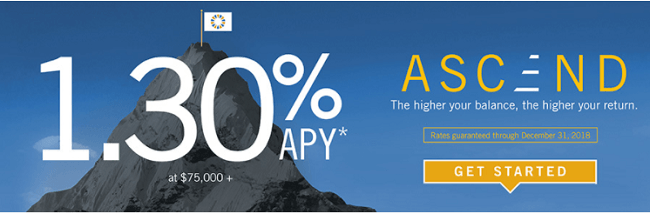

Available for residents nationwide, Mcgraw-Hill Credit Union is currently offering a great promotion for limited time only. Take advantage of their newest Ascend Account designed to give you a market-leading return and complete account accessibility—all with no hidden fees or activity requirements. You are guaranteed to earn the peak rate up to 1.30% APY until December 31, 2018! Members can enjoy benefits like no monthly service fees, low minimum deposit, no activity requirements or stipulations and have complete account access. What’s even better is that your funds are federally insured up to $250,000 and backed by NCUA so your money is in good hand.

Available for residents nationwide, Mcgraw-Hill Credit Union is currently offering a great promotion for limited time only. Take advantage of their newest Ascend Account designed to give you a market-leading return and complete account accessibility—all with no hidden fees or activity requirements. You are guaranteed to earn the peak rate up to 1.30% APY until December 31, 2018! Members can enjoy benefits like no monthly service fees, low minimum deposit, no activity requirements or stipulations and have complete account access. What’s even better is that your funds are federally insured up to $250,000 and backed by NCUA so your money is in good hand.

Eligibility: Membership in McGraw-Hill Federal Credit Union is open to anyone through a membership in VOICE Foundation (one-time donation of $10) and is also open to employees of McGraw-Hill Companies in New York City and over 120 other Select Employer Groups. View more details at the Individual Membership Application

|

|

McGraw Hill FCU Ascend Account Info:

- Apply now

- Account Type: Money Market Ascend Account

- Interest Rate: 1.30% APY

- Minimum Balance: $75,000

- Maximum Balance: $500,000

- Availability: Nationwide

- Expiration Date: 12/31/2018

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown, let us know.

- Opening Deposit Requirement: $5,000 min to earn interest

- Additional Requirements: Funds must be deposited with the credit union between 3/1/2017 and 12/31/2018 to earn promotional rate.

- Monthly Fee: $25 fee if balance drops below 5k

- Early Termination Fee: $25

- Insured: NCUA

Ascend Account Tiered Rates:

| APY Rate | Deposit Amount |

|---|---|

| 1.00% APY | $5,000 to $19,999.99 |

| 1.10% APY | $20,000 to $74,999.99 |

| 1.30% APY | $75,000+ (Maximum deposit of $500,000) |

Why You Should Sign Up for this Account:

- No monthly service fees

- Low minimum deposit to get started

- No activity requirments or stipulations

- Complete account accessibility

Bottom Line:

If you are currently looking for a reliable place to stash your fund while earning a nice interest return, then you should look into McGraw Hill Federal Credit Union. Simply contact their Member Care Team to get your account setup. Once you become a member, don’t forget to take advantage of the valuable member benefits such as competitive loan rates, massive no-surcharge ATM network, plus much more. Please feel free to share your banking experience by commenting below. You ca also find all the Best Bank Rates from our exclusive list nationwide!

The Hilton Honors American Express Business Card has a welcome offer of 175,000 Hilton Honors Bonus Points after you spend $8,000 in purchases on the Hilton Honors Business Card within the first six months of Card Membership. Offer Ends 4/29/2025. You'll earn: • Earn 12X Hilton Honors Bonus Points on eligible Hilton purchases. • Earn 5X Hilton Honors Bonus Points on other purchases made using the Hilton Honors Business Card on the first $100,000 in purchases each calendar year, 3X points thereafter. • Enjoy up to $240 back each year (in the form of statement credit) for eligible purchases made directly with Hilton. • Enjoy complimentary National Car Rental® Emerald Club Executive® status. Enrollment in the complimentary Emerald Club program is required. Terms apply. • Enjoy complimentary Hilton Honors Gold Status with your Hilton Honors Business Card. With Hilton Honors Gold status, you can enjoy benefits at hotels and resorts within the Hilton Portfolio. As a Gold member, earn an 80% Bonus on all Base Points you earn on every stay. In addition, you can enjoy complimentary Hilton Honors Gold Status with your Hilton Honors Business Card. This card has a $195 annual fee. (See Rates & Fees) Terms & Limitations Apply. |

Left a soft pull for their money market account fyi