Available nationwide, find the latest Marcus by Goldman Sachs Savings account bonuses and promotions here.

Continue reading below to learn everything you need to know about Marcus by Goldman Sachs.

About Marcus by Goldman Sachs Savings Review

This bank was established in 1990 and renamed in 2017. Marcus by Goldman Sachs is owned by the Goldman Sachs Group, Inc., a multinational firm founded in 1869 and headquartered in New York, NY. This bank is an online bank available nationwide.

With such a great APY rate you can earn big! They are committed to offering efficient banking products with personal customer service.

I’ll review Marcus by Goldman Sachs Savings below.

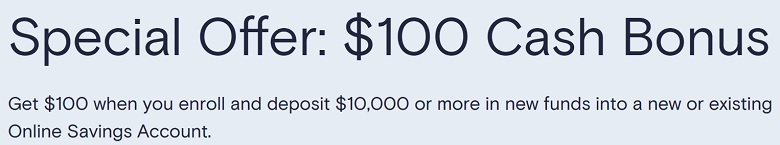

Marcus by Goldman Sachs $100 Savings Bonus

Marcus by Goldman Sachs is offering new or existing customers a chance to earn a $100 bonus when you deposit $10,000 in new funds towards your savings account.

(Offer expires 02/15/2023)

| AlumniFi Credit Union Savings (4.75% APY) | SoFi Checking & Savings ($325 Bonus + 3.80% APY) |

| Upgrade Premier Savings (4.15% APY) | Discover® Bank Savings (Up to $200 Bonus + 3.70% APY) |

| CIT Bank Platinum Savings ($225 or $300 Bonus + 4.10% APY) | Harborstone Credit Union Money Market (4.30% APY) |

| FVCbank Advantage Direct Savings (4.55% APY) | Live Oak Bank Savings ($300 Bonus + 4.20% APY) |

How to Earn Bonus

- Enroll for the offer.

- Current Customers: Log in and enroll.

- New Customers: Open an account and enroll.

- After enrolling, deposit $10,000 or more in new funds within 10 calendar days of enrollment. Maintain at least $10,000 of those new funds, plus your existing balance as of 12 am ET on the day you enroll, in your account for 90 consecutive days after the 10-day Funding Period.

- Receive $100 into your account within 14 days after you fulfill the bonus requirements.

- Offer valid from 1/18/23 to 2/15/23 (“the Offer Period”).

- To qualify for the $100 Cash Bonus (the “Offer”), you must enroll a Marcus Online Savings Account (“Account”) in this Offer at https://www.marcus.com/us/en/savings/osa-savingsbonus or by calling Marcus at 1-855-730-SAVE (1-855-730-7283) by 11:59 pm ET on 2/15/23. Upon successful enrollment, you will receive a confirmation of your enrollment via email or U.S. mail.

- After enrolling, you must deposit $10,000 or more in new funds from an external account into your Account within 10 calendar days of enrollment (the “Funding Period”). The Account balance plus a minimum of $10,000 in new funds (the “Required Dollar Amount”) must be maintained in your Account for 90 consecutive days from the end of the Funding Period. The Account balance is based on the starting current balance reflected on your account at 12 am ET the day you enroll. Once the Funding Period has ended, your Account balance may not drop below the Required Dollar Amount at any point until after the 90 consecutive days have passed. You may make multiple deposits within the Funding Period to reach the Required Dollar Amount. Internal transfers do not count for purposes of this Offer.

- If you choose to enroll a different Marcus Online Savings Account in this Offer, you must deposit $10,000 or more in new funds from an external account into the newly enrolled Account within 10 calendar days of enrollment in this Offer, even if you reached the Required Dollar Amount in a previously enrolled account.

- The $100 bonus will be deposited into your enrolled Account within 14 calendar days after fulfilling the above requirements. To receive your bonus, your Account must be open and in good standing at the time the bonus is deposited in your Account. The bonus will be treated as interest for tax reporting purposes.

- Offer available to new and existing customers. Each customer is limited to one cash bonus under this Offer. This Offer can only be applied once to an account. If an Account has multiple owners, the Account is limited to being enrolled for this Offer under only one of the Account owners and receiving only one cash bonus. Remaining Account owners may be eligible to use another eligible Account to enroll in this Offer. This Offer may be combined with other promotional offers available to Marcus Online Savings Account customers.

How To Waive Monthly Fees

- Marcus Online Savings: None

|

|

Bottom Line

If you are interested in earning a high return on your funds, you should consider Marcus by Goldman Sachs and take advantage of their great APY rate.

Marcus by Goldman Sachs also offers a competitive interest rate, see our review to learn more.

For more bank offers, see the complete list of Best Bank Rates!

Check back often to see the latest info on Marcus by Goldman High-Yield Online Savings.

Note: Interested in Bank Bonuses? See our favorite banks including HSBC Bank, Chase Bank, Huntington Bank, Discover Bank, TD Bank, or CIT Bank.

Below two offers can be stacked making it 8.6% APY for 3 months

Offer 1: I’m here to share a Marcus Online Savings referral link for 4.60% APY (3.50% APY + 1% + 0.1 % thro free swagbucks AARP membership Bonus APY for 3 Months).

Referral Link: https://www.marcus.com/share/RAM-FJL-FN8G

Some additional benefits you will get:

Marcus Savings is FDIC insured (up to 250k)

There is no minimum deposit or monthly/transfer fees.

Great product experience

Once you sign up, you can also refer people with your link for another +3 months of +1% per referral, up to 5 per calendar year. Your friend will also receive +3 months of +1%.

Offer 2: New or existing Marcus by Goldman Sachs customers can enroll to be eligible for $100 bonus when depositing $10,000 in new funds within 10 days of enrollment (Enroll by 2/15/2023) and maintaining those funds plus your current balance for 90 consecutive days after the enrollment period . Link: https://www.marcus.com/us/en/savings/osa-savingsbonus

Thank you

Great! got it.