If you received an automated call to your cell phone from Department Stores National Bank and/or FDS Bank for debt collection purposes regarding a Macy’s and/or Bloomingdale’s credit card account between 9/3/2009 and 7/22/2015, you may be eligible for a payment of up to $750 from the Macy’s & Bloomingdale’s Credit Card TCPA Class Action Lawsuit. Apparently, the debt collection companies were placing calls to cell phones using an auto dialer and/or prerecorded message without first obtaining consent from the call recipient. The defendants deny any wrongdoing but have agreed to settle a total of $12.5 million in cash payments to Class Members who submit timely and valid claims.

If you received an automated call to your cell phone from Department Stores National Bank and/or FDS Bank for debt collection purposes regarding a Macy’s and/or Bloomingdale’s credit card account between 9/3/2009 and 7/22/2015, you may be eligible for a payment of up to $750 from the Macy’s & Bloomingdale’s Credit Card TCPA Class Action Lawsuit. Apparently, the debt collection companies were placing calls to cell phones using an auto dialer and/or prerecorded message without first obtaining consent from the call recipient. The defendants deny any wrongdoing but have agreed to settle a total of $12.5 million in cash payments to Class Members who submit timely and valid claims.

| BMO Bank Checking: Open a new BMO Smart Money Checking Account and get a $350 cash bonus* when you have a total of at least $4,000 in qualifying direct deposits within the first 90 days. Learn More---BMO Checking Review *Conditions Apply. Accounts are subject to approval and available in the U.S. by BMO Bank N.A. Member FDIC. $4,000 in qualifying direct deposits within 90 days of account opening. |

| Chase Ink Business Unlimited® Credit Card: New cardholders can enjoy a welcome offer of $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. Click here to learn how to apply--- Review |

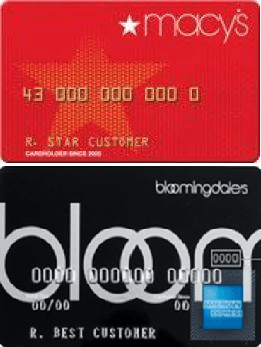

Macy’s Card TCPA Class Action Lawsuit:

- Macy’s & Bloomingdale’s Credit Card TCPA Claim Form

- Claim Form Deadline: 12/29/2015

- Who’s Eligible: Anyone in the nation who has received a prerecorded call from Department Stores National Bank and/or FDS Bank regarding debt collection purposes in connection with a Macy’s and/or Bloomingdale’s credit card account. If this kind of call was made on your cellular telephone number at any time on or after 9/3/2009 through 7/22/2015, you are an eligible class member.

- Estimated Amount: Up to $750

- Proof of Purchase: N/A

- Case Name & Number: Ameer A. Hashw v. Department Stores National Bank and FDS Bank, Case No. 0:13-cv-00727-RHK-BRT, in the U.S. District Court for the District of Minnesota

How to File a Claim:

- Head to the Macy’s & Bloomingdale’s Credit Card TCPA Claim Form

- To submit a Claim Form online, login using your Class Member ID number. Your Class Member ID number is in the upper right hand corner of the notice you received.

- If you did not receive a notice and believe that you are a class member of this case, use the Generic Claim Form.

- If you’re filing a Generic Claim Form, you will need to enter your first and last name, address, and phone number that was involved in the class action lawsuit. You will also need to provide a digital signature.

- File your claim by 12/29/2015 if you want to be included in the Macy’s & Bloomingdale’s Credit Card TCPA Settlement.

Bottom Line:

If you receive a prerecorded call regarding debt collection for a Macy’s or Bloomingdale’s credit card between 9/3/2009 and 7/22/2015, you may be able to make a claim and get up to $750 cash from the Macy’s & Bloomingdale’s Credit Card TCPA Class Action Lawsuit. If you think you qualify for this class action lawsuit, just file a claim by 12/29/2015. You can also check out the entire list of Class Action Lawsuit Settlements from HMB!

The Chase Sapphire Preferred® Card offers 100,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. You'll earn: • 5x on travel purchased through Chase TravelSM • 3x on dining, select streaming services and online groceries • 2x on all other travel purchases • 1x on all other purchases • $50 Annual Chase Travel Hotel Credit • Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027. Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase TravelSM This card carries a $95 annual fee. |

They’re still at it.

I’ve just started receiving the same type of calls. Interesting twist, though. My Bloomingdale’s card has had a $0 balance for over year. I haven’t used it either. I’m seeing multiple reports online of phantom charges showing up people’s credit cards, and Bloomingdale’s failing to do anything about it.

They never learn.

I am very, VERY happy with this Law suit. Last year on November 2014 I receive many calls from Debt Collection. This was a night mare!!!! I called macy’s customer Service many time and they automatically transfer me to Debt Collection. They didn’t want to listen the true only I was treated as a theft and they screamed to me and hung up the phone. After I went to Macy’s at Valley Fair, Santa Clara Ca; and Talk with the Manager and explain him the problem and show them all the receipts that I had. The Manager called them and explain them the reason I didn’t pay my bill was because I had credit (money in Macy’s account) even that they don’t want to recognize and force me to pay late payment plus $25 at that moment in the store to open my account again because my Account was in Debt Collection, the Manager was in shock!!! He told me never ever he hear something like this!!! Curious the bill was lower than $200.00 that I had in Macy”s Account and they will fix it the follow cycle!!! For this reason I am very happy with this action! God takes but not forgotten!