If you are from California, this new CA SB 250 bill might be of interest to you. The new California law – Senate Bill 250 by Senator Ellen Corbett (D – San Leandro), gives consumers the right to cash in any unused or used gift card when the balance is less than ten dollars.

You are wondering, “okay..how is this helpful?.”

- Imagine you have the Citi CashReturns Card. The card gives you 5% Cash Back on everything for the first 3 months. Buy gift cards less than $10, and then cash it. You are making 5% cash back for every $10 or less. Imagine buying 1000 – $9.99 gift card (I’m not sure if that is possible) and then get 5% cash back on that. I’m pretty sure this is not worth anybody time. The time you spent doing this prob equals to minimum wage. But hey, crazy people out there.

- You got a $100 gift card as a present. You want to convert it to cash instead. Go buy 12 items worth $8 on separate receipt. Then return the items for 12 separate gift cards of $8 each, and then cash it. Again, very time consuming but doable.

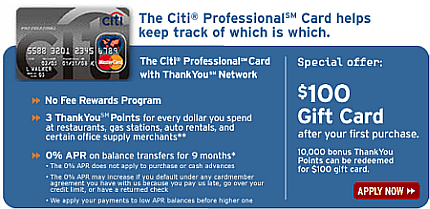

- You have a lot of Thank You Points, so use it to get gift cards and follow step #2.

- You go on Ebay and buy every gift card less than $10. I’m sure you are buying less than the face value, then cash the gift cards.

- Join program like Deal Pass and buy gift cards for 20% off. Then cash out by following step #2.

- If you use credit cards with 0% APR on purchases, you can buy gift cards to cash out and then use the money to put into 5% savings account. Of course, pay minimum until 0% promo is over.

Maybe I should send Senator Ellen Corbett #1 through 6 about these concepts. I guess the main reason why the law was needed because people were throwing away gift cards with low amount, hence stores were making billions of dollars with unused gift cards. $10 was the ideal number because I can’t imagine anyone going through the trouble I listed above. Nothing illegal, but just loopholes to talk about…haha.. Hustler talk..blah blah…

I have had gift cards from several retailers. never had a problem with losing the valu if not used right away. except with walmart. I have had a cashier say there was nothing on the card and pretend to throw it away. suggestion if you get a g card from walmart spend it immediately.YANKEE BAKER

Absolutely an amazing wealth of bankable information. Here’s a concern. A company called CreditCardBuilders.com, boast of a “Method” in which credit cards can be completely drawn down upon absent of any transactional fee(s) … I suspect this method may less than advertised and lack the $3500.00 Plan Cost to evaluate it. CCB.com claims to be knowledgeable of an institution(s) that will affect this transaction.

I sure would appreciate anyone who knows someone who is a current or past CCB.com member that knows or will share this the name of the institution and “Method” …

Would also appreciate any tips on Cash Back Reward Debit Cards and credit repair services that are extremely effective for personal / business credit.

Thank you in advance and patiently awaiting any response.

Just a quick FYI.

Generally speaking retailers do not make a bunch of money by holding the sub $10 amounts.

Under GAAP accounting rules (which govern all US public Companies)Gift Cards are a liability, not an asset.

They cannot charge off that amount for a long time, up to 7 years!

So why do they do it?

It ties up your “open to buy $$$.” If you get a Target gift card, your have to shop at Target to redeeem it!

One thing to know about gift cards. Retailers generally do NOT make billions on the leftovers a lot of times because according to GAAP accounting rules, Gift Cards are a liability, not an asset. Busineses that are GAPP compliant (all public ones – hopefully!) cannot take the little extra amount for years off of their books for years and years.

This rule will help some businesses since small cash amounts are at least portable and will generally be spent as redeemed.

So why would retailers want these things then?

It ties up your “open to buy” dollars with said retailer. If you give someone a Target gift card…guess where they will shop, Target; and generally go over the card amount.