When it comes to a retirement plan, the whole idea of it is to save some money and save some more. Making contributions to your 401(k) or another similar retirement plan seems likes a no-brainer, but most Americans feel like they are not on the right track to meet their income goal come retirement.

When it comes to a retirement plan, the whole idea of it is to save some money and save some more. Making contributions to your 401(k) or another similar retirement plan seems likes a no-brainer, but most Americans feel like they are not on the right track to meet their income goal come retirement.

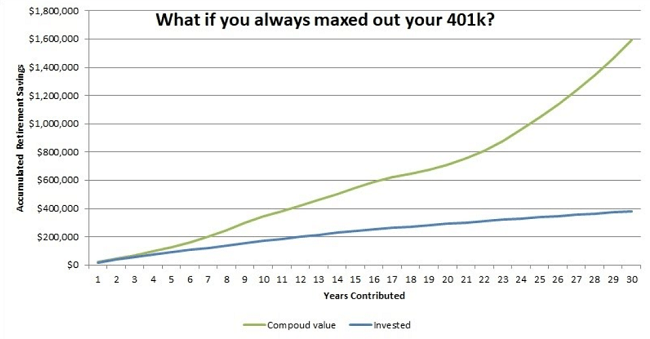

Most financial experts recommend savings around 10%-20% of your annual income in order to real the 80% income benchmark. Maxing out your 401(k) is the best way to guarantee a lavish retirement, but when should you/should not max your 401(k)?

| PROMOTIONAL LINK | OFFER | REVIEW |

| J.P. Morgan Self-Directed Investing | Up to $700 Cash | Review |

| TradeStation | $3500 Cash | Review |

| M1 Finance | Up to $2,000 Cash & free trades | Review |

| WeBull | 12 Free Stocks & free trades | Review |

| SoFi Invest | $25 Bonus and free trades | Review |

When You Should Maximize Contributions

A good rule of thumb is to contribute and match your company’s maximum contribution limit. There are situations though were going above and beyond on your contribution limit is required. In 2018, the maximum contribution limit was $18,500, and for those over 50 years old, it can be bumped up to $24,500.

Before you max out your 401(k) contributions, these are some benchmarks you should reach first:

- In the event of an emergency, you should have places at least 3 to 6 months of living expenses to the side.

- Eliminate any high interest loans. (Credit Card loans, car loans, etc.)

- If you are nearing retirement you have long-term care plans in place (LTC insurance, self-pay, etc.).

- You have adequate disability insurance coverage to protect you and your family if you miss work for six months or more.

- You are contributing the max amount possible towards your health savings account.

- You have adequate life insurance.

- You are on track to reach shorter-term financial life goals such as having a child, buying a home, or another major purchase.

- You have a formal estate plan including wills and other critical documents (living wills, health care power of attorney, trusts, etc.).

Of course when you consider maxing out your contributions, you must take your income into consideration. If you make around $50,000 a year, contributing $18,500 will take up 37% of your income. Unless your financial situation allows for you to contribute that much, reconsider maxing out.

The whole idea of planning for retirement is a balancing act. Unless you have the factors above in check, it’s not wise to jump in and max out your 401(k). Remember to pay off all your loans and have your emergency funds in check before you make the leap into maximizing your contributions. It may bite you in the back one day when you decide to max out your contributions without fully being prepared for it.

| BMO Bank Checking: Open a new BMO Smart Money Checking Account and get a $350 cash bonus* when you have a total of at least $4,000 in qualifying direct deposits within the first 90 days. Learn More---BMO Checking Review *Conditions Apply. Accounts are subject to approval and available in the U.S. by BMO Bank N.A. Member FDIC. $4,000 in qualifying direct deposits within 90 days of account opening. |

| Chase Ink Business Unlimited® Credit Card: New cardholders can enjoy a welcome offer of $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. Click here to learn how to apply--- Review |

Bottom Line

You always want to make sure your financial situation is in check and balanced before you consider maxing out your 401(k). Be sure that you’ve acquired most if not all of the benchmarks listed above for the most ideal situation.

If you find these posts informative and would like to know any other banking tips and tools, be sure to check out our other Bank Guides! We also have posts on the best Bank Bonuses, Saving Rates and Best Brokerage Bonuses!

Leave a Reply