Who said travelling for work can’t be rewarding? Consider signing up for the U.S. Bank FlexPerks® Business Travel Rewards Card. This card will earn you easy FlexPoints that you can use towards airfare, hotel stays, car rentals and more!

Who said travelling for work can’t be rewarding? Consider signing up for the U.S. Bank FlexPerks® Business Travel Rewards Card. This card will earn you easy FlexPoints that you can use towards airfare, hotel stays, car rentals and more!

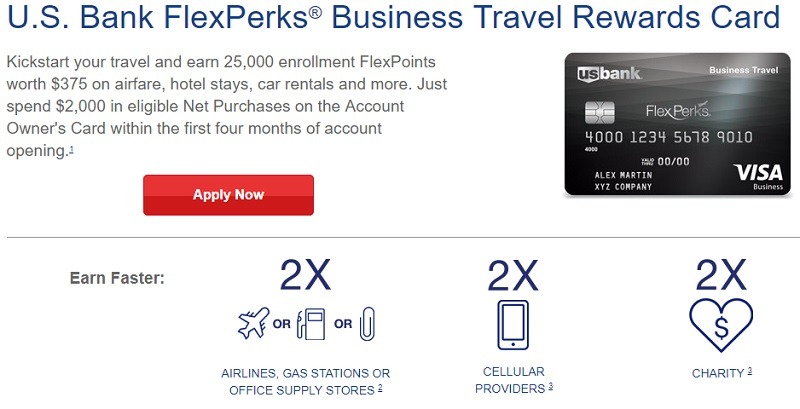

As a sign up bonus, you could get 25,000 FlexPoints when you spend $2,000 within the first 4 months. Flexperks points can be redeemed for flights on over 150 airlines with no expiration dates or fees. The FlexPoints are worth up to $375 ticket value. Imagine saving that much when you’re travelling.

Don’t forget about earning 2X FlexPoints on the category you spend the most on, between gas stations, grocery stores or airlines, office supply stores, and on qualifying charitable donations and 1x FlexPoints on all purchase purchases. Keep in mind that there is a $55 annual but it can be credited back if you spend if $24,000 or more in net purchases posts to your company’s account within your 12-month annual statement year. If this is something you’re interested in, continue reading ahead!

|

*Take a look at U.S. Bank’s great Checking/Savings accounts’ sign up bonuses.

U.S. Bank FlexPerks Business Travel Rewards Card Summary

| Bonus Available | Earn 25,000 bonus FlexPoints after you make at least $2,000 in purchases within the first 4 months of account opening. |

| Bonus Value* | $375 |

| Travel Credit | Credit for your annual fee if $24k+ spent within 12-month annual statement year. |

| Ongoing Rewards/Benefits |

2 FlexPoints for every $1 spent on gas, office supplies or airline purchases (whichever you spent the most on that month) $25 airline allowance per award ticket towards baggage fees, inflight food and beverages, or seat upgrades. |

| Foreign Transaction Fees | No |

| Airport Lounge Access | N/A |

| Annual Fee | $55, credited back to your account if you spend at least $24,000 in purchases within your membership year.

$10 for each additional card to your account. |

PROS

- Bonus points

- Bonus categories

- Airline allowance

- Annual fee credit

- No foreign transaction fees

CONS

- Annual fee

- Excellent credit needed to qualify

- Limited travel benefits

- No transfer partners

Editor’s Alternate Pick

The Ink Business Preferred® Credit Card offers 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase TravelSM. You'll earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year; 1 point per $1 on all other purchases - with no limit to the amount you can earn. Furthermore, points are worth 25% more when you redeem for travel through Chase TravelSM. This card does come with a $95 annual fee but does not have any foreign transaction fees. |

FlexPerks Business Card 25,000 Bonus Points Offer

Take advantage of the U.S. Bank FlexPerks Business Travel Rewards card’s 25,000 bonus FlexPoints offer. My valuation puts these points at around $375 (more on that later).

To qualify, charge at least $2,000 to your card within the first 4 months of opening your account.

What Are FlexPoints Worth?

