Check out the latest Tally bonuses, savings, and promotions here.

If you’ve never heard of Tally, it’s an app that lets you keep earning points and rewards on your credit cards without high interest rates and unnecessary fees. Tally manages all your cards in one place while making the right payment on time every month.

There are no fees to use the app, just download the app via iOS or Google Play Store for Android users. So keep reading below to see how you can earn bonuses when you sign up for the first time at Tally!

Tally Features

Tally is an app that bundles your debt from multiple credit cards, letting you make a single, smart payment every month. The app takes over your credit card bills, making sure you never miss a payment. It also determines the smartest way to pay off your debt using your Tally line of credit to save on interest across all your credit cards with higher APRs. To qualify for a credit line, the app takes into consideration your outstanding balances, interest rates, spending behavior, and credit score (minimum 660).

(Click the button to learn more)

If you want to make card payments yourself, choose the You Pay option. Tally will still send you reminders when your payment is due and how much you should pay towards each credit card. Other features include:

- Tally Credit Card Manager, a comprehensive dashboard that covers all your credit card balances to give you a snapshot of your overall debt.

- Tally Advisor, which uses built-in AI to analyze your credit card debt, spending habits, and financial goals to recommend a customized payoff plan that gets you out of debt in the shortest amount of time possible.

- A debt calculator that takes into consideration your credit card balances, APRs, credit score, and the payments you made in the past month, to determine the amount of interest you’ll spend on your credit cards.

- A late fee protection, which guarantees that you never miss any payments. Tally pays at least the minimum amount on all your credit cards two days before they’re due.

- A covid relief program to support members who experienced a loss of income due to the pandemic. You can postpone a credit line payment, but interest charges will still accrue on the balance. Tally will also halt payments to your credit cards, so you’ll need to make the payments yourself.

And if you have any questions or come across an issue, you can reach Tally customer support via email.

About Tally

Tally separates the burden of credit cards from the benefits. Tally believes lending should be fair, Annual Percentage Rate (APR) should be low and owning credit cards should be empowering. Where finance meets technology, wrapped up in a simple, elegant, incredibly powerful app.

(Apply Now at Tally)

Pay Off Your Credit Cards & Save Money with Tally

- Tally combines all your cards into a single payment at a lower interest rate.

- Once you qualify, Tally will analyze your cards and credit profile to find you an offer for a credit line. (FICO Score of 660+ to qualify)

- Tally will use your Tally credit line to pay your credit cards, helping you to save money on interest.

- Every month you’ll make one payment to Tally, no matter how many cards you have.

- Keep making your monthly Tally payments & they will keep paying down your credit card balances until you’re debt-free.

(Apply Now at Tally)

Tally Perks

Overcome your credit card debt! Tally can help pay your cards for you and save you money on interest. Get your time and money back with Tally.

Tally members, on average, save $5,300 in interest charges. Tally members, on average, pay down their cards twice as fast.

- Pay down debt faster

- Average lifetime savings of $5,300

- No more high APRs or late fees

(Apply Now at Tally)

How Tally Works

You save money immediately when Tally pays your high-interest credit cards. Tally combines all your cards into a single payment at a lower interest rate. Here’s how it works:

- Tally gives you a credit line. If you qualify, Tally analyzes your cards and credit profile to find the best offer. You need a FICO Score of 660 or higher to qualify.

- Tally pays your credit cards. Tally uses your Tally credit line to help you save money on interest. Their late fee protection guarantees you never worry about missed payments.

- You repay Tally every month. No matter how many cards you have, you only make one payment to Tally. Tally manage your cards so you don’t have to.

- Tally keeps saving you money. As you pay Tally back, they’re able to make more payments to your cards and pay down your balances until you’re debt-free.

Current Tally Promotions

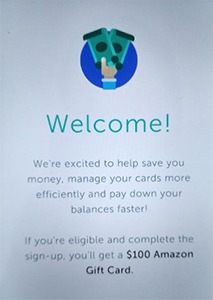

$100 Amazon Gift Card Referral Bonus

Get Amazon credit!

Tally is currently offering $100 Amazon gift card referral bonus when you sign up! You’ll need to add at least one card and have a minimum interest-bearing balance of $1,000 across all credit cards. If you have a referral link feel free to share it below for people to sign up with!

- Offer expiration: While supplies last

- What you’ll get: $100 Amazon gift card referral bonus

- Where it’s available: Tally user’s referral link

- How to earn it: To receive a referral award, he Referee must become an active user and have a minimum interest-bearing balance of $1,000 across all registered cards.

- Offer terms: Referral rewards capped at $599.99 per individual each calendar year.

- Gift Card Disclosure: Account subject to credit approval by Tally and credit line acceptance. Tally’s Standard Terms & Conditions and Privacy Policy apply. Offer is available to new Tally customers only. To utilize this offer, you must register a minimum of one (1) credit card with Tally and have a minimum interest-bearing balance of $1,000 across all registered cards. As long as your Tally account is current, Tally will issue a $50 Amazon gift card within 60 days of account activation. Limit one (1) voucher per person. For addition questions, please contact support@meettally.com.

*$50 Sign-Up Bonus* (Expired)

Earn a $50 sign-up bonus with registration

If you head to Groupon, they are giving away $50 for free when you register for a new account with Tally.

- Offer expiration: While supplies last

- What you’ll get: Free $50 for credit card payments

- Who is eligible: New Tally customers only

- Where it’s available: Groupon

- How to earn it:

- Head over to the Groupon promotion page, See link below.

- Get the Tally deal by checking out, you won’t actually have to spend any money during this process

- Visit the website listed on your voucher to complete the $50 redemption

- Download the Tally app, register your credit cards and use your bonus to pay them off

- Terms: To qualify, register at least one credit card and have a minimum interest-bearing balance of $1,000 across all cards

- Promotional value expires 180 days after purchase.Your sign-up bonus will be paid within 60 days of activation. Account subject to credit approval by Tally. If no approved or if you don’t accept line of credit with Tally, voucher will not be redeemed. Offer is not eligible for Tally promo codes or other discounts.

(Visit Groupon.com to get $50 voucher for Tally)

Tally Limitations

Unfortunately, Tally has limited availability. They don’t offer credit lines in Maine, Montana, Nevada, West Virginia, and Wyoming at the moment. Plus, you’ll need a minimum credit score of at least 660 to take advantage of a Tally credit line.

|

|

Bottom Line

Tally is the first automated debt manager that makes it easy to save money, manage your cards, and pay down balances faster! Use Tally and free yourself from credit card debt faster!

Don’t have a credit card? We got you covered, you can check out our list on the best credit cards and see which one fits your needs the best!

While you’re here on HustlerMoneyBlog, see more ways to save money, buying Discounted Gift Cards, as well as Best Cash Back Shopping Portals!

Leave a Reply