Travel credit cards are one of the best ways to earn rewards points and miles toward travel. We’re here to help you steer clear from making a mistake with your travel rewards card as that error can be an expensive one. Read on to learn more about travel rewards card mistakes and how you can avoid it!

See our list of the best credit card bonuses here on HMB.

The Chase Sapphire Preferred® Card offers 100,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. You'll earn: • 5x on travel purchased through Chase TravelSM • 3x on dining, select streaming services and online groceries • 2x on all other travel purchases • 1x on all other purchases • $50 Annual Chase Travel Hotel Credit • Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027. Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase TravelSM This card carries a $95 annual fee. |

Keeping A Balance

When you keep a balance, it affects your credit score making it difficult for you to open another card or loan accounts. Most travel cards have high interest rates, so if you find yourself keeping a balance every month and not paying it off, you’ll reverse any rewards you earned with your spending.

Tip: Aim to pay your balance in full every time. Try to keep a budget so that you don’t overspend on what you make.

Missing A Payment

Make sure when you open a card when you have the ability to pay it off full every month since missing payments can get expensive. Payments made past their due dates also get reported to credit bureaus, negatively impacting your credit score.

Tip: Never miss your payment date again by setting up automatic payments! However it might take a while for it to actually activate, so be sure to make those payments manually.

Closing Your Credit Card

Make sure that you remember to not close your old credit card account before opening a new one. This method will hurt your credit score and not only that, it will decrease the amount of credit that is available to you as well as affect your credit utilization ratio.

Tip: Remember not to cancel a card unless you know that it won’t hurt your credit score. On top of that, if you want to avoid having to pay an annual fee on a card, it is better to downgrade the credit card to a no-annual-fee one.

Losing Your Points or Miles

Some loyalty programs like Delta SkyMiles and JetBlue TrueBlue have rewards that never expire. While many other other airline and hotel programs on various travel cards still have expiration policies. This period is usually 18 months, although we’ve seen it as short as three months with Spirit Airlines Free Spirit.

Tip: Make at least one purchase a year on every card you have to make sure these points and miles don’t expire.

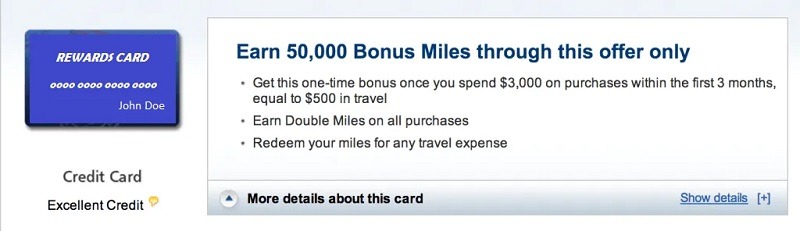

Missing Out on A Welcome Bonus

One of the main reasons why people sign up for a credit card is to get the welcome bonus. Most of the travel credit card that comes with welcome bonus that you can earn once you spend the minimum requirement on the card with the specific given time frame. However, if you fail to meet the requirement, you are likely to miss out on a large amount of rewards.

Tip: Make sure that you know when your welcome bonus ends and what counts towards your spending requirement. Click here for more credit card bonus tips.

Using the Wrong Card

Pay attention to the rewards card’s bonus offers for certain purchases made with merchants and stores. Like travel, restaurants, gas stations, and supermarkets. You don’t want to earn 1% cash back to pay for something when you can earn 2X points with your Chase Sapphire Preferred card.

Tip: Make sure you read your credit card’s agreement and make sure you understand how its earning structure and benefits work.

Ignoring Cards With Annual Fees

People tend to ignore cards with annual fees because they think that the fees aren’t worth the cost. But you should consider looking into one since many of them offer better sign-up bonuses, ongoing rewards and benefits, and anniversary bonuses compared to their low-cost counterparts. Usually these perks and benefits outweighs the card’s annual fee.

Tip: Check out our list of the best credit card bonuses.

Paying Foreign Transaction Fees

Most people who sign up for a travel rewards card, usually use it to travel. Nowadays, most credit card issuers charge no foreign transaction fee for international spenders, while some charge up to 3% for purchases made in a foreign currency.

Tip: Simply get a credit card that doesn’t charge foreign transaction fees.

|

|

Bottom Line

Travel credit cards can be great tools for earning rewards such as free flights and hotel stays as well as other traveling perks. However, make sure you avoid the common mistakes that people are making when they open or own a travel rewards credit card.

If you’re interest on looking for a travel rewards card check out our credit card list and for more travel related stuff, check out our point, miles & bonuses posts!

Leave a Reply