Like many other rewards cards, your points’ worth depends on how you use them. On average, each FlexPoint is worth around $0.015. That’s a great value considering the average across different rewards cards is just $0.01 per point.

You can use your FlexPoints for:

- Travel

- Annual fee

- Merchandise

- Gift cards

You’ll get the most value for your FlexPoints if you use them for travel. You’ll receive 1.5 cents per point in value for airfare, hotel stays, car rentals, etc. Redeeming your points to pay for the card’s annual fee comes in at a close second. All other redemption options will yield a value of approximately $0.01 per point.

U.S. Bank FlexPerks Business Travel Rewards Card Benefits

With every award ticket, get a $25 airline fee credit towards:

- Baggage fees

- Inflight food and beverages

- Seat upgrades.

The $55 annual fee will be credited back to your account if you charge at least $24,000 in purchases to your card within a membership year.

Make purchases abroad without worrying about foreign transaction fees with the U.S. Bank FlexPerks Business Travel Rewards card.

Bottom Line

The U.S. Bank FlexPerks® Business Travel Rewards Card is a simple travel rewards card that allows you to get points quickly while having no foreign transaction fee.

You will also receive 25,000 FlexPoints after spending $2,000 in net purchases in the first 4 months of your account opening.

Enjoy additional benefits such as up to 2X FlexPoints which can be redeemed for your next flight. If you are interested in more deals that U.S. Bank has to offer, see our list of the Best U.S Bank Promotions. For more credit cards, see our latest list of the best credit card bonuses.

The editorial content on this page is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are author's alone.

What’s The Competition?

Top Alternatives To The FlexPerks Business Travel Rewards

The Ink Business Preferred Credit Card from Chase and Capital One Spark Miles for Business are two top alternatives to consider. It’ll cost a bit more for the annual fees with both. It all depends on which categories your business spends most on when deciding.

If you’re interested in a more premium business rewards card, The Business Platinum Card from American Express may be worth a look.

The Ink Business Preferred® Credit Card offers 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase TravelSM. You'll earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year; 1 point per $1 on all other purchases - with no limit to the amount you can earn. Furthermore, points are worth 25% more when you redeem for travel through Chase TravelSM. This card does come with a $95 annual fee but does not have any foreign transaction fees. |

The Capital One Spark Miles for Business offers a one-time bonus of 50,000 miles - equal to $500 in travel - once you spend $4,500 on purchases within the first 3 months from account opening. You'll earn: • 2 Miles per $1 on every purchase, everywhere. • 5 Miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel. Receive up to a $120 credit for Global Entry or TSA PreCheck There is an annual fee of $95, however, there is a $0 intro annual fee for the first year. Enjoy no foreign transaction fees and fly on any airline, anytime, with no blackout dates or seat restrictions. |

The Business Platinum Card® from American Express has a welcome offer of 250,000 Membership Rewards points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership. You'll earn: • 5X Membership Rewards Points on Flights, and Prepaid Hotels Booked through AmexTravel.com. • 1X points on other eligible purchases. • 1.5X points (that's an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more, on up to $2 million per Card Account per calendar year. Purchases eligible for multiple additional point bonuses will only receive the highest eligible bonus. • Unlock over $1,000 in statement credits on select purchases, including tech, recruiting and wireless in the first year of membership with the Business Platinum Card. Enrollment required. See how you can unlock over $1,000 annually in credits on select purchases with the Business Platinum Card • Fly like a pro with a $200 Airline Fee Credit. Select one qualifying airline to receive up to $200 back per year on baggage fees and other incidentals. • $199 CLEAR Plus Credit: Use your card and get up to $199 in statement credits per calendar year on your CLEAR Plus Membership (subject to auto-renewal) when you use the Business Platinum Card. • NEW! Make the Business Platinum Card work even harder for you. Hilton For Business members get up to $200 back per calendar year when you make an eligible purchase at Hilton properties across the globe. Benefit enrollment required. This card does come with a $695 annual fee. (See Rates & Fees) Terms Apply. |

Leave a Reply