If you’re interested in learning more about CD rates, we have some information that might shook you. If you noticed normally CD rates are spread out in 6 months, 12 months, then afterwards it’s spread out to years. So the pattern usually is 6 months, 12 months, 24 months, 36 months, and can go up to 60 months. What we’ve been noticing lately is that there’s a correlated trend with odd months that might actually be providing better CD rates than the standard ones that are issued periodically. These odd CD rates are considerably higher than what you would expect from the standard CD rates of the yearly rates.

If you’re interested in learning more about CD rates, we have some information that might shook you. If you noticed normally CD rates are spread out in 6 months, 12 months, then afterwards it’s spread out to years. So the pattern usually is 6 months, 12 months, 24 months, 36 months, and can go up to 60 months. What we’ve been noticing lately is that there’s a correlated trend with odd months that might actually be providing better CD rates than the standard ones that are issued periodically. These odd CD rates are considerably higher than what you would expect from the standard CD rates of the yearly rates.

If you’re still mind boggled on this information, we have a extensive list of the Best CD Rates that you can refer to and compare, using your own judgement and information.

How Common Are Odd CD Rates?

It’s not surprising that Odd CD Rates are relatively higher and probably more popular. If you were to pull up a graph that shows the CD rates among some of the banks you’re interested, you’ll notice that the odd ones are closely similar to the standard ones. For standard CD Rates, we expect to be every 12 months, so anything outside that time frame is considered odd. These odd CD rates are shown to be high, meaning, there’s a strategy being utilized to capture consumer with greater rates.

Are Banks and Credit Unions Similar?

So far from our research, we can see that physical banks are more likely to provide odd CD rates then online banks. Though credit union banks do offer rates similar to a physical bank, but they’re not exactly the same. There is a mere difference. Though online banks provide more stable standard rates, there was a significant increase in their rates yearly.

Should You Go For An Odd CD Rate?

Not everyone would like to focus on a standard CD rate due to the inflexibility. The Odd CD Rates allow customers to be even more flexible, meaning they can control more of their savings. If you needed money within 9 months, the Odd CD Rates come in handy because you can grab it outside of the standard rates. Sometimes people don’t want to deal with the standard yearly rates, which is why people opt for the odd ones, which can be a reason why Odd CD Rates are so favorable.

Bottom Line

Now that you have a little bit more information on CD rates, you can form your own opinion and decide which rates are the best for you. If you are okay with retrieving money yearly, then the normal standard rates are favorable for you. But if you think you can’t handle yourself and need money, lets say, 13 months or even 7 months, the Odd CD rates are best for you. Odd CD Rates provide more flexibility and control over your savings, compared to having a standard CD rate. To understand more and comprehend rates, be sure to check out our listings of Best CD Rates that you can overlook.

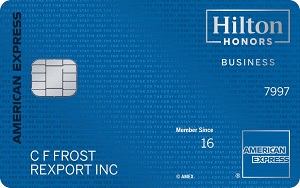

The Hilton Honors American Express Business Card has a welcome offer of 175,000 Hilton Honors Bonus Points after you spend $8,000 in purchases on the Hilton Honors Business Card within the first six months of Card Membership. Offer Ends 4/29/2025. You'll earn: • Earn 12X Hilton Honors Bonus Points on eligible Hilton purchases. • Earn 5X Hilton Honors Bonus Points on other purchases made using the Hilton Honors Business Card on the first $100,000 in purchases each calendar year, 3X points thereafter. • Enjoy up to $240 back each year (in the form of statement credit) for eligible purchases made directly with Hilton. • Enjoy complimentary National Car Rental® Emerald Club Executive® status. Enrollment in the complimentary Emerald Club program is required. Terms apply. • Enjoy complimentary Hilton Honors Gold Status with your Hilton Honors Business Card. With Hilton Honors Gold status, you can enjoy benefits at hotels and resorts within the Hilton Portfolio. As a Gold member, earn an 80% Bonus on all Base Points you earn on every stay. In addition, you can enjoy complimentary Hilton Honors Gold Status with your Hilton Honors Business Card. This card has a $195 annual fee. (See Rates & Fees) Terms & Limitations Apply. |

Leave a Reply