Putting your money in a certificate of deposit (CD) ensures you can earn a high amount of interest as long as you keep your funds there for a long time.

A growing number of banks have begun offering no-penalty CDs, which are breakable CDs that effectively give the best of both worlds (higher CD rates and no long term commitment).

If you are thinking about investing in a CD, check out no-penalty CDs to give you some flexibility.

View our list of the best CD rates. We recommend you learning more about CIT Bank’s No Penalty CD!

What Is A No-Penalty CD?

No-penalty CDs aren’t that different from your average CD. They both offer high interest rates as long as you leave your money on deposit for a certain period of time.

However, no-penalty CDs allow you to break your commitment and pull money out early if you need to. This gives the consumer a big advantage because early withdrawal penalties from traditional CDs can be expensive.

What Happens If You Withdraw Early?

Generally, certificates of deposit are issued for specific terms, or periods of time, that can range from just a few months to five years. For example, if you sign up for a one year CD, you are expected to keep your money in that CD for the entire year or else you will be charged a fee for withdrawing that money early.

With a no-penalty CD, you have access to your funds before the term is up without paying any fees. This lack of a penalty can really help.

No-Penalty CD Terms

| Bank | CD Name | CD Term (in months) | Traditional / Online |

| Marcus by Goldman Sachs | No Penalty CD | 7 | Online |

| Ally Bank | No Penalty CD | 11 | Online |

| CIT Bank | No Penalty CD | 11 | Online |

| Marcus by Goldman Sachs | No Penalty CD | 11 | Online |

| Citibank | No Penalty CD | 12 | Traditional |

| S and T Bank | Penalty Free CD | 12 | Traditional |

| Marcus by Goldman Sachs | No Penalty CD | 13 | Online |

| Old Line Bank | No Penalty CD | 13 | Traditional |

| Ridgewood Bank | Penalty Free CD | 15 | Traditional |

How To Compare No-Penalty CDs

As you can see from the table above, no-penalty CDs come in all shapes and sizes. Rates change frequently too, so that will affect your decision making process. So how do you compare them to each other?

There are two characteristics that are generally true of these no-penalty CDs:

- They generally have fairly short terms. As mentioned above, a traditional CD can last up to 5 years whereas the longest no-penalty CD lasts only as long as 15 months. What this means is a no-penalty CD cannot truly replace a long term CD, but it can be a good alternative to CDs that range from 6 months to the 1 year range.

- No-penalty CDs often have irregular time periods, such as 7, 11 or 13 months. This may seem to make them harder to compare to the standard CD lengths of 3 months, 6 months or a year until you remember that you can break into no-penalty CDs at any time. That means you can compare them to any CD of similar length or shorter.

Lean toward long-term, no-penalty CDs

With all of this being said, your best bet is to look at no-penalty CDs with the longest term you can find. This way you can earn the highest interest rates while also being able to break out of the CD anytime you want without any fees.

Comparing no-penalty CDs with conventional CDs

- Consider yield. This is an important factor to take into account. For example, if you wanted a 1 year CD, consider the the slightly longer 13 or 15 month options if they offer the best yield. You can always shorten the term to suit your needs in the future.

- Consider how likely you are to break into a conventional CD. If you know you’re going to need the money sooner rather than later, then this is a great option for you. The earlier you might break into your CD, the greater the advantage of a no-penalty CD.

What Happens If You Withdraw Early: Penalty vs. No-Penalty CDs

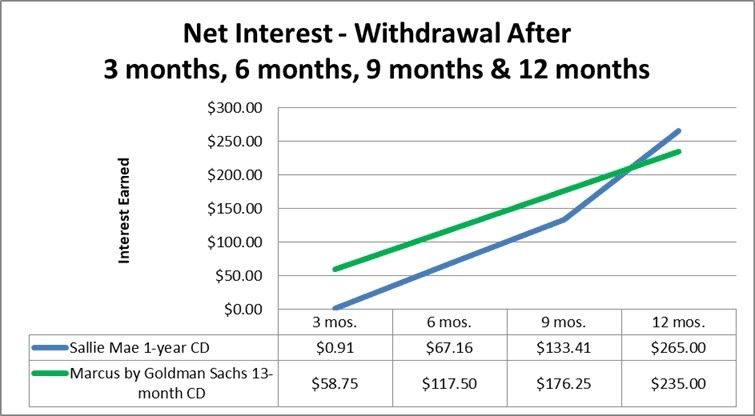

To help you visualize, we have a chart that shows two high yield CDs with about a one year term length. The Sallie Mae CD has a higher yield but an early withdrawal penalty, while the Marcus by Goldman Sachs CD has no penalty.

