SmartyPig is a personal finance site that is dedicated to helping people save money for specific goals. To find out if SmartyPig is right for you, continue reading the review below.

Following their slogan of “a simple, smart and secure way to save for a specific goal”, SmartyPig is not a bank, but rather an additional online savings tool to help you organize all you finances while earning interest.

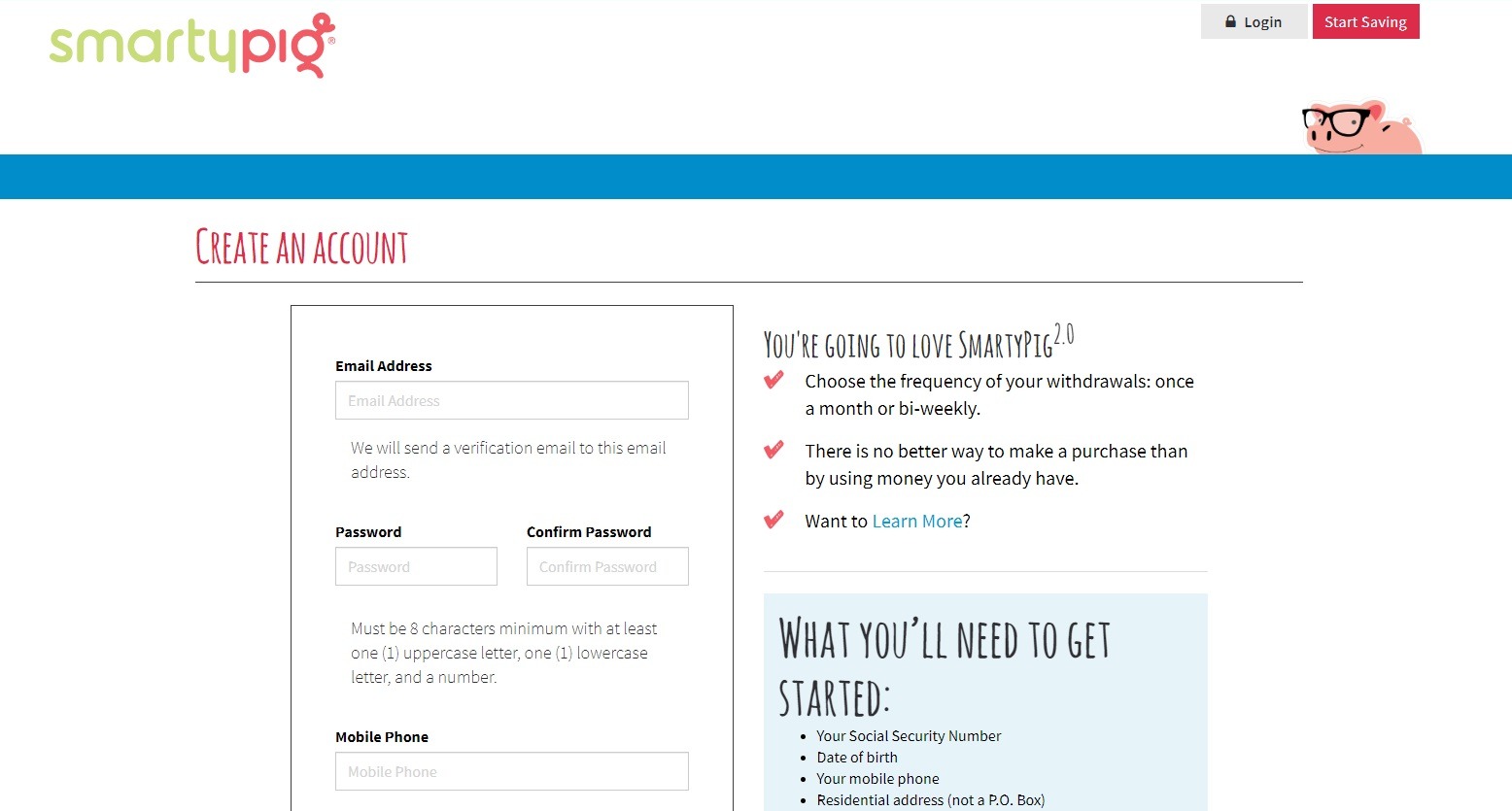

How To Open a SmartyPig Account

You can open a SmartyPig account if you are at least 18 years old and are a U.S. citizen. Down below are simple steps to opening a SmartyPig savings account.

- Navigate to SmartyPig’s website and sign up here.

- Create an account and provide the following info:

- Driver’s license number or state issued ID

- Social security number

- Home address

- E-mail address

- Date of birth

- Phone number

- Set up your savings goals from anywhere starting at $25 to $250,000

- Link an existing checking or savings account to your savings account

- Create an account and provide the following info:

Sign up for SmartyPig and start saving for your goals!

SmartyPig’s Top Features

- You can set up any kind of goals you want

- They have a bunch of options that will help you achieve your goals

- Deposit more money towards your goals any time you please

- Share your goals with your family and friends

- Track your savings progress

- Keep all your savings accounts in one place

- Redeem your funds through a retail debit card or bank account transfer

- They have a mobile app so you can access your account anytime, anywhere

- You can combine your SmartyPig savings account with other money management sites

Pros of Banking with SmartyPig

- You can fund and withdraw money from your SmartyPig account completely free of charge

- Opening a SmartyPig account is free

- You only need $25 to open a savings account

- You can make contributions to others to help them meet their goals

- Since SimplyPig is an online financing site, it earns higher interest than an actual bank. The general APY is 2.01%

- Interest is compounded daily so your money can continuously grow

- Accounts are FDIC insured up to $250,000.

- You can earn an additional 12% if you transfer your savings account money onto a retail card

- Utilize the “Tracking Account Visualizer” tool to take the guesswork out of savings

- You can give gift cards to anyone that would also like to start saving

Cons of Banking with SmartyPig

- If outsiders such as friends or family want to contribute to your account, it will cost you a 2.9% convenience fee

- Since SmartyPig isn’t a bank, you will need a separate checking or savings account to fund your SmartyPig account

- You have to be a U.S citizen to open an account

- It isn’t heavily implied, but SmartyPig encourages you to spend your retail card

- They are more concerned with you saving for emergency (e.g. a down payment) rather than long-term goals (e.g. starting a business)

Alternatives to SmartyPig

- CIT Bank: CIT Bank is an online bank that offers several different account options, and also has high APY for their savings, money market and CD accounts.

- Discover Bank: Discover Bank is an online nationwide bank that offers bonuses for their checking and savings accounts! You can earn cash back rewards when you open a checking account and generous bonuses for opening a savings one.

- Capital One 360: Capital One 360, you can bank fee-free with online and mobile checking that actually pays you back. Whether you’re looking for one of their 40,000 fee-free ATMs or a Capital One location–chances are they are right nearby.

Bottom Line

Overall, SmartyPig is not a bank but rather a personal finance site that aims to help you save for emergency goals. You can save for long-term goals, but it is encouraged that you utilize SmartyPig when you don’t want to keep up with a regular savings account.

You can, however, link your preexisting savings or checking account to double your savings, and others can contribute to your savings as well!

The interest is compounded daily like some online savings account, but for SmartyPig, you don’t have to worry about paying a monthly fee. A one time deposit of $25 to open a savings account is enough, but you do have to keep up with it to continue earning interest.

If you prefer to actually invest in a traditional bank or online bank, then be sure to check our full list of Best Bank Promotions for more options!

Leave a Reply