If you have a TD Bank account and you want to manage it through your phone, download the TD Bank Mobile app. You can use this app to check your balances, transfer money, pay bills, and more. It’s the perfect tool to help you stay on top of your funds anywhere you are. In case any of you have trouble with this product, I’ve decided to publish a guide on how to download and login to the TD Bank Mobile app.

If you have a TD Bank account and you want to manage it through your phone, download the TD Bank Mobile app. You can use this app to check your balances, transfer money, pay bills, and more. It’s the perfect tool to help you stay on top of your funds anywhere you are. In case any of you have trouble with this product, I’ve decided to publish a guide on how to download and login to the TD Bank Mobile app.

If you’re wondering, “How do I open a TD Bank account?” you can read my guide to learn about the three ways to open an account.

Eligibility: TD Bank accounts are only available to residents of CT, DC, DE, FL, MA, MD, ME, NC, NH, NJ, NY, PA, RI, SC, VA, and VT.

| PROMOTIONAL LINK | OFFER | REVIEW |

| TD Bank Beyond Checking | $300 Cash | Review |

| TD Bank Convenience CheckingSM | $200 Cash | Review |

How to Set up the TD Bank Mobile App:

- Download the app onto your phone or tablet. You can follow the links below or find the app in your app store.

- Android Link: TD Bank App

- iOS: TD Bank App

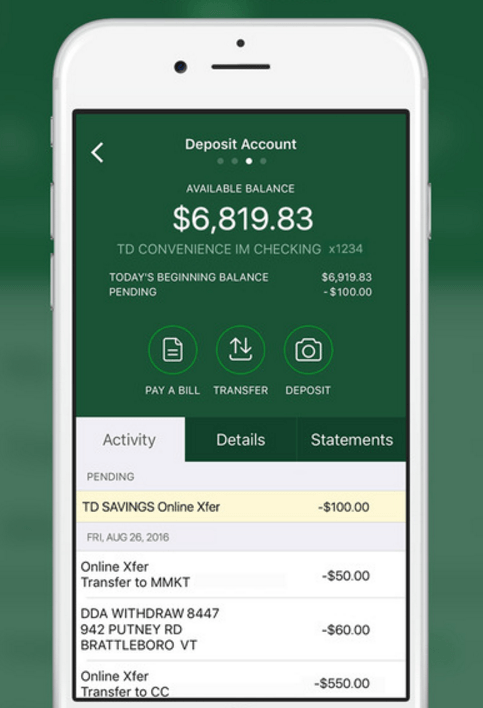

- When you first use the app, you’ll be taken to a dashboard with options to view your accounts, pay a bill, transfer money, or deposit checks. Click on any of these icons to get started.

- When you click on an icon, you’ll be taken to a log in screen.

- If you don’t have a TD Bank Online Banking account, click “Sign Up” in the lower left corner of the log in screen.

- To enroll in online banking, you will need your Social Security Number, TD Bank Debit Card, email address, and TD Bank Account Number.

- Click the “Let’s get started” button on the following screen.

- Accept the Online Banking Agreement.

- Provide your personal information.

- Select a username and password.

- Once you’ve set up your account, you can use it to log into the TD Bank Mobile App.

Bottom Line:

Congratulations, you’re now ready to use the TD Bank Mobile app! As long as you follow the above steps, you can you can use this great banking tool to transfer money, view your balances, deposit checks, and more. Looking for a TD Bank account but don’t know where to start? Check out our complete list of TD Bank Promotions.

The Blue Cash Everyday® Card from American Express offers $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months. Enjoy 0% intro APR on purchases and balance transfers for 15 months from the date of account opening. After that, 18.24% to 29.24% variable APR. You'll earn: • 3% Cash Back at U.S. supermarkets on up to $6,000 per year in purchases, then 1%. • 3% Cash Back on U.S. online retail purchases, on up to $6,000 per year, then 1%. • 3% Cash Back at U.S. gas stations, on up to $6,000 per year, then 1%. • 1% back on other eligible purchases. Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout. There are no annual fees with this card (See Rates & Fees). Terms Apply. |

Leave a Reply