Even though personal checks aren’t being used much as they used to, they’re still a popular way to make payments.

They’re still frequently used in paychecks, insurance benefits, and other payments like social security – although it’s becoming common for social security payments to be electronically now. All these different payments are frequently made through personal checks.

Note: Check out the following cards to earn one of the best flat cash back opportunities across all purchases: Wells Fargo Cash Wise card, the Chase Freedom Unlimited card, or the American Express Cash Magnet card! For a wider variety, see more credit card bonus offers here.

What are Personal Checks?

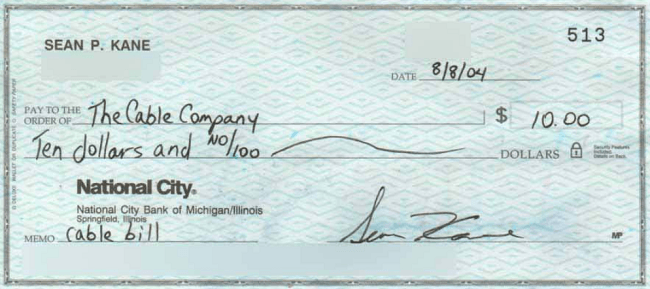

Personal checks are paper checks that are used between individual transfer of money. You fill in information on the check like to whom the check is going to and the amount being paid. You then hand it to whoever you’re paying and they’ll turn it into the back, either physically or by remote deposit.

The reason they’re personal checks is because the money is transferred out of a personal account – it’s not linked to a business, government, or organization account.

Why Does It Matter?

The reason checks are still reasonably popular is because they can be used to pay for almost anything so long as the payee accepts being paid by check. You can pay for groceries, insurance, a new car, rent, etc. However, personal checks are not always accepted.

As said in the previous paragraph, personal checks are paid through a personal account which aren’t always guaranteed to enough funds for the amount written on the check. For some transactions – especially large transactions like home purchases – a more trustworthy form of payment is required.

Sellers want more assurance that they’ll get paid, so they might require bank wires, cashier’s checks, or money orders (but even those can be used fraudulently). Likewise, if you receive a payment by personal check, it’s best to be sure the check is good before you spend that money (you should really ensure that every check is good – but it’s especially important with personal checks).

How to Spot a Personal Check

Personal checks are smaller than other checks and will generally be written by hand. However, larger computer generated checks can still be personal checks, though that doesn’t happen too often.

Online banking/banks sometimes make payments through personal accounts and by doing that, they’re still risking the sames risks that come with using a handwritten personal check.

Another way to identify a personal check is to look at the account owner information: if you see an individual’s name, it’s a personal check.

Cashing Personal Checks

Since there are greater risks that come with cashing in personal checks they can be more difficult to cash. Your best bet is to go to the same bank that the payer has an account at.

There they can check whether or not the account holder has sufficient. If you cash in your check at your own bank, they may take the check, but only give you up to $200. The bank is just taking precautions in case the check bounces and if that were to happen, you would be responsible for paying the bank back.

Besides banks and credit unions, there are very few places that cash personal checks. Some retailers and check cashing outfits might cash small checks. As of this writing, Kmart cashes personal checks up to $500.

If you ever run out of personal checks, You can order more from your bank, order from a printer, or even print your own checks.

Alternatives to Checks

Even though you can pay for countless things with check, they may not be the most optimal. Electronic tools allow you to send your funds securely and avoid the potential risk of theft and you don’t have to show your account number to whoever you’re paying.

It’s also inexpensive and tracking your payments is easier than ever thanks to online/electronic payments. Instead of writing a check, you can pay with plastic, send money electronically through various banking and third party apps, or using your banks online banking to make regular payments.

|

|

Bottom Line

Checks have their pros and cons. Even though they are very versatile and can be used to pay for pretty much anything, electronic/plastic payments are becoming even more popular than they already are. It’s still handy to know how to spot a personal check just for reference in case you’re paid with one.

If you find posts like this interesting, be sure to check out other banking posts on HMB!Also be sure to check out our posts on Best Bank Bonuses, Best Savings Rates, and Best Credit Card Bonuses.

Leave a Reply