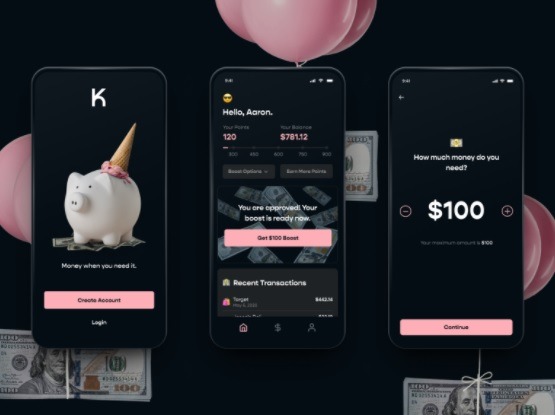

Klover is a cash advance provider that will loan you up to $250 between paychecks. This helps if you are a little short on cash, plus they don’t run any credit checks. Additionally, there is no paperwork, no interest, and no hidden fees. Continue reading to learn more about Klover.

See the best credit repair services here.

Klover Features

Klover gives you free access to your wages early, along with tools to help you stay financially stable. They’re able to provide complimentary products and services by using your data with your permission. Registering for an account is quick and easy, without any complicated paperwork or credit checks. Here’s how it works:

- Sign up. Tell Klover a little about yourself, link your bank account and verify your paycheck. They’ll never check your credit.

- Data opt-in. Your data is your asset. Opt-in to the Truth in Data agreement to use Klover’s suite of financial products. Don’t worry, your data is secured by 256-bit encryption.

- Access to cash and tools. Your Klover account gives you tools to improve your financial health and access cash whenever you need to. No questions asked.

We like that Klover:

Gives you fast cash advances. Get extra cash before payday in seconds, with no credit check, no interest and no hidden fees.

Let’s you track your spending. View your monthly spending by category and analyze your cashflow with the Money In – Money Out tool.

Let’s you earn points. Earn rewards for extra boost amounts by checking your spending, saving money and scanning receipts. You can even use your points for a chance to win big with Klover’s daily sweepstakes.

Klover Fees

Klover is free to use. In return for their services, the company uses your custom profile to show you relevant offers in the form of ads, to earn or save with their partners and to gather anonymous market research.

Klover does charge an Express Fee for expedited disbursement of a Balance Boost, which depends on the amount:

| BALANCE BOOST AMOUNT | EXPRESS FEE |

| Up to $100 | $9.99 |

| Up to $50 | $7.49 |

| Up to $25 | $2.99 |

| Up to $10 | $1.99 |

Klover Limitations

Before you register for a free Klover account, keep the following in mind:

- If you only recently started a new job, you’ll need to wait to apply with Klover. They require at least three consistent direct deposits within the past two months, with no gaps in pay with the same employer. Once you meet these requirements, you can sign up with Klover and request a cash advance.

- Klover uses your data. It’s encrypted and anonymous. If you’re still uncomfortable with sharing your information, then you’ll want to look for cash advances elsewhere.

Current Klover Promotions

Get Up To $250 Between Paychecks

Get Up To $250 Between Paychecks!

Klover is offering customers a promotion to get Up To $250 Between Paychecks!

We currently do not have a referral link, however feel free to leave yours in the comment section below.

- Promotion: Get Up To $250 Between Paychecks

- Expiration: Limited time offer

- Availability: Online at Klover

- How to get it: Sign up for a Klover account and begin getting a cash advance!

- Terms & Conditions: Terms & Conditions apply.

(Click here to learn more)

|

|

Bottom Line

Klover is a quick and easy way to get up to $250 between paychecks if you are a little short on money. There is no credit check, no interest, and no hidden fees. Just allow Klover to share your data. If you would like to try it out, then visit their website now!

Another option is OppLoans, in which they offer short-term installment loans up to $4,000 with no credit check.

Hey! I’ve been using Klover to get free cash advances. Try it using my code to get up to $100 in free cash advance.

https://cash.klover.app/PuAe/invite?code=a6dfca4d2c9cc9de7dde65893d7e777328007bad