The table shows how much interest you would earn net of the early withdrawal penalty if you took out your money in less than one year and if you kept it in for the full year:

Although it has a slightly lower yield, the Marcus by Goldman Sachs CD has an advantage if you take the money out in less than a year. Whereas for Sallie Mae, you would have to keep the money in for the full term for it to be more worthwhile than the Goldman Sachs CD.

This kind of choice will come down to how certain you are that you will be able to leave your money in the CD for the full term.

Why Would You Break a CD?

If you can earn more interest if you held your money in a CD longer, why would you break it?

Well, the answer is simple, emergencies can arise anytime and will require you to spend your money. Additionally, if you find a better interest rate from the current bank or an opposing bank, then you would want to break your CD.

Predictable needs

Predictable needs can relate to putting a down payment on a home in six months. If you believe you won’t need your money anytime soon, consider a longer term CD because:

- The extra interest you would earn in six months exceeds the penalty you would pay for breaking the CD, or

- The CD had no early withdrawal penalty

Unpredictable needs

As in most financial situations, many needs that will come up will be unpredictable. That’s why it’s important that you consider how long you can commit to a CD and how big a penalty you would pay.

If there is a low chance of an unexpected financial need arising, you can confidently commit to a longer term. Also, if the certificate of deposit has no early withdrawal penalty, there is no downside to breaking it early if you have to.

That just leaves the other type of situation when you might break a CD – for example, when you have been shopping for CD rates and you know there’s a better rate elsewhere.

When To Break a CD for Higher Rates

Let’s say you decide to get a one year CD and, in a couple of months, you find that CD rates have risen. What do you do?

If you have a no penalty CD, all you have to do is break it early. You won’t be charged any early withdrawals fees.

If interest rates do rise and you have a CD with an early withdrawal penalty, the answer is more complicated:

- You have to calculate how much extra interest you could earn in a higher yielding CD over the remaining term of your current CD, and then compare that to the penalty you would pay if you broke into your CD early.

Only during period of sharply rising interest rates will it make sense to break your CD to try and get one of those CDs. However, if you have no penalty CD, you have the option of making that switch even for more normal interest-rate increases.

With no-penalty CDs, it is still important to make sure they offer a fairly competitive interest rate. If that is the case, then the flexibility they give you in case of unexpected needs or rising interest rates give them a special advantage over conventional CDs.

What Are No Penalty CDs Best For?

In summary, here are a couple of examples of good uses for a no penalty CD:

Emergency funds

As mentioned above, emergency funds are designed to help you out when unexpected expenses come up.

Expenses with uncertain timing

Suppose you are shopping for a house. You could put your down payment money in a no-penalty CD even before you know when it will be needed, since there is no cost to accessing the money at any time.

Rising interest-rate environments

If interest rates were to rise, being stuck in a traditional CD might hold you back because you won’t be able to earn the interest from that. With a no penalty CD, you will be able to advantage of rising interest rates by breaking your current CD.

|

|

Bottom Line

A no penalty CD can offer you great flexibility and get you the best interest rates as long as you’re not looking to store your money for a long period of time. No penalty CDs are best used for about a year to maximize the benefits.

In summary, if you don’t need your money soon, putting it in a traditional CD can offer you some pretty high interest rates. However, if you think you’ll need your money in the foreseeable future, then a no penalty CD will allow you to break it without any withdrawal fees.

For more posts like this, check out our list of bank guides here on HMB!

Looking for a more specific term CD? See the following lists below:

- Best 6-Month CD Rates

- Best 9-Month CD Rates

- Best 12-Month CD Rates

- Best 18-Month CD Rates

- Best 24-Month CD Rates

- Best 36-Month CD Rates

- Best 48-Month CD Rates

- Best 60-Month CD Rates

Leave a Reply