specifically to track how your spending makes you feel.

Link Your Accounts

Joy allows users to connect your bank and credit card accounts to easily track their finances. All major U.S. banks, as well as over 20,000 other banks, credit unions and credit card companies, have the ability to sync with the app.

Rate Your Purchases

The joy app prompts users to rate their transactions as “happy” or “sad” spends. By acknowledging how your spending makes you feel, you’ll end up buying more of what makes you happy and less of what makes you sad.

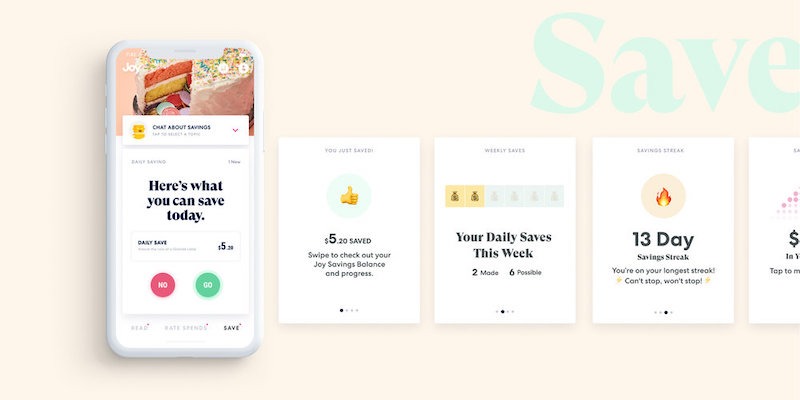

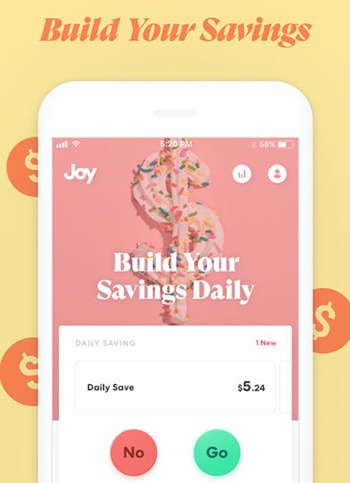

Build Your Savings

Joy makes it easy to save more money by giving behavior-based daily savings recommendations, as well as a free, FDIC-insured savings account. The app gathers your income data and spending habits to suggest an amount to squirrel away every day.

You will then be prompted to transfer that bit of savings to your Joy Savings account. This enables you to recognize daily opportunities to save, build your savings, and promote a sense of control over your financial future.

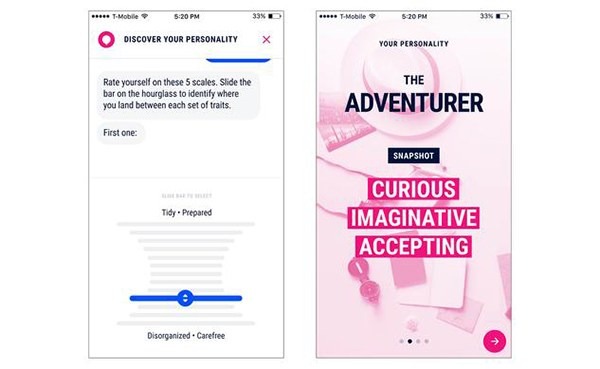

Figure Out Your Money Personality

Joy will ask you five simple questions and use your responses to assign you a “money personality,” which correlates with how you spend your money.

Once Joy has this information they’ll be able to personalize your experience with the app.

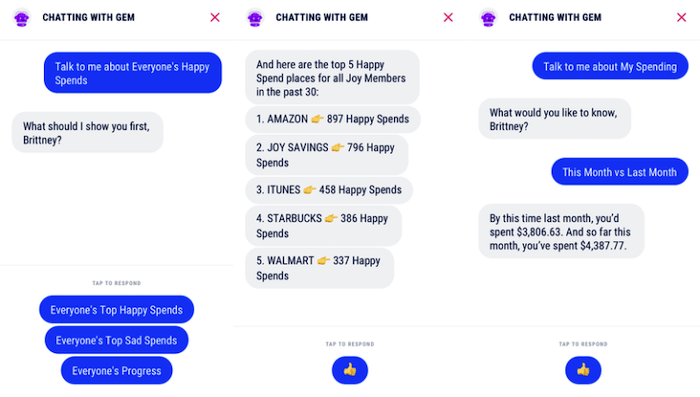

Meet Your Personalized Money Coach

Joy will set you up with a money coach, which is an artificially intelligent robot. Your money coach interacts with you based on your money personality– encouraging you to do better, presenting goals, celebrating victories, and even punctuation, slang and emoji.

You chat with your coach whenever you want. The topics and responses are limited to the information you’ll need to use the app, but your coach can also give you reports on how you’re doing with your spending or saving (more on that below).

See Your Progress

Joy allows you to see how your budgeting and savings have progressed over time. All you need to do is ask your money coach how much you’ve spent this month compared to last month, how your happy spends compare with sad spends, or how you’re doing with your savings habits compared with other people with the same money personality, and much more.

|

|

Bottom Line

Joy is a great option if you aren’t in tune with your spending habits. The app helps you take inventory of your finances, recognize how you spend, and connect it all with your emotions. So you can manage your money better. Who knows? Maybe you’ll get some joy out of it as well!

If you’re looking for more money management apps or ways to save money then be sure to check out more posts on HMB!

(Click the button above to learn more about Joy)

Leave a Reply