Have you been exploring bank account options and found that you would like to open a BB&T Bank Account, but don’t know how? Well, we are here to help you out by listing the things you will need and describing different account options.

Have you been exploring bank account options and found that you would like to open a BB&T Bank Account, but don’t know how? Well, we are here to help you out by listing the things you will need and describing different account options.

BB&T Bank is highly known for its various products ranging from simple savings accounts to wealth management services. They have nearly 1,700 branches across 15 states so check to see if you have a physical location near you!

Read on to learn how you can open a BB&T Bank account.

How to Open a BB&T Account?

For BB&T, there are 3 main ways to open an account. It should be a quick and easy process as long as you know what you’re looking for in a banking product and have basic pieces of information with you.

1. Determine Which Bank Account You Want to Open

Not all bank accounts are the same. For example, a savings account is great for putting money away for an emergency, but it isn’t great if you need the money in the immediate future, such as for paying bills. Lucky for you, BB&T has multiple options for checking and savings accounts.

Checking Accounts

- BB&T Fundamentals

- Bright Banking

- Student Checking

- Senior Checking

- Elite Gold

Savings Accounts

- eSavings

- High Performance Money Market Account

- Investor’s Deposit Account

- Young Savers

Naturally, you might decide that you want to open multiple types of accounts. Having both a savings and checking account is very normal for many customers. This gives you multiple options for accounts that will give you more flexibility in your finances.

2. Gather Your Personal Information

In order to complete your application, BB&T will need some personal information from you. Before you start the signup process, make sure you have easy access to the following:

- Social Security number

- Date of birth

- Address

- Government-issued ID

- Your opening deposit

3. Apply Online or in Person

Once you’ve decided on the banking product that best suits your needs, it’s time to gather our personal identification and contact BB&T to get started.

If you live near a BB&T branch, which you can find using the bank’s locator, you can simply visit the branch in person and apply for an account.

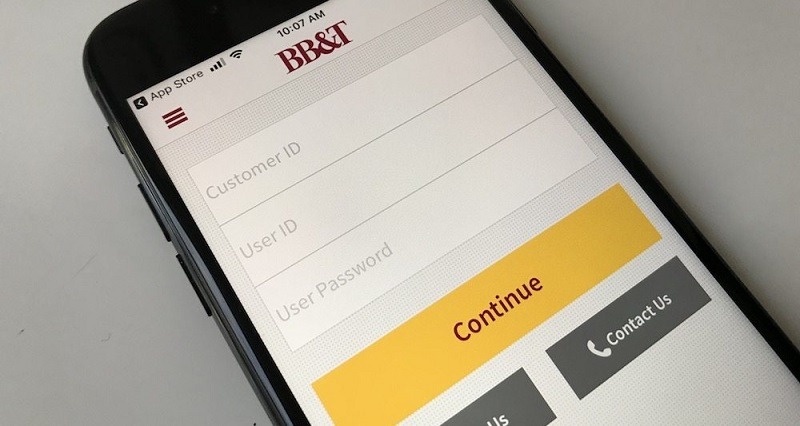

If you prefer to do your banking online, all you have to do is go to the BB&T homepage. All you have to do is scroll down to the drop-down menu and select “Open an account.” Select the account you want to start and click “Get started”.

What To Do If You Need Help From BB&T Customer Service

You might have questions or concerns about your account in the future. Contacting BB&T’s customer service department is easy to do. You can call BB&T at (800) BANK BBT — or (800) 226-5228 — for help by phone, or log into your account to send secure direct messages. And of course, visiting the nearest BB&T location is another option.

BB&T Account Fees and Features

Some of the things you should be looking out for as a new banking customer should be what the bank charges are and what it can offer you. Different accounts might have various fee structures that will affect you differently, and you want to be sure you’re getting the most out of your account by understanding everything that it comes with.

Checking Account Fees and Features

Different types of checking accounts offer different benefits, so make sure you review these options offered by BB&T before settling on your selection:

BB&T Checking Accounts at a Glance

| Fees and Features | BB&T Fundamentals | Bright Banking | Student Checking | Senior Checking | Elite Gold |

| Minimum opening deposit | $50 | $50 | $0 | $100 | $100 |

| Monthly service charge | $5 | $12 | $0 | $10 | $30 |

| Out-of-network ATM fee | $3 | $3 | $3 | $3 | $3 |

| Overdraft fee | $36 | $36 | $36 | $36 | $36 |

Savings Account Fees and Features

The right savings account can really boost your nest egg, so take some time to consider each of these accounts offered by BB&T:

BB&T Savings Accounts at a Glance

| Fees and Features | eSavings | High Performance Money Market Account | Investor’s Deposit Account | Young Savers |

| Minimum opening deposit | $0 | $100 | $10,000 | $0 |

| Monthly service charge | $0 | $12 | $15 | $0 |

| Out-of-network ATM fee | $0 | $0 | $0 | $0 |

| Overdraft fee | $36 | $36 | $36 | $36 |

| Annual percentage yield | 0.01% | 0.01% – 0.10% | 0.01% | N/A |

How To Avoid Unwanted Fees

The best way to avoid any unwanted fees that you might occur during your time with the bank is to keep yourself informed as to what’s happening. With your account opening, you should have access to the full fee schedule for any bank account you may sign up for. Take the time to review every potential fee that could be applied to your account is going to be the best possible way in avoiding them.

Monitoring and Protecting Your Bank Account

In today’s digital age, everything has transferred to the online world, and that includes crime. There are now more ways than ever to access your information and bank account, so it is up to you and your bank to make sure your account and assets are well protected.

- Take great caution before sharing any personal information, whether online, over the phone or in person

- Don’t log into secure sites while using an unfamiliar or unsecured Wi-Fi network

- Check your account regularly for any unfamiliar charges or withdrawals

- Don’t access your account from a shared computer

- Don’t open emails if you’re not familiar with the sender

You can also consult with representatives at BB&T for any suggestions they might have on keeping your account secure from hackers and scammers.

|

|

Bottom Line

Opening a BB&T Bank account is quick and easy with basic information and an initial deposit. All of these accounts have varying monthly fees and most offer comparatively high APY rates.

Learn more about BB&T Bank and keep up with the latest BB&T Bank Promotions!

Try it out and see how you like it! For more information on banking, check out all of our bank guides.

Leave a Reply